Introduction:

Forex trading mein support aur resistance levels ka istemal karna buhat ahem hai. Yeh levels traders ko market ki direction ka andaza lagane mein madad karte hain aur unhein trading decisions banane mein help dete hain.

Support aur Resistance Kya Hain:

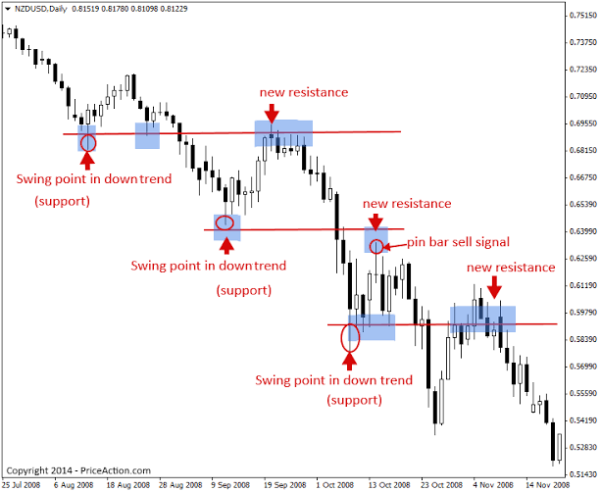

Support ek aisa level hota hai jahan traders ko lagta hai ke market ke neeche ki taraf pressure hai aur price ko neeche jane se roka ja raha hai. Resistance level wahi hota hai jahan traders ko lagta hai ke market ke upar ki taraf pressure hai aur price ko upar jane se roka ja raha hai.

Support aur Resistance Levels Ka Hesab:

Support aur resistance levels ko calculate karne ke liye traders market ke previous highs aur lows ka istemal karte hain. Yeh levels chart patterns, technical indicators aur price action analysis ke zariye bhi determine kiye ja sakte hain.

Trading Strategy aur Support/Resistance:

Traders support aur resistance levels ka istemal karke trading strategies develop karte hain. Support level par buy karne aur resistance level par sell karne jaise strategies common hoti hain. Iske ilawa, breakout trading bhi support aur resistance levels ke around hoti hai.

Stop Loss aur Take Profit Orders:

Support aur resistance levels ko istemal karke traders apni stop loss aur take profit orders set karte hain. Agar price support level ke neeche ya resistance level ke upar jaata hai, toh traders apne positions ko close kar sakte hain.

Risk aur Reward Ka Evaluation:

Support aur resistance levels ko samajh kar, traders apne trades ka risk aur reward evaluate karte hain. Support level se buy karne par risk kam hota hai jabke reward zyada hota hai, aur resistance level se sell karne par opposite hota hai.

Conclusion:

Support aur resistance levels forex trading mein important tools hain jo traders ko market analysis aur trading decisions mein madad karte hain. In levels ko samajhna aur sahi tareeqe se istemal karna traders ke liye zaroori hai.

Forex trading mein support aur resistance levels ka istemal karna buhat ahem hai. Yeh levels traders ko market ki direction ka andaza lagane mein madad karte hain aur unhein trading decisions banane mein help dete hain.

Support aur Resistance Kya Hain:

Support ek aisa level hota hai jahan traders ko lagta hai ke market ke neeche ki taraf pressure hai aur price ko neeche jane se roka ja raha hai. Resistance level wahi hota hai jahan traders ko lagta hai ke market ke upar ki taraf pressure hai aur price ko upar jane se roka ja raha hai.

Support aur Resistance Levels Ka Hesab:

Support aur resistance levels ko calculate karne ke liye traders market ke previous highs aur lows ka istemal karte hain. Yeh levels chart patterns, technical indicators aur price action analysis ke zariye bhi determine kiye ja sakte hain.

Trading Strategy aur Support/Resistance:

Traders support aur resistance levels ka istemal karke trading strategies develop karte hain. Support level par buy karne aur resistance level par sell karne jaise strategies common hoti hain. Iske ilawa, breakout trading bhi support aur resistance levels ke around hoti hai.

Stop Loss aur Take Profit Orders:

Support aur resistance levels ko istemal karke traders apni stop loss aur take profit orders set karte hain. Agar price support level ke neeche ya resistance level ke upar jaata hai, toh traders apne positions ko close kar sakte hain.

Risk aur Reward Ka Evaluation:

Support aur resistance levels ko samajh kar, traders apne trades ka risk aur reward evaluate karte hain. Support level se buy karne par risk kam hota hai jabke reward zyada hota hai, aur resistance level se sell karne par opposite hota hai.

Conclusion:

Support aur resistance levels forex trading mein important tools hain jo traders ko market analysis aur trading decisions mein madad karte hain. In levels ko samajhna aur sahi tareeqe se istemal karna traders ke liye zaroori hai.

تبصرہ

Расширенный режим Обычный режим