WHAT IS SCOOP PATTERN IN FOREX TRADING DISCUSS IT:

SCOOP PATTERN KI TAREEF.

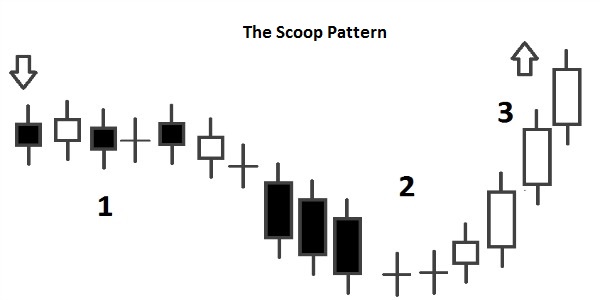

Scoop Pattern ek technical analysis tool hai jo market mein trend ko identify karne mein madad karta hai. Scoop Pattern market mein trend reversal ko suggest karta hai, yani agar price pehle down ja rahi thi to ab upward movement ki possibility hai.Scoop Pattern accurate nahi hota har waqt, isliye confirmatory indicators ka istemal zaroori hai.Target ko set karna important hai, taki profit ka maqsood hasil kiya ja sake.

SCOOP PATTERN APPEARANCE

Scoop Pattern ko ek "U" shape mein dekha jaata hai, jismein price pehle downward trend mein hota hai phir ek sudden upward movement hota hai. Scoop Pattern market mein trend reversal ko suggest karta hai, yani agar price pehle down ja rahi thi to ab upward movement ki possibility hai.Jab Scoop Pattern complete hota hai, traders entry point ko identify karte hain.

SCOOP PATTERN TRADING STRATEGY & ENTRY POINTS

Jab Scoop Pattern complete hota hai, traders entry point ko identify karte hain.

STOP LOSS

Stop loss ko set karna important hai, taake in case price reverse ho to nuksan kam ho.

TARGET

Target ko set karna important hai, taki profit ka maqsood hasil kiya ja sake.

SCOOP PATTERN KI LIMITATIONS

Scoop Pattern accurate nahi hota har waqt, isliye confirmatory indicators ka istemal zaroori hai.Target ko set karna important hai, taki profit ka maqsood hasil kiya ja sake.

Jab Scoop Pattern complete hota hai, traders entry point ko identify karte hain.Scoop Pattern market mein trend reversal ko suggest karta hai, yani agar price pehle down ja rahi thi to ab upward movement ki possibility hai.Stop loss ko set karna important hai, taake in case price reverse ho to nuksan kam ho.

SCOOP PATTERN KI TAREEF.

Scoop Pattern ek technical analysis tool hai jo market mein trend ko identify karne mein madad karta hai. Scoop Pattern market mein trend reversal ko suggest karta hai, yani agar price pehle down ja rahi thi to ab upward movement ki possibility hai.Scoop Pattern accurate nahi hota har waqt, isliye confirmatory indicators ka istemal zaroori hai.Target ko set karna important hai, taki profit ka maqsood hasil kiya ja sake.

SCOOP PATTERN APPEARANCE

Scoop Pattern ko ek "U" shape mein dekha jaata hai, jismein price pehle downward trend mein hota hai phir ek sudden upward movement hota hai. Scoop Pattern market mein trend reversal ko suggest karta hai, yani agar price pehle down ja rahi thi to ab upward movement ki possibility hai.Jab Scoop Pattern complete hota hai, traders entry point ko identify karte hain.

SCOOP PATTERN TRADING STRATEGY & ENTRY POINTS

Jab Scoop Pattern complete hota hai, traders entry point ko identify karte hain.

STOP LOSS

Stop loss ko set karna important hai, taake in case price reverse ho to nuksan kam ho.

TARGET

Target ko set karna important hai, taki profit ka maqsood hasil kiya ja sake.

SCOOP PATTERN KI LIMITATIONS

Scoop Pattern accurate nahi hota har waqt, isliye confirmatory indicators ka istemal zaroori hai.Target ko set karna important hai, taki profit ka maqsood hasil kiya ja sake.

Jab Scoop Pattern complete hota hai, traders entry point ko identify karte hain.Scoop Pattern market mein trend reversal ko suggest karta hai, yani agar price pehle down ja rahi thi to ab upward movement ki possibility hai.Stop loss ko set karna important hai, taake in case price reverse ho to nuksan kam ho.

تبصرہ

Расширенный режим Обычный режим