Introduction.

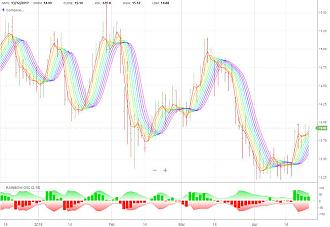

Rainbow Oscillator Indicator forex mein ek popular technical indicator hai. Iska istemal market trend aur momentum ko samajhne ke liye kiya jata hai. Is indicator ko traders aur investors dwara istemal kiya jata hai taaki unhe market mein hone wale changes aur opportunities ke baare mein pata chal sake.

Rainbow Oscillator Indicator Formation.

Rainbow Oscillator Indicator ka matlab hai ki yeh indicator market ke trends aur momentum ko ek range ke andar dikhata hai. Is indicator mein 13 alag-alag moving averages shamil hote hain, jinhe ek saath dikhaya jata hai. Is indicator ki range -100 se 100 tak hoti hai.

Rainbow Oscillator Indicator Uses.

Rainbow Oscillator Indicator ka istemal market trend aur momentum ko samajhne ke liye kiya jata hai. Is indicator ko istemal karke traders aur investors market mein hone wale changes aur opportunities ko identify kar sakte hain.

Is indicator mein ek moving average ki jagah 13 moving averages shamil hote hain, jisse market trend aur momentum ko aur bhi accurate tareeke se samajha ja sakta hai.

Rainbow Oscillator Indicator Calculation.

Rainbow Oscillator Indicator ki calculation 13 moving averages par tika hoti hai. Yeh moving averages price ko track karte hain aur ek range ke andar dikhate hain. Is indicator ki range -100 se 100 tak hoti hai, jiske andar market ke trends aur momentum ko samajha ja sakta hai.

Basics of Rainbow Oscillator Indicator.

Rainbow Oscillator Indicator forex mein ek popular technical indicator hai, jiska istemal traders aur investors market trend aur momentum ko samajhne ke liye karte hain. Is indicator mein 13 moving averages shamil hote hain, jinhe ek saath dikhaya jata hai. Is indicator ki range -100 se 100 tak hoti hai, jiske andar market ke trends aur momentum ko samajha ja sakta hai.

Rainbow Oscillator Indicator forex mein ek popular technical indicator hai. Iska istemal market trend aur momentum ko samajhne ke liye kiya jata hai. Is indicator ko traders aur investors dwara istemal kiya jata hai taaki unhe market mein hone wale changes aur opportunities ke baare mein pata chal sake.

Rainbow Oscillator Indicator Formation.

Rainbow Oscillator Indicator ka matlab hai ki yeh indicator market ke trends aur momentum ko ek range ke andar dikhata hai. Is indicator mein 13 alag-alag moving averages shamil hote hain, jinhe ek saath dikhaya jata hai. Is indicator ki range -100 se 100 tak hoti hai.

Rainbow Oscillator Indicator Uses.

Rainbow Oscillator Indicator ka istemal market trend aur momentum ko samajhne ke liye kiya jata hai. Is indicator ko istemal karke traders aur investors market mein hone wale changes aur opportunities ko identify kar sakte hain.

Is indicator mein ek moving average ki jagah 13 moving averages shamil hote hain, jisse market trend aur momentum ko aur bhi accurate tareeke se samajha ja sakta hai.

Rainbow Oscillator Indicator Calculation.

Rainbow Oscillator Indicator ki calculation 13 moving averages par tika hoti hai. Yeh moving averages price ko track karte hain aur ek range ke andar dikhate hain. Is indicator ki range -100 se 100 tak hoti hai, jiske andar market ke trends aur momentum ko samajha ja sakta hai.

Basics of Rainbow Oscillator Indicator.

Rainbow Oscillator Indicator forex mein ek popular technical indicator hai, jiska istemal traders aur investors market trend aur momentum ko samajhne ke liye karte hain. Is indicator mein 13 moving averages shamil hote hain, jinhe ek saath dikhaya jata hai. Is indicator ki range -100 se 100 tak hoti hai, jiske andar market ke trends aur momentum ko samajha ja sakta hai.

تبصرہ

Расширенный режим Обычный режим