Introduction

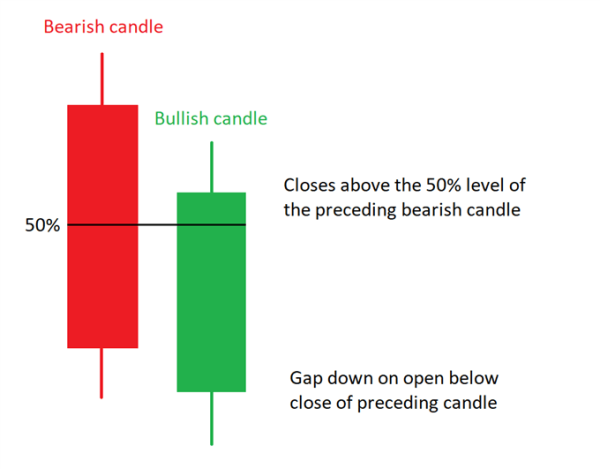

forex market mein piercing line candlestick pattern aik kesam ka candlestick pattern hota hey jo keh forex market kay trend ko bottom ko reversal janay ko he indicate kar sakta hey jab forex market mein bulls enter ho saktay hein to forex market ke prices ko oncha dahkail daytay hein

piercing pattern 2 candlestick mein he involve ho sakta hey candlestick pehle low candlestick par he open ho sakte hey bearish candle ke body 50% say oper he close ho jate hey

Piercing Pattern ke pehchan

forex market ka mumkana trend reversal oper ke taraf jata hey

bear price ke important level par he hosla kho rahay hotay hein

new trader kay ley pehchan karnay mein bhe assan ho jata hey

saz gar risk o reward ratio ka bhe imkan rehta hey

piercing pattern entry kay bad matlova entry level ko he paish keya ja raha hota hey

Trade with Piercing Pattern

nechay EUR/USD ka chart deya geya hey jo keh forex market mein nellay rang kay piercing pattern ko he wazah kar sakta hey es pattern say pehlay strong nechay ka trend tha jaisa keh forex market ke lower level or lower highs say zahair hota hey yeh mesal hey keh forex market kay nechay kay tren ka tayon karnay kay ley zahair ke jate hey trader zyada tar forex market ke confirmation kay ley technical indicator ka estamal kar saktay hein moving average ka estamal aam tor par zyadakeya jata hey

oper de gai es example mein RSI indicator ka estamal keya geya hey jo keh forex market ke long term trade mein bhe enter ho sakta hey tahum trader bhee es tarah kay indicator kay estamal say best earning hasell kar saktay hein

forex market mein piercing line candlestick pattern aik kesam ka candlestick pattern hota hey jo keh forex market kay trend ko bottom ko reversal janay ko he indicate kar sakta hey jab forex market mein bulls enter ho saktay hein to forex market ke prices ko oncha dahkail daytay hein

piercing pattern 2 candlestick mein he involve ho sakta hey candlestick pehle low candlestick par he open ho sakte hey bearish candle ke body 50% say oper he close ho jate hey

Piercing Pattern ke pehchan

forex market ka mumkana trend reversal oper ke taraf jata hey

bear price ke important level par he hosla kho rahay hotay hein

new trader kay ley pehchan karnay mein bhe assan ho jata hey

saz gar risk o reward ratio ka bhe imkan rehta hey

piercing pattern entry kay bad matlova entry level ko he paish keya ja raha hota hey

Trade with Piercing Pattern

nechay EUR/USD ka chart deya geya hey jo keh forex market mein nellay rang kay piercing pattern ko he wazah kar sakta hey es pattern say pehlay strong nechay ka trend tha jaisa keh forex market ke lower level or lower highs say zahair hota hey yeh mesal hey keh forex market kay nechay kay tren ka tayon karnay kay ley zahair ke jate hey trader zyada tar forex market ke confirmation kay ley technical indicator ka estamal kar saktay hein moving average ka estamal aam tor par zyadakeya jata hey

oper de gai es example mein RSI indicator ka estamal keya geya hey jo keh forex market ke long term trade mein bhe enter ho sakta hey tahum trader bhee es tarah kay indicator kay estamal say best earning hasell kar saktay hein

تبصرہ

Расширенный режим Обычный режим