Introduction:

Harmonic price patterns, jinhe aksar "Harmonic Patterns" bhi kaha jata hai, financial markets mein technical analysis ka ek shakh hai. Ye patterns price charts par specific geometrical shapes hote hain jo price movement ko analyze karne mein madadgar hote hain.

Fibonacci Retracement:

Harmonic price patterns mein Fibonacci retracement levels ka istemal hota hai. Ye levels market mein retracement zones darust karne ke liye istemal kiye jate hain. Fibonacci retracement levels market trend ko samajhne mein madadgar hote hain.

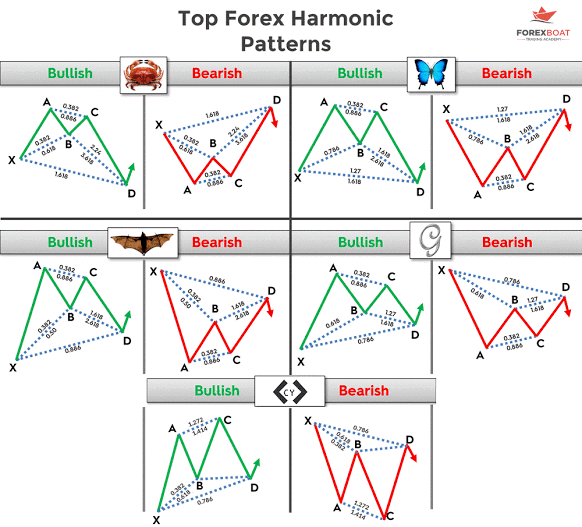

Bat Pattern:

Bat pattern ek popular harmonic pattern hai. Ye pattern bariyat se chand geometrical shapes se bana hota hai. Bat pattern ko recognize karne ke liye specific retracement aur extension levels ka istemal hota hai.

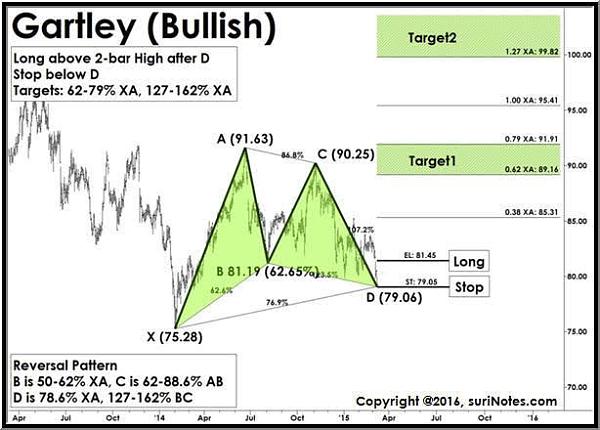

Gartley Pattern:

Gartley pattern ek aur mashhoor harmonic pattern hai jo market mein dekha jata hai. Ye pattern Fibonacci retracement aur extension levels ka istemal karta hai. Gartley pattern market mein trend reversal ko point out karta hai.

Butterfly Pattern:

Butterfly pattern bhi ek aham harmonic pattern hai. Ye pattern market mein trend reversal ko darust karta hai. Butterfly pattern ko Fibonacci ratios ki madad se recognize kiya jata hai.

Crab Pattern:

Crab pattern bhi ek makhsoos harmonic pattern hai jo market mein dekha jata hai. Ye pattern market mein strong reversals ko point out karta hai. Crab pattern ko Fibonacci retracement aur extension levels se identify kiya jata hai.

Conclusion:

Harmonic price patterns, traders aur investors ke liye aik ahem tool hain market analysis mein. In patterns ki sahi samajh aur istemal se, traders market movements ko behtar taur par samajh sakte hain aur trading decisions ko improve kar sakte hain.

Harmonic price patterns, jinhe aksar "Harmonic Patterns" bhi kaha jata hai, financial markets mein technical analysis ka ek shakh hai. Ye patterns price charts par specific geometrical shapes hote hain jo price movement ko analyze karne mein madadgar hote hain.

Fibonacci Retracement:

Harmonic price patterns mein Fibonacci retracement levels ka istemal hota hai. Ye levels market mein retracement zones darust karne ke liye istemal kiye jate hain. Fibonacci retracement levels market trend ko samajhne mein madadgar hote hain.

Bat Pattern:

Bat pattern ek popular harmonic pattern hai. Ye pattern bariyat se chand geometrical shapes se bana hota hai. Bat pattern ko recognize karne ke liye specific retracement aur extension levels ka istemal hota hai.

Gartley Pattern:

Gartley pattern ek aur mashhoor harmonic pattern hai jo market mein dekha jata hai. Ye pattern Fibonacci retracement aur extension levels ka istemal karta hai. Gartley pattern market mein trend reversal ko point out karta hai.

Butterfly Pattern:

Butterfly pattern bhi ek aham harmonic pattern hai. Ye pattern market mein trend reversal ko darust karta hai. Butterfly pattern ko Fibonacci ratios ki madad se recognize kiya jata hai.

Crab Pattern:

Crab pattern bhi ek makhsoos harmonic pattern hai jo market mein dekha jata hai. Ye pattern market mein strong reversals ko point out karta hai. Crab pattern ko Fibonacci retracement aur extension levels se identify kiya jata hai.

Conclusion:

Harmonic price patterns, traders aur investors ke liye aik ahem tool hain market analysis mein. In patterns ki sahi samajh aur istemal se, traders market movements ko behtar taur par samajh sakte hain aur trading decisions ko improve kar sakte hain.

تبصرہ

Расширенный режим Обычный режим