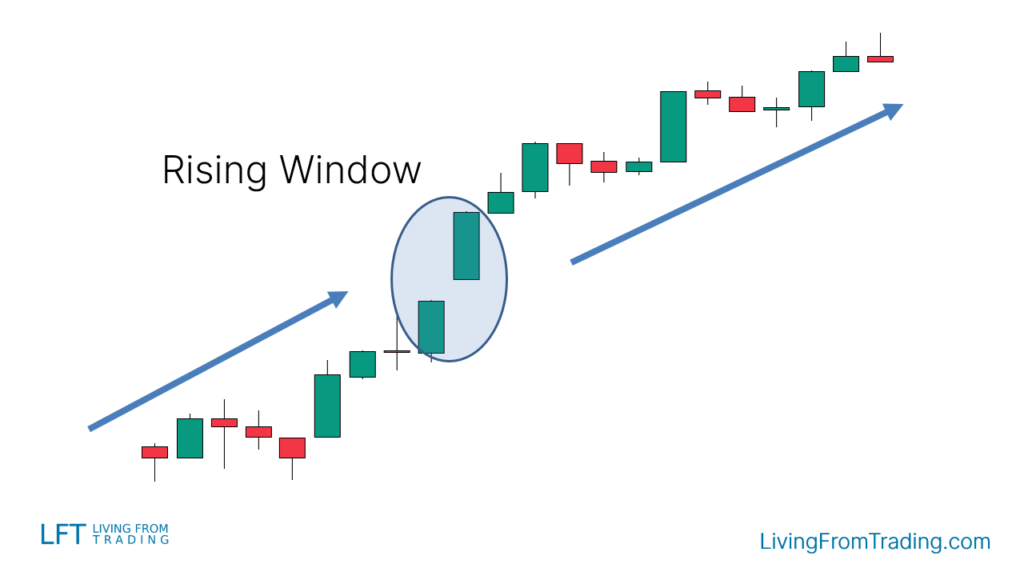

Rising window candlestick pattern, ya gap-up window, bullish window, ya tasweer chalta jaa raha hai, ek mumtaz technical analysis pattern hai jo ke uptrend ki continuation ki nishaani hai. Ye pattern wahi hota hai jab doosre din ke open price pehle din ke high price se ziada hota hai. Ye pattern ek strong uptrend ka indication deta hai.

Rising window candlestick pattern dekhne mein aasaan hota hai, lekin iski interpretation ko sahi taur par samajhna zaroori hai taake false signals se bacha ja sake. Is pattern ko pehchane ke liye, do din ke candlesticks ko dekhein, pehle din ek red (downward) candle aur doosre din ek green (upward) candle. Doosre din ke green candle ka open price pehle din ke red candle ke close price se ziada hota hai aur yehi gap rising window ki pehchan hoti hai.

Rising window candlestick pattern, market ke trend ki continuation ko indicate karta hai. Is pattern ko sahi taur par samajhne ke liye, market ko analyze karna zaroori hai. Yeh pattern commonly short-term aur intermediate-term traders ke liye beneficial hota hai. Is pattern ka zyada istemal karke, traders market ke trend ko sahi taur par samajh sakte hain aur sahi waqt par positions le sakte hain.

Rising Window Candlestick Pattern Ki Tafseelat

Rising window candlestick pattern, ek bullish continuation pattern hai. Is pattern mein, doosre din ke open price pehle din ke high price se ziada hota hai. Yeh pattern market mein bullish momentum ko darust karne ki nishani hai. Is pattern ko confirm karne ke liye, trading volume bhi dekha jata hai. Agar volume bhi barh raha hai, to yeh pattern aur bhi powerful hota hai.

Rising window candlestick pattern ko samajhne ke liye, yeh steps follow kiye ja sakte hain:

1. Pehle din ka candle: Pehla candle downward hota hai.

2. Dusra din ka candle: Doosre din ka candle upward hota hai aur iska open price pehle din ke close price se ziada hota hai. Yeh gap-up window kehlaya jata hai.

Pattern Ko Samajhne Ka Tareeqa:

1. Market Context: Rising window candlestick pattern ko samajhne ke liye, market ka context dekhna zaroori hai. Agar yeh pattern uptrend ke doran aata hai, to yeh bullish continuation pattern ke tor par consider kiya jata hai.

2. Volume: Volume bhi consider karna important hai. Agar volume bhi increase ho raha hai doosre din, to yeh pattern aur bhi reliable hota hai.

3. Confirmation: Confirmation ke liye, traders doosre din ke candle ko wait karte hain. Agar doosre din ka candle pehle din ke close price se ziada open hota hai aur volume bhi increase hota hai, to yeh pattern confirm hota hai.

Trading Strategies:

1.Buy Signals: Jab rising window candlestick pattern dekha jata hai, traders ko long positions lena chahiye.

2. Stop Loss: Stop loss lagana bhi zaroori hai taake nuksan se bacha ja sake.

3. Target Price: Target price ko set karna bhi important hai.

Rising window candlestick pattern ek powerful technical indicator hai jo ke bullish continuation ke liye signal deta hai. Is pattern ko samajhna aur sahi taur par interpret karna traders ke liye zaroori hai. Is pattern ko confirm karne ke liye, market ke trend aur volume ko sahi taur par analyze karna zaroori hai. Agar sahi taur par istemal kiya jaye, to yeh pattern traders ko profit mein madadgar sabit ho sakta hai.

Rising window candlestick pattern dekhne mein aasaan hota hai, lekin iski interpretation ko sahi taur par samajhna zaroori hai taake false signals se bacha ja sake. Is pattern ko pehchane ke liye, do din ke candlesticks ko dekhein, pehle din ek red (downward) candle aur doosre din ek green (upward) candle. Doosre din ke green candle ka open price pehle din ke red candle ke close price se ziada hota hai aur yehi gap rising window ki pehchan hoti hai.

Rising window candlestick pattern, market ke trend ki continuation ko indicate karta hai. Is pattern ko sahi taur par samajhne ke liye, market ko analyze karna zaroori hai. Yeh pattern commonly short-term aur intermediate-term traders ke liye beneficial hota hai. Is pattern ka zyada istemal karke, traders market ke trend ko sahi taur par samajh sakte hain aur sahi waqt par positions le sakte hain.

Rising Window Candlestick Pattern Ki Tafseelat

Rising window candlestick pattern, ek bullish continuation pattern hai. Is pattern mein, doosre din ke open price pehle din ke high price se ziada hota hai. Yeh pattern market mein bullish momentum ko darust karne ki nishani hai. Is pattern ko confirm karne ke liye, trading volume bhi dekha jata hai. Agar volume bhi barh raha hai, to yeh pattern aur bhi powerful hota hai.

Rising window candlestick pattern ko samajhne ke liye, yeh steps follow kiye ja sakte hain:

1. Pehle din ka candle: Pehla candle downward hota hai.

2. Dusra din ka candle: Doosre din ka candle upward hota hai aur iska open price pehle din ke close price se ziada hota hai. Yeh gap-up window kehlaya jata hai.

Pattern Ko Samajhne Ka Tareeqa:

1. Market Context: Rising window candlestick pattern ko samajhne ke liye, market ka context dekhna zaroori hai. Agar yeh pattern uptrend ke doran aata hai, to yeh bullish continuation pattern ke tor par consider kiya jata hai.

2. Volume: Volume bhi consider karna important hai. Agar volume bhi increase ho raha hai doosre din, to yeh pattern aur bhi reliable hota hai.

3. Confirmation: Confirmation ke liye, traders doosre din ke candle ko wait karte hain. Agar doosre din ka candle pehle din ke close price se ziada open hota hai aur volume bhi increase hota hai, to yeh pattern confirm hota hai.

Trading Strategies:

1.Buy Signals: Jab rising window candlestick pattern dekha jata hai, traders ko long positions lena chahiye.

2. Stop Loss: Stop loss lagana bhi zaroori hai taake nuksan se bacha ja sake.

3. Target Price: Target price ko set karna bhi important hai.

Rising window candlestick pattern ek powerful technical indicator hai jo ke bullish continuation ke liye signal deta hai. Is pattern ko samajhna aur sahi taur par interpret karna traders ke liye zaroori hai. Is pattern ko confirm karne ke liye, market ke trend aur volume ko sahi taur par analyze karna zaroori hai. Agar sahi taur par istemal kiya jaye, to yeh pattern traders ko profit mein madadgar sabit ho sakta hai.

تبصرہ

Расширенный режим Обычный режим