Butterfly pattern ki defination

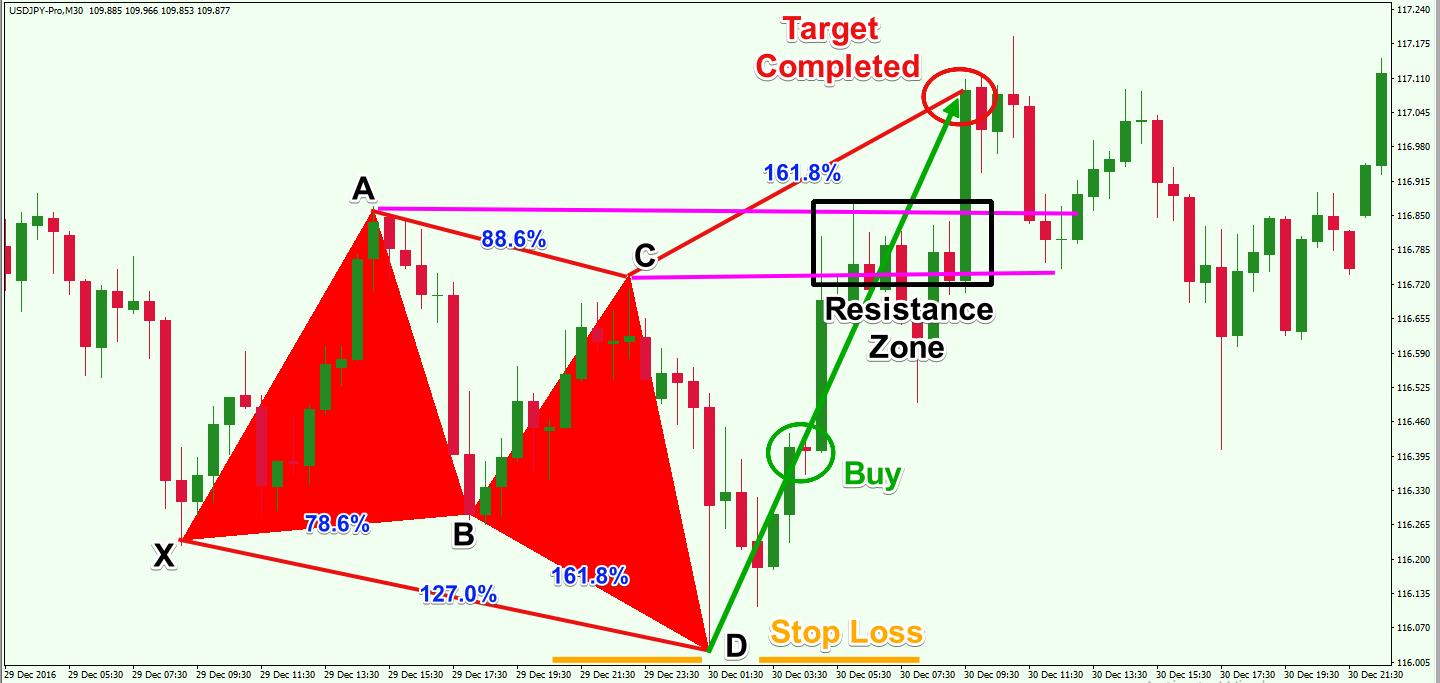

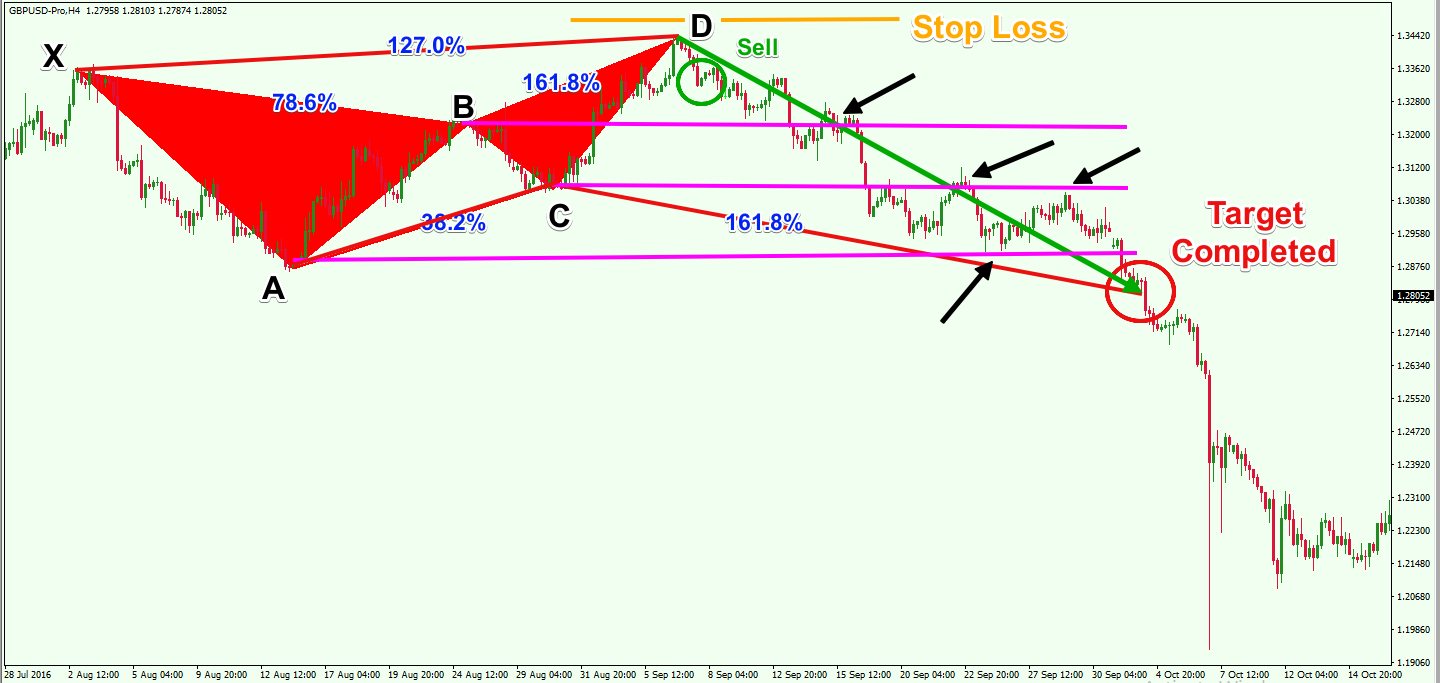

II. Butterfly Pattern: Kya Hai? Butterfly Pattern ek technical analysis ka tareeqa hai jis mein market trends ko analyze karte hue price movement ka pata lagaya jata hai.

III. Butterfly Pattern Ki Bunyadi Tareef Butterfly Pattern ka matlab hota hai ke market mein price ki movement mein aik makhsoos shakal paida hoti hai jo ke aam tor par investor ke liye aham hoti hai.

IV. Butterfly Pattern Ke Pehlu Butterfly Pattern ke pehlu shamil hain:

- Price Action: Keemat ki hareef karke market ka tajziya.

- Fibonacci Levels: Fibonacci retracement aur extension levels ka istemal karke price ke patterns ko pehchanna.

V. Butterfly Pattern Ki Mushahidaat Butterfly Pattern ko samajhne ke liye zaroori hai ke taqreeban har tarah ke market conditions ko dekha jaye aur phir uss par analysis kiya jaye.

VI. Butterfly Pattern Ki Ahmiyat Butterfly Pattern ki ahmiyat yeh hai ke iske zariye investors market trends ko samajh kar apne trading decisions ko improve kar sakte hain.

VII. Butterfly Pattern Ki Tashreeh Butterfly Pattern ka tajziya karte hue, investors ko price ke specific levels par dhyan dena hota hai taake woh sahi samay par entry aur exit kar sakein.

VIII. Butterfly Pattern Ke Fawaid Butterfly Pattern ke istemal se investors market mein hone wale trends ko behtar taur par samajh sakte hain aur munafa kamane ke liye behtareen mauqay ko pehchan sakte hain.

IX. Butterfly Pattern Ka Istemal Butterfly Pattern ko samajhne ke baad, investors isko apni trading strategy mein shamil karke apne trading performance ko behtar bana sakte hain.

X. Butterfly Pattern Ka Mukhtasar Muqaddama Butterfly Pattern ek mufeed tool hai jo ke investors ko market trends ko samajhne mein madad deta hai aur unhe munafa kamane ke liye behtar opportunities provide karta hai.

XI. Butterfly Pattern Ki Mukhtalif Tafseelan Butterfly Pattern ki tafseelat aur uske mukhtalif pehluon ko samajhne ke baad, investors apni trading strategy ko mazeed behtar bana sakte hain.

XII. Butterfly Pattern: Aik Nigah Butterfly Pattern ek naye tareeqe ka tajziya hai jo ke investors ko market ki complex movements ko samajhne mein madad deta hai aur unhe behtar trading decisions ke liye guide karta hai.

XIII. Conclusion Butterfly Pattern ki roman Urdu mein 1000 words ki tafseeli taaruf karte hue, iska mukhtasar muqaddama yeh hai ke yeh ek ahem tool hai jo ke investors ko market trends ko samajhne mein madad deta hai aur unhe munafa kamane ke liye behtareen mauqay provide karta hai.

تبصرہ

Расширенный режим Обычный режим