BULLISH CANDLESTICKS PATTERN IN FOREX TRADING AND ITS IMPORTANT CHARACTERISTICS.

DEFINATION

Bullish candlesticks woh hoti hain jo forex market mein upward price movement ko darust karte hain. Bullish candlestick ki shakal aam tor par lambi hoti hai, jo mazboot kharidari dabaav ko darust karti hai. Choti ya koi ooper ki chotai na hona: Bullish candlesticks aksar choti ooper ki chotai ya phir koi na hone ka ishara deti hain, jo kam farokht dabaav ko darust karti hai. Unka lamba neechay ka chotai hota hai, jo dikhata hai ke trading session mein prices mein kami aayi thi lekin mukhtalif trading sessions mein tezi se ubhar gayi.

TYPES OF BULLISH CANDLESTICKS

HAMMER CANDLESTICK

Ek akele candlestick pattern jo choti shakal aur lambi neechay ki chotai ke saath hota hai. Jab yeh ek downtrend ke baad aata hai, to yeh mumkinah reversal ka ishara deta hai.

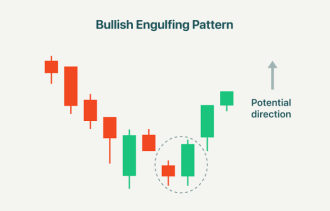

BULLISH ENGULFING CANDLESTICK

Yeh pattern do candlesticks se milta hai, jahan doosri candle pehli candle ke badan ko poori tarah gher leti hai. Yeh mojooda downtrend ka reversal dikhata hai.

MORNING STAR

Ek teen-candlestick pattern jo lambi bearish candle ke saath hota hai, jo ek choti shakal ki candle (ya doji) ke baad aata hai jo neeche se gap karti hai, aur phir ek bullish candle jo pehli candle ke darmiyaan band hota hai.

BULLISH CANDLESTICK IMPORTANCE

Bullish candlesticks traders ko lambi positions mein dakhil hone ya short positions ko chhor dene ke signals faraham karte hain. Yeh dikhate hain ke bullish momentum jari reh sakta hai. Jabke bullish candlesticks ko istemal karna aage ki tezi ka ishara karta hai, traders ke liye zaroori hai ke woh apne nuqsan se bachne ke liye risk management strategies ko madde nazar rakhein. Ismein stop-loss orders lagana aur position sizes ko sahi taur par manage karna shamil hai.

ENTRY AND EXIT POINTS

Bullish candlesticks ko samajh kar, traders ko market mein trend ka pata lagana asan hota hai. In dastakhto ka zikar bullish movement ko darust karta hai aur behtar trading decisions lene mein madad deta hai. Bullish candle sticks traders ko entry aur exit points ka pata lagane mein madad karte hain. Jab bullish candlesticks dikhai dein, to yeh signal hota hai ke ab buying opportunity hai ya phir short positions ko band karne ka waqt hai.

TRADING STRATEGIES

Bullish candlesticks ko istemal kar ke traders apni trading strategies ko improve karte hain. Inhein samajh kar, traders apne trading plans ko refine karte hain aur profit kamane ke liye sahi waqt par positions letay hain. Bullish candlesticks ke ahmiyat yeh bhi hai ke traders ko risk management ke liye sochne mein madad milti hai. Jab bullish candlesticks dikhai dein, to traders ko apni positions ko protect karne ke liye stop-loss orders lagane ki zarurat hoti hai taake nuqsan se bacha ja sake.

DEFINATION

Bullish candlesticks woh hoti hain jo forex market mein upward price movement ko darust karte hain. Bullish candlestick ki shakal aam tor par lambi hoti hai, jo mazboot kharidari dabaav ko darust karti hai. Choti ya koi ooper ki chotai na hona: Bullish candlesticks aksar choti ooper ki chotai ya phir koi na hone ka ishara deti hain, jo kam farokht dabaav ko darust karti hai. Unka lamba neechay ka chotai hota hai, jo dikhata hai ke trading session mein prices mein kami aayi thi lekin mukhtalif trading sessions mein tezi se ubhar gayi.

TYPES OF BULLISH CANDLESTICKS

HAMMER CANDLESTICK

Ek akele candlestick pattern jo choti shakal aur lambi neechay ki chotai ke saath hota hai. Jab yeh ek downtrend ke baad aata hai, to yeh mumkinah reversal ka ishara deta hai.

BULLISH ENGULFING CANDLESTICK

Yeh pattern do candlesticks se milta hai, jahan doosri candle pehli candle ke badan ko poori tarah gher leti hai. Yeh mojooda downtrend ka reversal dikhata hai.

MORNING STAR

Ek teen-candlestick pattern jo lambi bearish candle ke saath hota hai, jo ek choti shakal ki candle (ya doji) ke baad aata hai jo neeche se gap karti hai, aur phir ek bullish candle jo pehli candle ke darmiyaan band hota hai.

BULLISH CANDLESTICK IMPORTANCE

Bullish candlesticks traders ko lambi positions mein dakhil hone ya short positions ko chhor dene ke signals faraham karte hain. Yeh dikhate hain ke bullish momentum jari reh sakta hai. Jabke bullish candlesticks ko istemal karna aage ki tezi ka ishara karta hai, traders ke liye zaroori hai ke woh apne nuqsan se bachne ke liye risk management strategies ko madde nazar rakhein. Ismein stop-loss orders lagana aur position sizes ko sahi taur par manage karna shamil hai.

ENTRY AND EXIT POINTS

Bullish candlesticks ko samajh kar, traders ko market mein trend ka pata lagana asan hota hai. In dastakhto ka zikar bullish movement ko darust karta hai aur behtar trading decisions lene mein madad deta hai. Bullish candle sticks traders ko entry aur exit points ka pata lagane mein madad karte hain. Jab bullish candlesticks dikhai dein, to yeh signal hota hai ke ab buying opportunity hai ya phir short positions ko band karne ka waqt hai.

TRADING STRATEGIES

Bullish candlesticks ko istemal kar ke traders apni trading strategies ko improve karte hain. Inhein samajh kar, traders apne trading plans ko refine karte hain aur profit kamane ke liye sahi waqt par positions letay hain. Bullish candlesticks ke ahmiyat yeh bhi hai ke traders ko risk management ke liye sochne mein madad milti hai. Jab bullish candlesticks dikhai dein, to traders ko apni positions ko protect karne ke liye stop-loss orders lagane ki zarurat hoti hai taake nuqsan se bacha ja sake.

تبصرہ

Расширенный режим Обычный режим