Introduction to Chaikin Money Flow (CMF) Indicator

Chaikin Money Flow (CMF) indicator ek aham technical analysis tool hai jo traders istemal karte hain taake wo ek security mein paisay ka daur ko dekh sakein jo ek mukarrar arsay mein hota hai. Ye Marc Chaikin ne tayar kiya tha aur iska bunyadi tajurba yeh hai ke qeemat ke harkaat ko trading volume ka asar hota hai. CMF price aur volume data ko mila kar istemal karta hai taake market mein khareedne aur bechnay ke dabao ko samajh sake. Traders CMF ko aksar trends ko tasdiq karna, mumkinayat ke palat aur trading faislay mein aqalmandi se amal karna ke liye istemal karte hain.

CMF indicator ka bunyadi istemal price aur volume ke darmiyan taluqat ka andaza lagane ke liye hota hai. Is se security mein paisay ka daur ko samajhne mein madad milti hai taake samajh mein aaye ke ek qeemat ke harkat ko mazboot ya kamzor khareedne ya bechne ke dabao ne sath diya hai.

Calculation Method of CMF

CMF ka calculation kai steps par mabni hota hai. Sab se pehle, Money Flow Multiplier (MF Multiplier) ko calculate kiya jata hai jismein dekha jata hai ke closing price pehle ke closing price se zyada ya kam hai. Agar closing price pehle se zyada hai, to MF Multiplier ka formula ((Close - Low) - (High - Close)) / (High - Low) hota hai. Agar closing price pehle se kam hai, to MF Multiplier ka formula ((Close - High) - (Low - Close)) / (High - Low) hota hai.

Phir, Money Flow Volume (MF Volume) ko calculate kiya jata hai jismein MF Multiplier ko us period ke corresponding volume se multiply kiya jata hai. Ye step har qeemat ki harkat ke sath jude paisay ka daur ko quantify karta hai.

Aakhir mein, CMF ko calculate kiya jata hai jismein ek mukarrar arsay (aam tor par 20 periods) ke MF Volume ko jama kiya jata hai aur usay usi mukarrar arsay ke volume se divide kiya jata hai. Is se CMF ka value aata hai jo -1 se +1 ke darmiyan ek scale par normalize kiya jata hai, jise ye formula istemal karta hai ((CMF Period Volume - Min CMF Period Volume) / (Max CMF Period Volume - Min CMF Period Volume)) * 2 - 1.

Interpretation of CMF Values

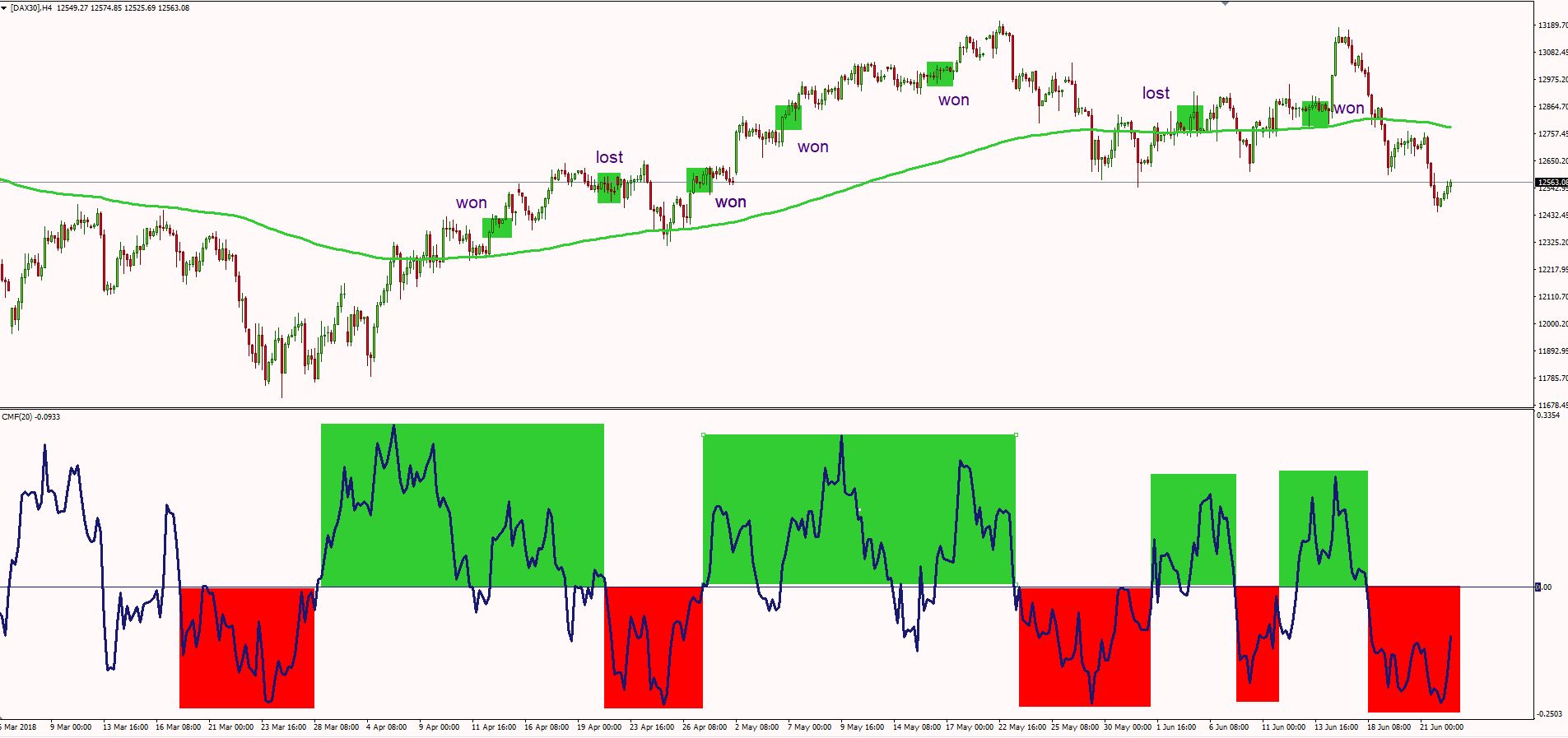

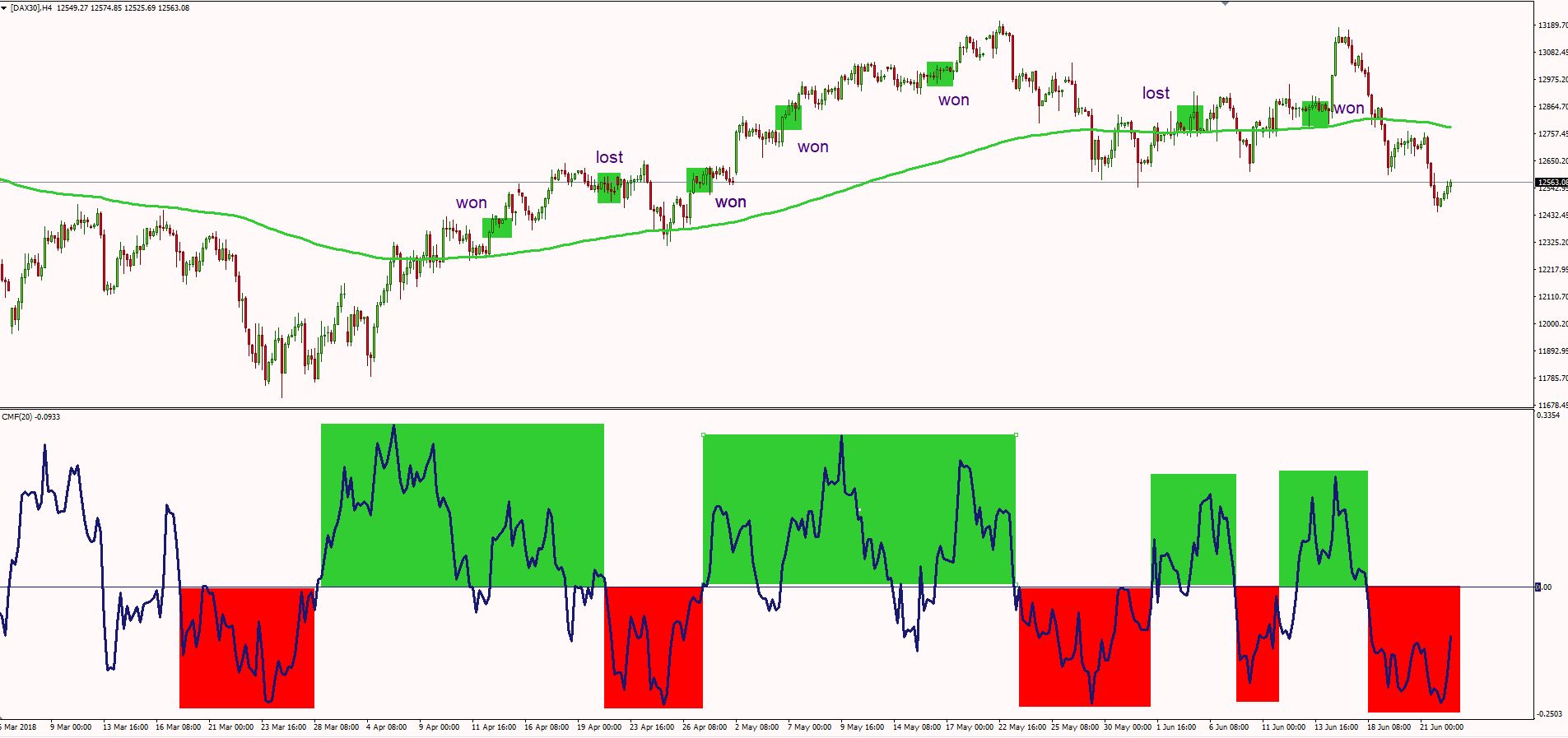

CMF ki tabeer ko samajhna CMF ke values aur unke asar ko samajhne mein maddad karti hai. Ek musbat CMF value yeh batati hai ke paisay ka daur bullish hai, yani market mein zyada khareedne ka dabao hai. Ulta agar CMF ki value negative hai to iska matlab hai ke bearish paisay ka daur hai, yani zyada bechne ka dabao hai. Traders CMF aur price ki harkat mein farq dekhte hain taake potential trend reversals ko pehchane ya mojooda trends ko tasdiq kar sakein.

Practical Applications in Trading Strategies

Amli tor par, traders CMF ko mukhtalif tareeqon se apne trading strategies ko behtar banane ke liye istemal karte hain. Ek aam approach CMF ko doosre technical indicators jaise ke moving averages ya trend lines ke sath istemal karna hota hai taake trade signals ko tasdiq kiya ja sake. Misal ke taur par, agar ek stock ka trend upar ja raha hai aur CMF consistently musbat hai ya zyada bullish divergence dikhata hai, to ye ek long trade signal ko madadgar bana sakta hai.

Iske alawa, traders price aur paisay ka daur ke darmiyan potential divergences ko spot karne ke liye CMF ka istemal karte hain. Maslan, agar ek stock ki qeemat barh rahi hai magar CMF kam ho raha hai ya bearish divergence dikhata hai, to ye ek buying pressure mein kamzori aur potential trend reversal ko indicate kar sakta hai.

Applying CMF to Different Timeframes

Baqi, CMF ko mukhtalif timeframes par apply kiya ja sakta hai, jaise ke intraday charts se lekar longer-term charts tak, jo trader ki trading style aur maqsad par munhasir hota hai. Chhoti arsay ke traders chhoti CMF periods par focus karte hain taake jaldi momentum shifts ko capture kar sakein, jabke lambi arsay ke investors lambi CMF periods ko istemal karte hain taake overall market sentiment aur trends ka andaza lag sakein.

Risk Management with CMF

Risk management bhi ek area hai jahan CMF ka faida uthaya ja sakta hai. Price movements ke sath paisay ka daur aur volume ko monitor karke, traders apne positions ko adjust kar sakte hain ya agar CMF market sentiment mein kisi tabdeeli ko indicate karta hai jo unke initial trade thesis ke khilaaf hai, to wo apni trades se bahar nikal sakte hain.

Limitations and Considerations

Zaroori hai ke CMF ko valuable insights dene ka zariya samjha jaye, lekin ye koi magic formula nahi hai aur isay doosri analysis techniques aur risk management strategies ke sath istemal karna chahiye. False signals aur market noise bhi hosakte hain, khaaskar kam liquidity ya market volatility ke doran.

Chaikin Money Flow (CMF) indicator ek versatile tool hai jo traders ko security mein paisay ka daur samajhne mein madad deta hai. Iska calculation method price aur volume data ko mila kar market sentiment aur potential trend reversals ko samajhne mein madadgar hai. Traders CMF ko mukhtalif tareeqon se istemal karte hain, jaise ke trends ko tasdiq karna, divergences ko pehchanna, aur risk ko manage karna. Magar, zaroori hai ke CMF ko ek mukammal trading strategy ka hissa banaya jaye aur iske signals ko samajhne mein hoshiyari aur ehtiyaat ke sath kaam kya jaye.

Chaikin Money Flow (CMF) indicator ek aham technical analysis tool hai jo traders istemal karte hain taake wo ek security mein paisay ka daur ko dekh sakein jo ek mukarrar arsay mein hota hai. Ye Marc Chaikin ne tayar kiya tha aur iska bunyadi tajurba yeh hai ke qeemat ke harkaat ko trading volume ka asar hota hai. CMF price aur volume data ko mila kar istemal karta hai taake market mein khareedne aur bechnay ke dabao ko samajh sake. Traders CMF ko aksar trends ko tasdiq karna, mumkinayat ke palat aur trading faislay mein aqalmandi se amal karna ke liye istemal karte hain.

CMF indicator ka bunyadi istemal price aur volume ke darmiyan taluqat ka andaza lagane ke liye hota hai. Is se security mein paisay ka daur ko samajhne mein madad milti hai taake samajh mein aaye ke ek qeemat ke harkat ko mazboot ya kamzor khareedne ya bechne ke dabao ne sath diya hai.

Calculation Method of CMF

CMF ka calculation kai steps par mabni hota hai. Sab se pehle, Money Flow Multiplier (MF Multiplier) ko calculate kiya jata hai jismein dekha jata hai ke closing price pehle ke closing price se zyada ya kam hai. Agar closing price pehle se zyada hai, to MF Multiplier ka formula ((Close - Low) - (High - Close)) / (High - Low) hota hai. Agar closing price pehle se kam hai, to MF Multiplier ka formula ((Close - High) - (Low - Close)) / (High - Low) hota hai.

Phir, Money Flow Volume (MF Volume) ko calculate kiya jata hai jismein MF Multiplier ko us period ke corresponding volume se multiply kiya jata hai. Ye step har qeemat ki harkat ke sath jude paisay ka daur ko quantify karta hai.

Aakhir mein, CMF ko calculate kiya jata hai jismein ek mukarrar arsay (aam tor par 20 periods) ke MF Volume ko jama kiya jata hai aur usay usi mukarrar arsay ke volume se divide kiya jata hai. Is se CMF ka value aata hai jo -1 se +1 ke darmiyan ek scale par normalize kiya jata hai, jise ye formula istemal karta hai ((CMF Period Volume - Min CMF Period Volume) / (Max CMF Period Volume - Min CMF Period Volume)) * 2 - 1.

Interpretation of CMF Values

CMF ki tabeer ko samajhna CMF ke values aur unke asar ko samajhne mein maddad karti hai. Ek musbat CMF value yeh batati hai ke paisay ka daur bullish hai, yani market mein zyada khareedne ka dabao hai. Ulta agar CMF ki value negative hai to iska matlab hai ke bearish paisay ka daur hai, yani zyada bechne ka dabao hai. Traders CMF aur price ki harkat mein farq dekhte hain taake potential trend reversals ko pehchane ya mojooda trends ko tasdiq kar sakein.

Practical Applications in Trading Strategies

Amli tor par, traders CMF ko mukhtalif tareeqon se apne trading strategies ko behtar banane ke liye istemal karte hain. Ek aam approach CMF ko doosre technical indicators jaise ke moving averages ya trend lines ke sath istemal karna hota hai taake trade signals ko tasdiq kiya ja sake. Misal ke taur par, agar ek stock ka trend upar ja raha hai aur CMF consistently musbat hai ya zyada bullish divergence dikhata hai, to ye ek long trade signal ko madadgar bana sakta hai.

Iske alawa, traders price aur paisay ka daur ke darmiyan potential divergences ko spot karne ke liye CMF ka istemal karte hain. Maslan, agar ek stock ki qeemat barh rahi hai magar CMF kam ho raha hai ya bearish divergence dikhata hai, to ye ek buying pressure mein kamzori aur potential trend reversal ko indicate kar sakta hai.

Applying CMF to Different Timeframes

Baqi, CMF ko mukhtalif timeframes par apply kiya ja sakta hai, jaise ke intraday charts se lekar longer-term charts tak, jo trader ki trading style aur maqsad par munhasir hota hai. Chhoti arsay ke traders chhoti CMF periods par focus karte hain taake jaldi momentum shifts ko capture kar sakein, jabke lambi arsay ke investors lambi CMF periods ko istemal karte hain taake overall market sentiment aur trends ka andaza lag sakein.

Risk Management with CMF

Risk management bhi ek area hai jahan CMF ka faida uthaya ja sakta hai. Price movements ke sath paisay ka daur aur volume ko monitor karke, traders apne positions ko adjust kar sakte hain ya agar CMF market sentiment mein kisi tabdeeli ko indicate karta hai jo unke initial trade thesis ke khilaaf hai, to wo apni trades se bahar nikal sakte hain.

Limitations and Considerations

Zaroori hai ke CMF ko valuable insights dene ka zariya samjha jaye, lekin ye koi magic formula nahi hai aur isay doosri analysis techniques aur risk management strategies ke sath istemal karna chahiye. False signals aur market noise bhi hosakte hain, khaaskar kam liquidity ya market volatility ke doran.

Chaikin Money Flow (CMF) indicator ek versatile tool hai jo traders ko security mein paisay ka daur samajhne mein madad deta hai. Iska calculation method price aur volume data ko mila kar market sentiment aur potential trend reversals ko samajhne mein madadgar hai. Traders CMF ko mukhtalif tareeqon se istemal karte hain, jaise ke trends ko tasdiq karna, divergences ko pehchanna, aur risk ko manage karna. Magar, zaroori hai ke CMF ko ek mukammal trading strategy ka hissa banaya jaye aur iske signals ko samajhne mein hoshiyari aur ehtiyaat ke sath kaam kya jaye.

تبصرہ

Расширенный режим Обычный режим