EXPLAIN IMPORTANT BEARISH CANDLESTICK PATTERNS IN FOREX MARKET

BEARISH CANDLESTICK DEFINITION

Bearish candlestick patterns Forex trading mein un patterns ko kehte hain jo yeh indicate karte hain ke market ki price neechay ja sakti hai. Yeh patterns traders ko help karte hain predict karne mein ke kab market sell karna hai ya kab exit karna hai. Main aap ko kuch common bearish candlestick patterns ke baare mein bata raha hoon:

COMMON BEARISH CANDLESTICK PATTERNS

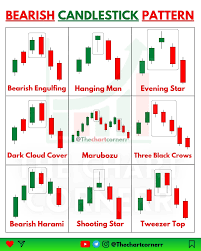

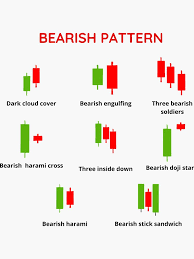

BEARISH ENGULFING PATTERN

Ye pattern do candles se banta hai. Pehli candle bullish hoti hai (price upar jati hai) aur dosri candle itni bari hoti hai ke pehli candle ko poora cover kar leti hai, magar ye neechay se start hoti hai. Ye signal deta hai ke sellers market mein control mein aa gaye hain aur prices gir sakti hain.

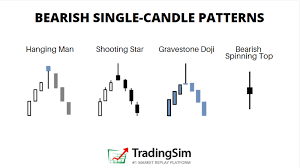

SHOOTING STAR

Ye ek single candle ka pattern hota hai jisme candle ka upper shadow (wick) bohat lamba hota hai aur body choti hoti hai. Ye top pe banta hai jab price pehle high gaya ho phir close uske low ke near ho. Ye indicate karta hai ke buyers ka control kamzor par raha hai aur price gir sakta hai.

HANGING MAN

Ye bhi shooting star ki tarah hota hai lekin ye aksar uptrend ke baad banta hai. Iski long lower shadow aur choti upper body hoti hai. Agar is pattern ke baad ek aur bearish candle banti hai, to ye confirmation hoti hai ke trend reverse ho sakta hai.

DARK CLOUD COVER

Ye ek two-candle pattern hai. Pehli candle bullish hoti hai aur dosri candle open higher hoti hai lekin close pehli wali candle ki mid-point se neeche hota hai. Ye suggest karta hai ke bearish reversal possible hai.

THREE BLACK CROWS

Ye ek sequence hota hai teen consecutive long bearish candles ka, har ek previous candle se lower opening aur closing ke sath. Ye strong bearish market trend ko show karta hai.

In patterns ko samajhna aur pehchan'na traders ko enable karta hai ke wo better trading decisions le saken, especially jab wo decide kar rahe hon ke kis point pe sell karna hai ya short position leni hai.

BEARISH CANDLESTICK DEFINITION

Bearish candlestick patterns Forex trading mein un patterns ko kehte hain jo yeh indicate karte hain ke market ki price neechay ja sakti hai. Yeh patterns traders ko help karte hain predict karne mein ke kab market sell karna hai ya kab exit karna hai. Main aap ko kuch common bearish candlestick patterns ke baare mein bata raha hoon:

COMMON BEARISH CANDLESTICK PATTERNS

BEARISH ENGULFING PATTERN

Ye pattern do candles se banta hai. Pehli candle bullish hoti hai (price upar jati hai) aur dosri candle itni bari hoti hai ke pehli candle ko poora cover kar leti hai, magar ye neechay se start hoti hai. Ye signal deta hai ke sellers market mein control mein aa gaye hain aur prices gir sakti hain.

SHOOTING STAR

Ye ek single candle ka pattern hota hai jisme candle ka upper shadow (wick) bohat lamba hota hai aur body choti hoti hai. Ye top pe banta hai jab price pehle high gaya ho phir close uske low ke near ho. Ye indicate karta hai ke buyers ka control kamzor par raha hai aur price gir sakta hai.

HANGING MAN

Ye bhi shooting star ki tarah hota hai lekin ye aksar uptrend ke baad banta hai. Iski long lower shadow aur choti upper body hoti hai. Agar is pattern ke baad ek aur bearish candle banti hai, to ye confirmation hoti hai ke trend reverse ho sakta hai.

DARK CLOUD COVER

Ye ek two-candle pattern hai. Pehli candle bullish hoti hai aur dosri candle open higher hoti hai lekin close pehli wali candle ki mid-point se neeche hota hai. Ye suggest karta hai ke bearish reversal possible hai.

THREE BLACK CROWS

Ye ek sequence hota hai teen consecutive long bearish candles ka, har ek previous candle se lower opening aur closing ke sath. Ye strong bearish market trend ko show karta hai.

In patterns ko samajhna aur pehchan'na traders ko enable karta hai ke wo better trading decisions le saken, especially jab wo decide kar rahe hon ke kis point pe sell karna hai ya short position leni hai.

تبصرہ

Расширенный режим Обычный режим