Butterfly Pattern:

Forex trading mein "Butterfly pattern" ek popular technical analysis pattern hai, jo price action ko predict karny k liye istemal hota hai. Butterfly pattern ek reversal pattern hai, jo trend k change hony ki possibility ko indicate karta hai. Butterly pattern Harmonic Trading ka hissa hai. Yeh pattern 4 legs ya phases se bana hota hai.

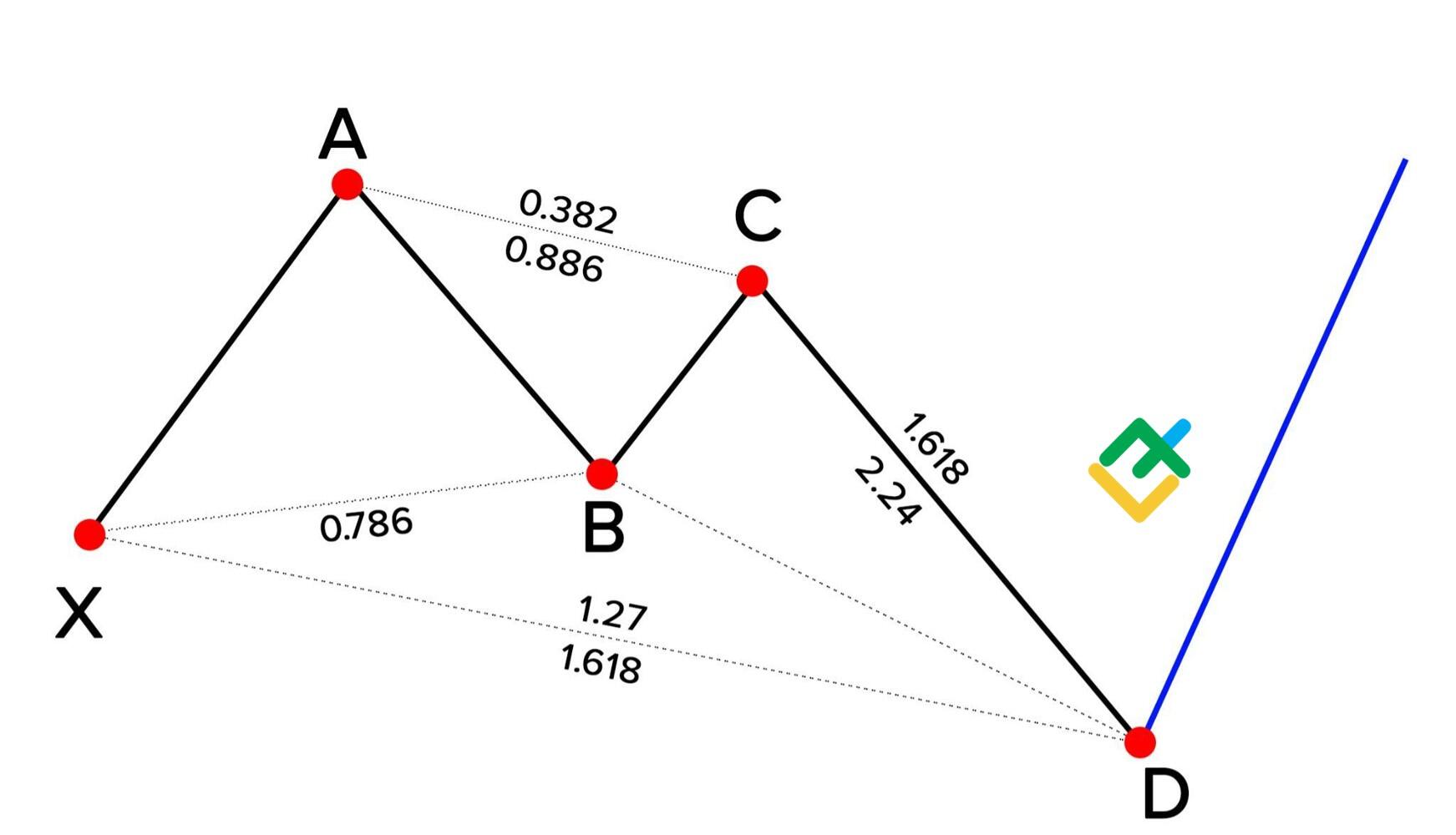

Butterfly Pattern Ki Phases:

1.X to A leg (Initial leg):

Market ek initial trend mein hota hai.

Yeh price move butterfly pattern ki shuruwat hoti hai.

2.A to B leg (First leg):

Price X se A point tak move karta hai.

Price A tak move hony k baad, retracement shuru hoti hai, yaani k price down ki taraf move karta hai.

3.B to C leg (Second leg):

Price B se C tak move karta hai.

C point B se 0.786 to 0.886 Fibonacci retracement level tak hota hai.

C point A se 1.618 to 2.618 Fibonacci extension level tak hota hai.

4.C to D leg (Final leg):

Price C se D point tak move karta hai.

D point B se 1.618 Fibonacci retracement level tak hota hai.

D point X se 0.786 to 0.886 Fibonacci retracement level tak hota hai.

D point A se 0.786 to 0.886 Fibonacci retracement level tak hota hai.

Butterfly Pattern Types:

1.Bullish Butterfly Pattern:

Bullish butterfly pattern market k downward trend k baad form hota hai.

D point C se upar hota hai.

Bullish butterfly pattern ka matlab hai k market ke uptrend hony ki possibility hai.

2.Bearish Butterfly Pattern:

2.Bearish Butterfly Pattern:

Bearish butterfly pattern market k upward trend k baad form hota hai.

D point C se neeche hota hai.

Bearish butterfly pattern ka matlab hai k market ke downtrend hony ki possibility hai.

Butterfly pattern ko samajhna aur pehchan'na, aur sahi waqt par trade karna, forex traders ke liye bohot zaroori hai. Magar yaad rahy k, jaise har technical analysis pattern, yeh bhi kabhi kabhi accurate nahi hota. Is liye, dusre indicators aur risk management k saath sahi time par istemal karna zaroori hai.

Forex trading mein "Butterfly pattern" ek popular technical analysis pattern hai, jo price action ko predict karny k liye istemal hota hai. Butterfly pattern ek reversal pattern hai, jo trend k change hony ki possibility ko indicate karta hai. Butterly pattern Harmonic Trading ka hissa hai. Yeh pattern 4 legs ya phases se bana hota hai.

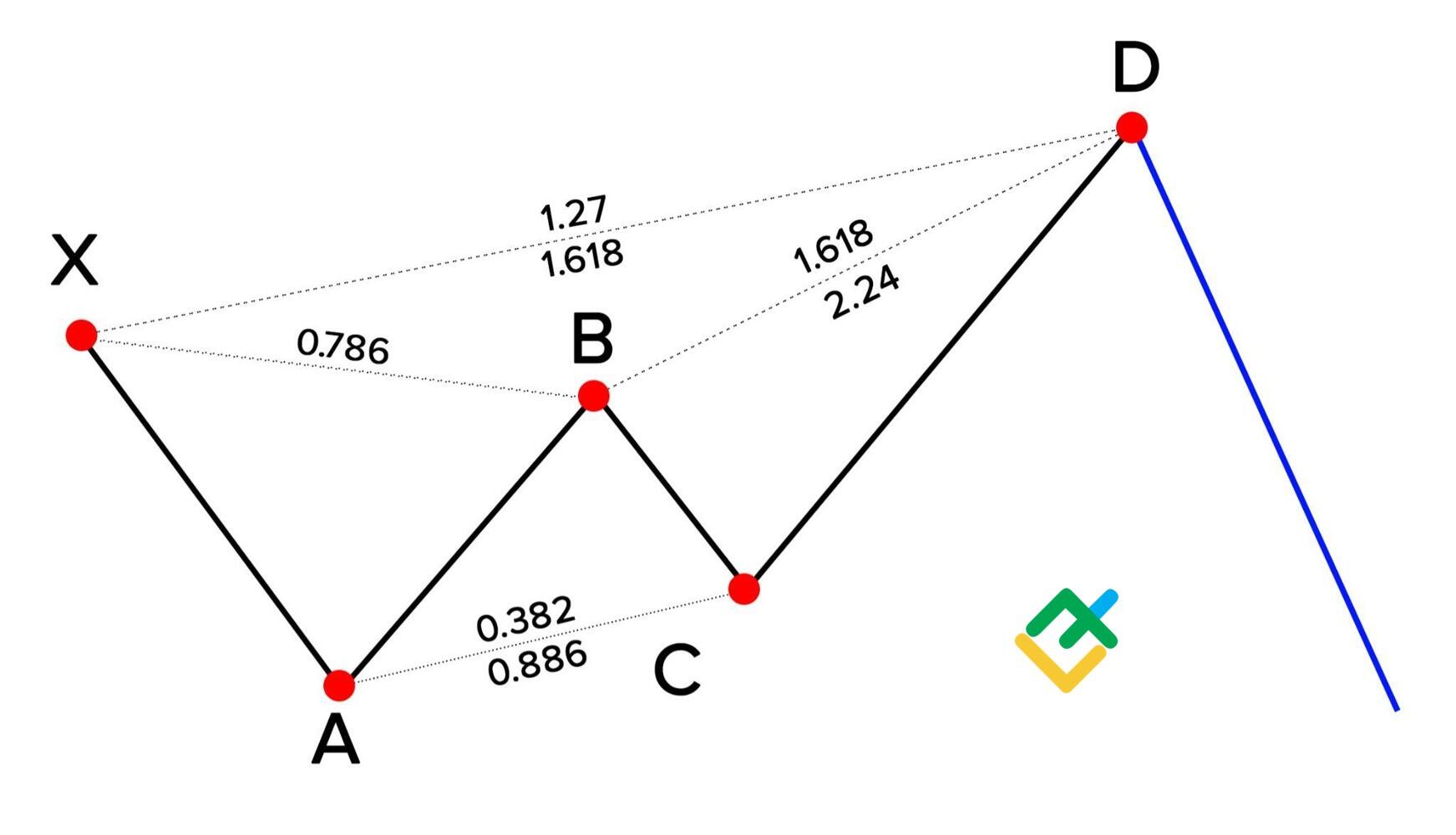

Butterfly Pattern Ki Phases:

1.X to A leg (Initial leg):

Market ek initial trend mein hota hai.

Yeh price move butterfly pattern ki shuruwat hoti hai.

2.A to B leg (First leg):

Price X se A point tak move karta hai.

Price A tak move hony k baad, retracement shuru hoti hai, yaani k price down ki taraf move karta hai.

3.B to C leg (Second leg):

Price B se C tak move karta hai.

C point B se 0.786 to 0.886 Fibonacci retracement level tak hota hai.

C point A se 1.618 to 2.618 Fibonacci extension level tak hota hai.

4.C to D leg (Final leg):

Price C se D point tak move karta hai.

D point B se 1.618 Fibonacci retracement level tak hota hai.

D point X se 0.786 to 0.886 Fibonacci retracement level tak hota hai.

D point A se 0.786 to 0.886 Fibonacci retracement level tak hota hai.

Butterfly Pattern Types:

1.Bullish Butterfly Pattern:

Bullish butterfly pattern market k downward trend k baad form hota hai.

D point C se upar hota hai.

Bullish butterfly pattern ka matlab hai k market ke uptrend hony ki possibility hai.

Bearish butterfly pattern market k upward trend k baad form hota hai.

D point C se neeche hota hai.

Bearish butterfly pattern ka matlab hai k market ke downtrend hony ki possibility hai.

Butterfly pattern ko samajhna aur pehchan'na, aur sahi waqt par trade karna, forex traders ke liye bohot zaroori hai. Magar yaad rahy k, jaise har technical analysis pattern, yeh bhi kabhi kabhi accurate nahi hota. Is liye, dusre indicators aur risk management k saath sahi time par istemal karna zaroori hai.

تبصرہ

Расширенный режим Обычный режим