GOLDEN CROSS TRADING STRATEGY EXPLANATION IN FOREX TRADING:

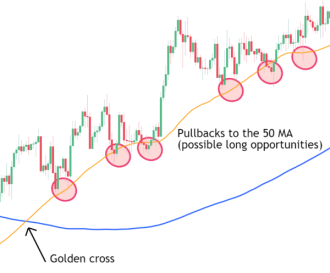

Golden Cross Trading Strategy ko istemal kar ke traders market mein invest karte hain. Yeh strategy technical analysis par mabni hai aur trend ko samajhne ke liye istemal hoti hai.Golden Cross hota hai jab short-term moving average (jaise 50-day moving average) long-term moving average (jaise 200-day moving average) ko upar se cross karta hai. Yeh bullish trend ka indication hai.

SHORT-TERM MOVING AVERAGE LONG-TERM MOVING AVERAGE

Agar short-term moving average long-term moving average ko upar se cross karta hai, to yeh signal hai ke market mein bullish trend shuru ho sakta hai. Traders is signal ko confirm karne ke liye aur technical indicators ka istemal karte hain jaise RSI (Relative Strength Index) ya MACD (Moving Average Convergence Divergence).Traders is strategy ko apni trading plan mein shamil karte hain taake unhe market ke trends ka acha andaza ho sake. Yeh tha Golden Cross trading strategy ka aik mukhtasar tazurba. Agar aur koi sawal ho to pooch sakte hain.

GOLDEN CROSS IS A POWERFUL INDICATOR:

Agar Golden Cross ho jata hai, to traders long position lete hain ya phir existing position ko hold karte hain. Stop-loss orders lagana zaroori hai taa ke nuksan se bacha ja sake.

Golden Cross ek powerful indicator hai lekin kabhi-kabhi false signals bhi ho sakte hain, is liye doosre technical indicators ka bhi istemal zaroori hai. Stocks, forex, ya anya financial markets mein Golden Cross ka istemal kiya jata hai.

Traders is strategy ko apni trading plan mein shamil karte hain taake unhe market ke trends ka acha andaza ho sake. Yeh tha Golden Cross trading strategy ka aik mukhtasar tazurba. Agar aur koi sawal ho to pooch sakte hain.

Golden Cross Trading Strategy ko istemal kar ke traders market mein invest karte hain. Yeh strategy technical analysis par mabni hai aur trend ko samajhne ke liye istemal hoti hai.Golden Cross hota hai jab short-term moving average (jaise 50-day moving average) long-term moving average (jaise 200-day moving average) ko upar se cross karta hai. Yeh bullish trend ka indication hai.

SHORT-TERM MOVING AVERAGE LONG-TERM MOVING AVERAGE

Agar short-term moving average long-term moving average ko upar se cross karta hai, to yeh signal hai ke market mein bullish trend shuru ho sakta hai. Traders is signal ko confirm karne ke liye aur technical indicators ka istemal karte hain jaise RSI (Relative Strength Index) ya MACD (Moving Average Convergence Divergence).Traders is strategy ko apni trading plan mein shamil karte hain taake unhe market ke trends ka acha andaza ho sake. Yeh tha Golden Cross trading strategy ka aik mukhtasar tazurba. Agar aur koi sawal ho to pooch sakte hain.

GOLDEN CROSS IS A POWERFUL INDICATOR:

Agar Golden Cross ho jata hai, to traders long position lete hain ya phir existing position ko hold karte hain. Stop-loss orders lagana zaroori hai taa ke nuksan se bacha ja sake.

Golden Cross ek powerful indicator hai lekin kabhi-kabhi false signals bhi ho sakte hain, is liye doosre technical indicators ka bhi istemal zaroori hai. Stocks, forex, ya anya financial markets mein Golden Cross ka istemal kiya jata hai.

Traders is strategy ko apni trading plan mein shamil karte hain taake unhe market ke trends ka acha andaza ho sake. Yeh tha Golden Cross trading strategy ka aik mukhtasar tazurba. Agar aur koi sawal ho to pooch sakte hain.

تبصرہ

Расширенный режим Обычный режим