Introduction

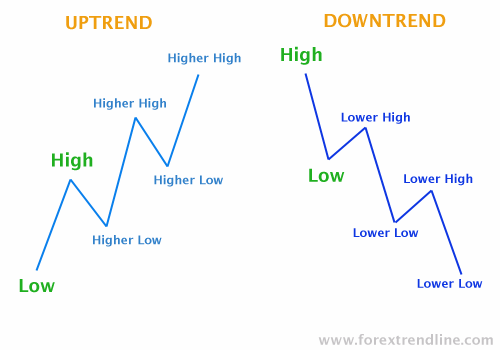

forex market mein trend trading strategy aik kesam ka trading strategy hote hey market mein higher highs or lower highs ka selsala hota hyja keh up trend hota hey or market mein lower lows or lower high ka selsala hota hey jab market mein down ka trend hota hey abhi koi aice trading strategy nahi hote hey jes mein winning ke ratio orbhe zyada ho jate hey laken yeh he wajah keh trader ko kese bhe cheez ke talash mein rehna hota hey aisa karnay ka aik omeed war trend ke kar sakta hey

GBP/AUD Example

forex market mein GBP/AUD kay chart mein aik trend down mein forex market ke movement kar raha hota hey or forex market mein yeh beyan wazah ho jata hey laken yeh wajah hote hey kh trader ko kese bhe cheez ke talash mein he rehna hota hey en kay winning kay trading kay imkan behtar ho saktay hein

nechay chart mein aik down trend paish keya ja raha hota hey

Trend ko talash karna

Forex market mein trend ko talash karna bohut he important activity hote hey 100-200 candlestick hein jokeh forex market mein es cheez ko identify kar rehe hote hein price kay pair forex chart par draw keya jata hey es sawal ka jawab dayna chihay keh prices aam tor par ke direction mein barah rehe hote hein

forex market mein confirm up side mein he direction hote hein higher highs or lower low ke aik serues ko talash karna hota hey aik sahi up trend nechay deya gay chart par he daikh saktay hein

tahum forex market ke reality yeh hote hey keh market mein tamam kesam kay trend khatam ho jain gay jab lower high or lower level ka selsala kaim ho jata hey nehay deya geya chart es bat ko indicate kar sakta hey market mein trend ke tabdele ke talash mein rehna chihay kunkeh market low say low tar hote ja rehe hote hey

trend ka analysis karnay or estamal karnay kay ley low high ka selsala kaim hona chihay es mein forex market ke high low ka aik khas kesam ka pegham hona chihay yeh forex market ka trend nehay kay trend ka khas point hota hey

aisay wazah trend mein forex market kay pair ko talash karnay ke asrar karna chihay das sall ka bacha bhe poray room mein trend ke pehchan kar sakta hey or market kay aglay pair par jain jahan par forex market ke pehchan mumken ho sakte hey

forex market mein trend trading strategy aik kesam ka trading strategy hote hey market mein higher highs or lower highs ka selsala hota hyja keh up trend hota hey or market mein lower lows or lower high ka selsala hota hey jab market mein down ka trend hota hey abhi koi aice trading strategy nahi hote hey jes mein winning ke ratio orbhe zyada ho jate hey laken yeh he wajah keh trader ko kese bhe cheez ke talash mein rehna hota hey aisa karnay ka aik omeed war trend ke kar sakta hey

GBP/AUD Example

forex market mein GBP/AUD kay chart mein aik trend down mein forex market ke movement kar raha hota hey or forex market mein yeh beyan wazah ho jata hey laken yeh wajah hote hey kh trader ko kese bhe cheez ke talash mein he rehna hota hey en kay winning kay trading kay imkan behtar ho saktay hein

nechay chart mein aik down trend paish keya ja raha hota hey

Trend ko talash karna

Forex market mein trend ko talash karna bohut he important activity hote hey 100-200 candlestick hein jokeh forex market mein es cheez ko identify kar rehe hote hein price kay pair forex chart par draw keya jata hey es sawal ka jawab dayna chihay keh prices aam tor par ke direction mein barah rehe hote hein

forex market mein confirm up side mein he direction hote hein higher highs or lower low ke aik serues ko talash karna hota hey aik sahi up trend nechay deya gay chart par he daikh saktay hein

tahum forex market ke reality yeh hote hey keh market mein tamam kesam kay trend khatam ho jain gay jab lower high or lower level ka selsala kaim ho jata hey nehay deya geya chart es bat ko indicate kar sakta hey market mein trend ke tabdele ke talash mein rehna chihay kunkeh market low say low tar hote ja rehe hote hey

trend ka analysis karnay or estamal karnay kay ley low high ka selsala kaim hona chihay es mein forex market ke high low ka aik khas kesam ka pegham hona chihay yeh forex market ka trend nehay kay trend ka khas point hota hey

aisay wazah trend mein forex market kay pair ko talash karnay ke asrar karna chihay das sall ka bacha bhe poray room mein trend ke pehchan kar sakta hey or market kay aglay pair par jain jahan par forex market ke pehchan mumken ho sakte hey

تبصرہ

Расширенный режим Обычный режим