ELABORATE DOW THEORY IN FOREX TRADING

INTRODUCTION OF DOW THEORY:

Dow Theory forex mein ek ahem nazariya hai jo taqreeban 100 saal se mojood hai. Yah nazariya asal mein stock market ke liye banaya gaya tha lekin ab forex market mein bhi istemal hota hai.Dow Theory forex mein ek ahem nazariya hai jo taqreeban 100 saal se mojood hai. Yah nazariya asal mein stock market ke liye banaya gaya tha lekin ab forex market mein bhi istemal hota hai.

BASIC PRINCIPLES:

Dow Theory ke bunyadi usool mein 3 ahem points shamil hain: trends, corrections, aur averages. In tino ke zariye market ki movement ko samjha jata hai.

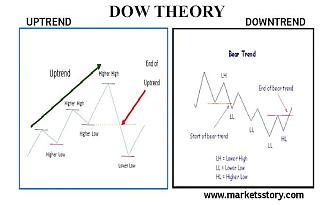

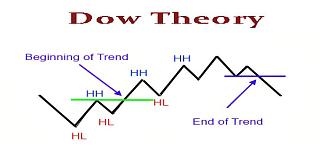

TREND (UP TREND & DOWN TREND)

Dow Theory ke mutabiq, market mein 3 qisam ke trends hote hain: uptrend (buland raftaar), downtrend (girawat ki taraf), aur sideways trend (ek hi level par chalna).

IMPLICATIONS OF DOW THEORY:

Forex traders Dow Theory ka istemal kar ke market ke trends ko samajhte hain aur unke mutabiq trading karte hain. Agar market uptrend mein hai to khareedna munasib hota hai, jabke downtrend mein bechna behtar hota hai.

AVERAGE AND KEY POINTS

Dow Theory mein moving averages ka istemal hota hai market ke trends ko samajhne ke liye. Maamoolan 50-day aur 200-day moving averages ka tawazun dekha jata hai. Dow Theory ke mutabiq, market ki movement ke peechay asal wajahain hoti hain jo economic factors, geopolitical events, aur market psychology se mutasir hoti hain.

Dow Theory forex traders ko market ke patterns aur trends ko samajhne mein madad deta hai, lekin sirf ek tool hai aur sirf is par aitemad nahi karna chahiye. Trading ke liye mukhtalif tools aur tajurba zaroori hain.

INTRODUCTION OF DOW THEORY:

Dow Theory forex mein ek ahem nazariya hai jo taqreeban 100 saal se mojood hai. Yah nazariya asal mein stock market ke liye banaya gaya tha lekin ab forex market mein bhi istemal hota hai.Dow Theory forex mein ek ahem nazariya hai jo taqreeban 100 saal se mojood hai. Yah nazariya asal mein stock market ke liye banaya gaya tha lekin ab forex market mein bhi istemal hota hai.

BASIC PRINCIPLES:

Dow Theory ke bunyadi usool mein 3 ahem points shamil hain: trends, corrections, aur averages. In tino ke zariye market ki movement ko samjha jata hai.

TREND (UP TREND & DOWN TREND)

Dow Theory ke mutabiq, market mein 3 qisam ke trends hote hain: uptrend (buland raftaar), downtrend (girawat ki taraf), aur sideways trend (ek hi level par chalna).

IMPLICATIONS OF DOW THEORY:

Forex traders Dow Theory ka istemal kar ke market ke trends ko samajhte hain aur unke mutabiq trading karte hain. Agar market uptrend mein hai to khareedna munasib hota hai, jabke downtrend mein bechna behtar hota hai.

AVERAGE AND KEY POINTS

Dow Theory mein moving averages ka istemal hota hai market ke trends ko samajhne ke liye. Maamoolan 50-day aur 200-day moving averages ka tawazun dekha jata hai. Dow Theory ke mutabiq, market ki movement ke peechay asal wajahain hoti hain jo economic factors, geopolitical events, aur market psychology se mutasir hoti hain.

Dow Theory forex traders ko market ke patterns aur trends ko samajhne mein madad deta hai, lekin sirf ek tool hai aur sirf is par aitemad nahi karna chahiye. Trading ke liye mukhtalif tools aur tajurba zaroori hain.

تبصرہ

Расширенный режим Обычный режим