- Concept of Divergences

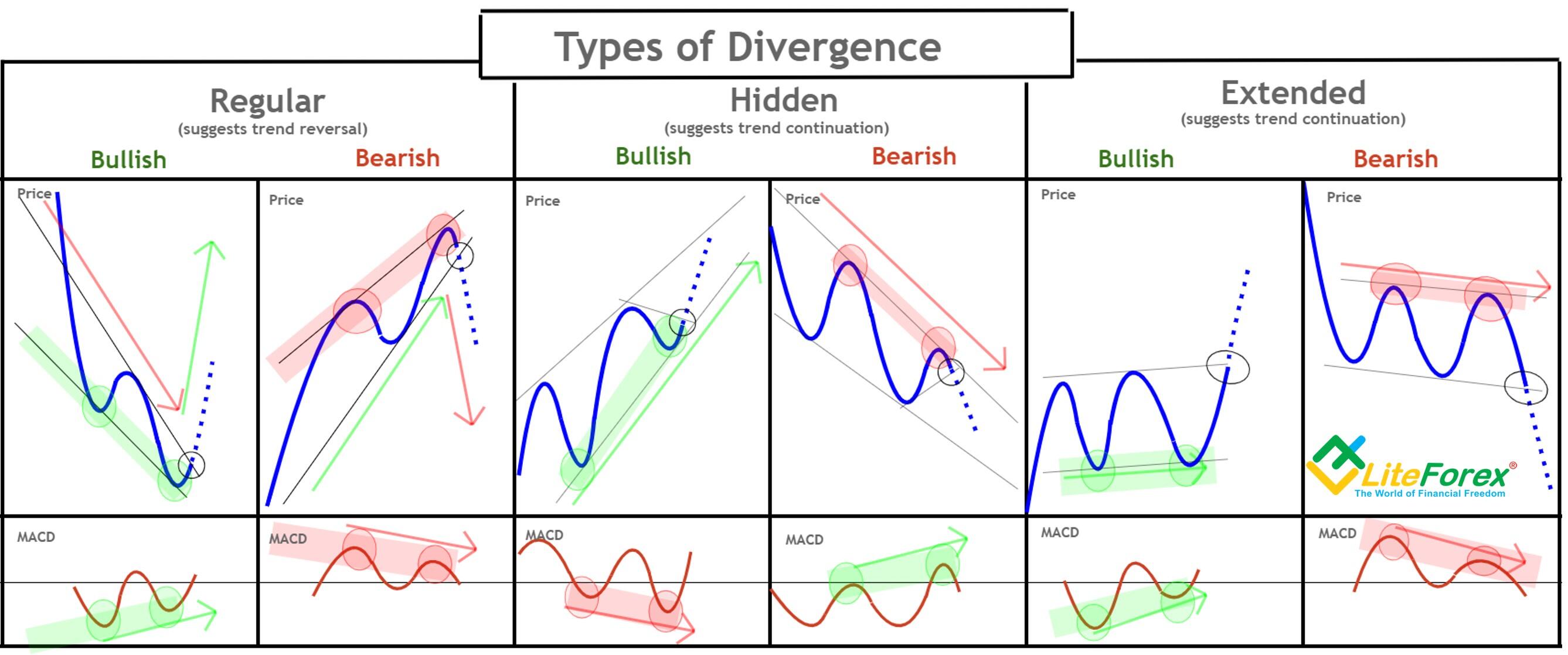

Divergence Forex trading mein aik ahem concept hai jo technical analysis ka hissa hai. Ye traders ko market ke mukhtalif trends aur price movements ka analysis karne mein madad deta hai. Divergence ka matlab hota hai jab price action aur kisi specific indicator, jaise ke MACD (Moving Average Convergence Divergence) ya RSI (Relative Strength Index), ke signals mein ikhtilaf hota hai. Ye ikhtilaf traders ko indicate karta hai ke market ka trend weaken ho sakta hai ya phir change hone wala hai.

- Understanding

- Market Price Prediction

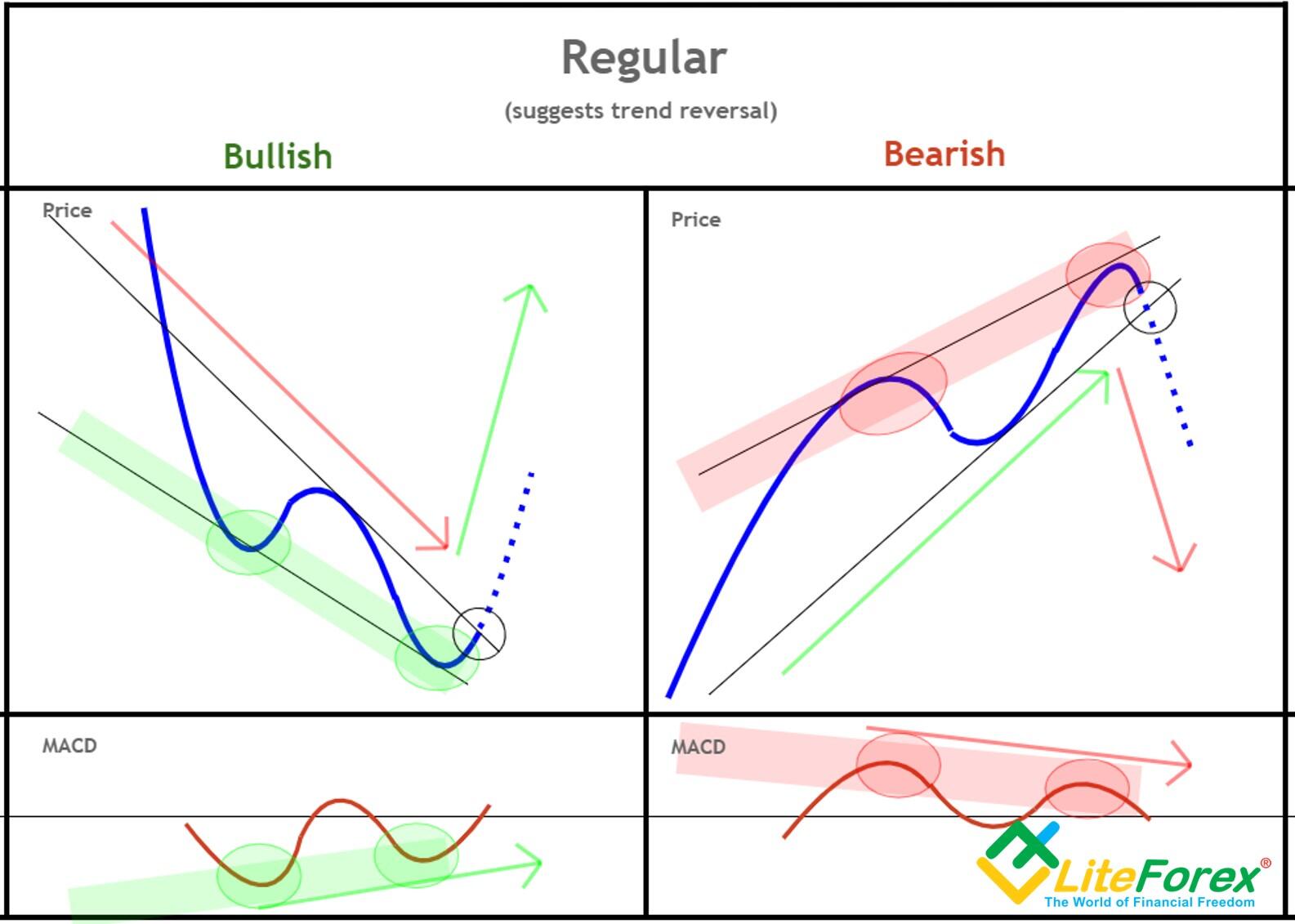

Ek common example divergence ka ye hai jab market price naye highs banata hai lekin indicator naye highs nahi banata ya phir market price naye lows banata hai lekin indicator naye lows nahi banata. Ye ek bearish divergence ya bullish divergence ko indicate karta hai, jo ke market ke trend ke change hone ki sambhavna ko darust karta hai. Bearish divergence mein price ka rise indicator ke signal se match nahi karta jabke bullish divergence mein price ka fall indicator ke signal se match nahi karta.

- Conclusion

تبصرہ

Расширенный режим Обычный режим