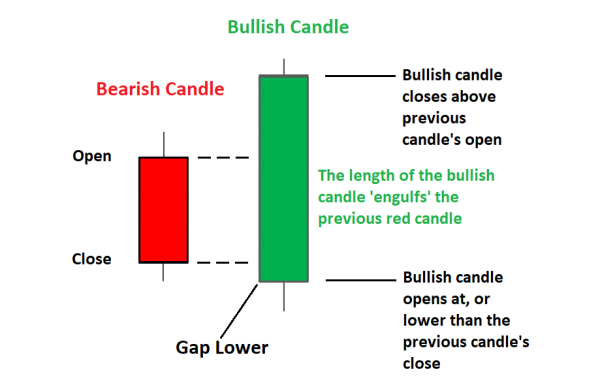

Bullish Engulfing Candlestick Pattern

Bullish Engulfing Candlestick Pattern, bullish trend ki shuruaat ya reversal ka ek mazboot indication hai. Is pattern mein pehla candle bearish hota hai aur doosra candle usa bada aur bullish hota hai. Doosra candle pehle candle ko puri tarah engulf kar leta hai, jo bullish momentum ka zahir hone ka Engulfing Candlestick Pattern, candlestick evaluation ka ek mukhya hissa hai jo buyers ko marketplace ki movement ka pata lagane mein madad deta hai. Is pattern mein do candlesticks shamil hote hain, jinmein se ek candle doosre candle ko puri tarah cowl kar leta hai. Yeh sample bullish ya bearish marketplace situations mein develop ho sakta hai aur trend reversal ya fashion continuaBullish Engulfing Pattern ko pehchanne ke liye investors ko do candlesticks ki formations ko dhyan se dekhna hota hai. Pehla candle normally ek small bearish candle hota hai jo suggest karta hai ke selling stress gift hai. Doosra candle pehle candle ko completely cover kar leta hai aur generally ek lengthy bullish candle hota hai. Is pattern ko validate karne ke liye, investors ko extent ka bhi dhyan dena hota hai. Agar doosre candle ki quantity pehle candle se zyadtion ke indications offer karta hai. Engulfing sample ko pehchanne ka tareeqa easy hai, lekin iski confirmation ke liye doosre technical signs aur fee movement indicators ka bhi istemal kiya jata hasign hai. Bullish engulfing sample ko pehchanne ke baad, buyers long positions enter kar sakte hain, particularly jab yeh sample vital guide stage ya Fibonacci retracement stage ke paas increase hota hai.

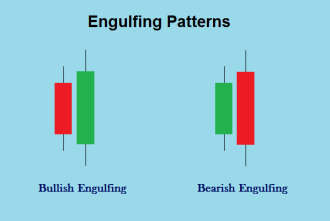

Bearish Engulfing Candlestick Pattern

Bearish Engulfing Candlestick Pattern, bearish fashion ki shuruaat ya reversal ka ek sturdy indication hai. Is pattern mein pehla candle bullish Bullish Engulfing Pattern ko samajhne ke liye buyers ko marketplace ki universal route aur rate movement ko analyze karna hota hai. Yeh sample commonly downtrend ke baad expand hota hai, jab marketplace mein bullish reversal ki ummeed hoti hai. Is sample ko verify karne ke liye, traders ko doosre technical signs jaise ki RSI, MACD, ya moving averages ka istemal karke rate action ko valida.Bearish Engulfing Pattern ko pehchanne ke liye traders ko do candlesticks ki formations ko dhyan se dekhna hota hai. Pehla candle normally ek small bullish candle hota hai jo suggest karta hai ke shopping for stress gift hai. Doosra candle pehle candle ko absolutely cowl kar leta hai aur generally ek lengthy bearish candle hota hai. Is pattern ko validate karne te karna hota hai. Bullish engulfing pattern ke mukhtalif versions bhi hote hain jaise ki piercing pattern ya morning star sample, jo market sentiment ko aur bhi mazboot karte hain. Hai aur doosra candle america bada aur bearish hota hai. Doosra candle pehle candle ko puri tarah engulf kar leta hai, jo bearish stress ka zahir hone ka sign hai. Bearish engulfing sample ko pehchanne ke baad, investors short positions input kar sakte hain, in particular jab yeh sample critical resistance level ya Fibonacci retracement stage ke paas broaden hota hai.

Bullish Engulfing Candlestick Pattern, bullish trend ki shuruaat ya reversal ka ek mazboot indication hai. Is pattern mein pehla candle bearish hota hai aur doosra candle usa bada aur bullish hota hai. Doosra candle pehle candle ko puri tarah engulf kar leta hai, jo bullish momentum ka zahir hone ka Engulfing Candlestick Pattern, candlestick evaluation ka ek mukhya hissa hai jo buyers ko marketplace ki movement ka pata lagane mein madad deta hai. Is pattern mein do candlesticks shamil hote hain, jinmein se ek candle doosre candle ko puri tarah cowl kar leta hai. Yeh sample bullish ya bearish marketplace situations mein develop ho sakta hai aur trend reversal ya fashion continuaBullish Engulfing Pattern ko pehchanne ke liye investors ko do candlesticks ki formations ko dhyan se dekhna hota hai. Pehla candle normally ek small bearish candle hota hai jo suggest karta hai ke selling stress gift hai. Doosra candle pehle candle ko completely cover kar leta hai aur generally ek lengthy bullish candle hota hai. Is pattern ko validate karne ke liye, investors ko extent ka bhi dhyan dena hota hai. Agar doosre candle ki quantity pehle candle se zyadtion ke indications offer karta hai. Engulfing sample ko pehchanne ka tareeqa easy hai, lekin iski confirmation ke liye doosre technical signs aur fee movement indicators ka bhi istemal kiya jata hasign hai. Bullish engulfing sample ko pehchanne ke baad, buyers long positions enter kar sakte hain, particularly jab yeh sample vital guide stage ya Fibonacci retracement stage ke paas increase hota hai.

Bearish Engulfing Candlestick Pattern

Bearish Engulfing Candlestick Pattern, bearish fashion ki shuruaat ya reversal ka ek sturdy indication hai. Is pattern mein pehla candle bullish Bullish Engulfing Pattern ko samajhne ke liye buyers ko marketplace ki universal route aur rate movement ko analyze karna hota hai. Yeh sample commonly downtrend ke baad expand hota hai, jab marketplace mein bullish reversal ki ummeed hoti hai. Is sample ko verify karne ke liye, traders ko doosre technical signs jaise ki RSI, MACD, ya moving averages ka istemal karke rate action ko valida.Bearish Engulfing Pattern ko pehchanne ke liye traders ko do candlesticks ki formations ko dhyan se dekhna hota hai. Pehla candle normally ek small bullish candle hota hai jo suggest karta hai ke shopping for stress gift hai. Doosra candle pehle candle ko absolutely cowl kar leta hai aur generally ek lengthy bearish candle hota hai. Is pattern ko validate karne te karna hota hai. Bullish engulfing pattern ke mukhtalif versions bhi hote hain jaise ki piercing pattern ya morning star sample, jo market sentiment ko aur bhi mazboot karte hain. Hai aur doosra candle america bada aur bearish hota hai. Doosra candle pehle candle ko puri tarah engulf kar leta hai, jo bearish stress ka zahir hone ka sign hai. Bearish engulfing sample ko pehchanne ke baad, investors short positions input kar sakte hain, in particular jab yeh sample critical resistance level ya Fibonacci retracement stage ke paas broaden hota hai.

تبصرہ

Расширенный режим Обычный режим