WHAT IS THE DIFFERENCE BETWEEN PENDING ORDER AND INSTANT ORDER IN FOREX

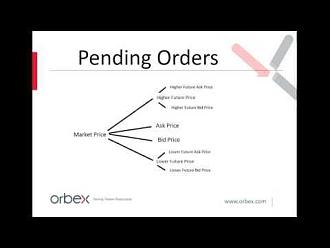

PENDING ORDER

Pending order yeh hota hai jab aap trading platform par ek order place karte hain lekin uska execution future mein hota hai, jab market specified price tak pahunchti hai. Pending orders aapko control aur flexibility dete hain future market movements ke hisab se, jabke instant orders turant action lene mein madadgar hote hain jab aapki zarurat hoti hai.Yeh orders aksar future price levels par entry ya exit ke liye istemal kiye jate hain.

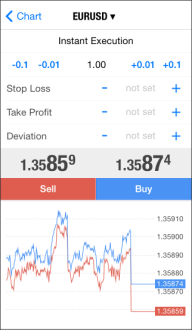

INSTANT ORDER

Instant order yeh hota hai jab aap trading platform par ek order place karte hain aur wo turant execute ho jata hai, current market price par. Yeh orders immediate entry ya exit ke liye istemal kiye jate hain.

USES IN DIFFERENT CONDITIONS

Pending orders aksar market analysis aur future predictions ke adhar par istemal kiye jate hain jabke instant orders turant market mein active hone ke liye istemal kiye jate hain.

CONTROL AUR FLEXIBILITY

Pending orders aapko control aur flexibility dete hain future market movements ke hisab se, jabke instant orders turant action lene mein madadgar hote hain jab aapki zarurat hoti hai.

RISK AND TIMING

Pending orders aapko market movements ka wait karne ka moqa dete hain, jisse aap apne risk ko manage kar sakte hain, jabke instant orders mein timing crucial hoti hai aur aapko turant entry ya exit karne ki ijazat dete hain. Pending orders aapko control aur flexibility dete hain future market movements ke hisab se, jabke instant orders turant action lene mein madadgar hote hain jab aapki zarurat hoti hai.

Pending orders aur instant orders dono forex trading mein ahmiyat rakhte hain, lekin inka istemal mukhtalif situations aur trading strategies ke mutabiq hota hai. Samajhna ke dono orders ke faide aur nuksan important hai trading mein kamiyabi hasil karne ke liye.

PENDING ORDER

Pending order yeh hota hai jab aap trading platform par ek order place karte hain lekin uska execution future mein hota hai, jab market specified price tak pahunchti hai. Pending orders aapko control aur flexibility dete hain future market movements ke hisab se, jabke instant orders turant action lene mein madadgar hote hain jab aapki zarurat hoti hai.Yeh orders aksar future price levels par entry ya exit ke liye istemal kiye jate hain.

INSTANT ORDER

Instant order yeh hota hai jab aap trading platform par ek order place karte hain aur wo turant execute ho jata hai, current market price par. Yeh orders immediate entry ya exit ke liye istemal kiye jate hain.

USES IN DIFFERENT CONDITIONS

Pending orders aksar market analysis aur future predictions ke adhar par istemal kiye jate hain jabke instant orders turant market mein active hone ke liye istemal kiye jate hain.

CONTROL AUR FLEXIBILITY

Pending orders aapko control aur flexibility dete hain future market movements ke hisab se, jabke instant orders turant action lene mein madadgar hote hain jab aapki zarurat hoti hai.

RISK AND TIMING

Pending orders aapko market movements ka wait karne ka moqa dete hain, jisse aap apne risk ko manage kar sakte hain, jabke instant orders mein timing crucial hoti hai aur aapko turant entry ya exit karne ki ijazat dete hain. Pending orders aapko control aur flexibility dete hain future market movements ke hisab se, jabke instant orders turant action lene mein madadgar hote hain jab aapki zarurat hoti hai.

Pending orders aur instant orders dono forex trading mein ahmiyat rakhte hain, lekin inka istemal mukhtalif situations aur trading strategies ke mutabiq hota hai. Samajhna ke dono orders ke faide aur nuksan important hai trading mein kamiyabi hasil karne ke liye.

تبصرہ

Расширенный режим Обычный режим