HOCKEY CANDLESTICK PATTERN EXPLANATION:

INTRODUCTION

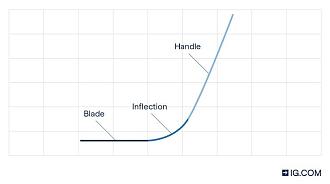

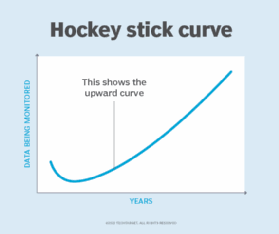

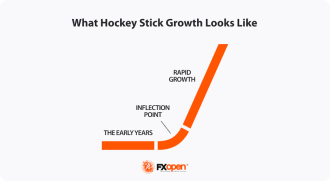

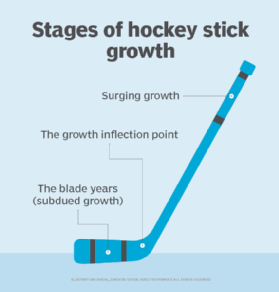

Hockey candlestick pattern ek technical analysis tool hai jo share market mein istemal hota hai. Ye pattern price movements ko samajhne aur future price ki prediction karne mein madadgar hota hai. Hockey candlestick pattern ek bearish reversal pattern hai jo price chart par aik specific shape mein appear hota hai. Ye pattern do candlesticks se bana hota hai aur usually uptrend ke doran nazar ata hai.

RECOGNIZATION OF HOCKEY CANDLESTICK PATTERN

Hockey candlestick pattern ko recognize karne ke liye, pehle ek lambi bullish candlestick aati hai jo uptrend ko darust karti hai. Phir, doosri candlestick jismein price open aur close pehli candlestick ke upper hoti hai aur iski body chhoti hoti hai, dikhayi deti hai.

TRADING STRATEGY

Hockey candlestick pattern ka matlab hota hai ke uptrend ka momentum khatam ho gaya hai aur bearish trend shuru hone wala hai. Is pattern ko dekh kar traders apni trading strategy ko adjust karte hain aur potential bearish movement ka faida uthate hain.

Agar hockey candlestick pattern dekha jaye toh traders ko selling opportunity nazar aati hai. Woh is pattern ke baad short positions le sakte hain ya phir existing long positions ko close kar sakte hain.

FORMATION AND CAVEATS

Hockey candlestick pattern ko sirf do candlesticks ki formation par base mat karain. Always confirm karein ke market ka overall trend aur doosre technical indicators bhi pattern ko support karte hain ya nahi.

Hockey candlestick pattern ka matlab hota hai ke uptrend ka momentum khatam ho gaya hai aur bearish trend shuru hone wala hai. Is pattern ko dekh kar traders apni trading strategy ko adjust karte hain aur potential bearish movement ka faida uthate hain.

INTRODUCTION

Hockey candlestick pattern ek technical analysis tool hai jo share market mein istemal hota hai. Ye pattern price movements ko samajhne aur future price ki prediction karne mein madadgar hota hai. Hockey candlestick pattern ek bearish reversal pattern hai jo price chart par aik specific shape mein appear hota hai. Ye pattern do candlesticks se bana hota hai aur usually uptrend ke doran nazar ata hai.

RECOGNIZATION OF HOCKEY CANDLESTICK PATTERN

Hockey candlestick pattern ko recognize karne ke liye, pehle ek lambi bullish candlestick aati hai jo uptrend ko darust karti hai. Phir, doosri candlestick jismein price open aur close pehli candlestick ke upper hoti hai aur iski body chhoti hoti hai, dikhayi deti hai.

TRADING STRATEGY

Hockey candlestick pattern ka matlab hota hai ke uptrend ka momentum khatam ho gaya hai aur bearish trend shuru hone wala hai. Is pattern ko dekh kar traders apni trading strategy ko adjust karte hain aur potential bearish movement ka faida uthate hain.

Agar hockey candlestick pattern dekha jaye toh traders ko selling opportunity nazar aati hai. Woh is pattern ke baad short positions le sakte hain ya phir existing long positions ko close kar sakte hain.

FORMATION AND CAVEATS

Hockey candlestick pattern ko sirf do candlesticks ki formation par base mat karain. Always confirm karein ke market ka overall trend aur doosre technical indicators bhi pattern ko support karte hain ya nahi.

Hockey candlestick pattern ka matlab hota hai ke uptrend ka momentum khatam ho gaya hai aur bearish trend shuru hone wala hai. Is pattern ko dekh kar traders apni trading strategy ko adjust karte hain aur potential bearish movement ka faida uthate hain.

تبصرہ

Расширенный режим Обычный режим