Complete Details.

Forex trading mein risk/reward ratio ko calculate karna bohat zaroori hai. Is se aap ko pata chale ga ke aap ka trade kitna profitable hai aur aap kitna loss bardasht kar sakte hain. Is article mein hum aap ko batayenge ke aap forex trading mein risk/reward ratio ko kaise calculate kar sakte hain.

Risk/Reward Ratio ?

Risk/reward ratio, forex trading mein aik strategy hai jo traders use karte hain apne trades ki profitability ko measure karne ke liye. Is ko use kar ke traders apne trades ko analyse karte hain aur ye decide karte hain ke un ko kis trade mein invest karna chahiye aur kis trade se door rehna chahiye.

Risk/Reward Ratio how to Calculate ?

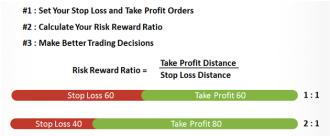

Risk/reward ratio ko calculate karna bohat asan hai. Aap ko sirf apne trade ki entry aur exit points ko note karna hai aur phir aap ko apne risk aur reward ko calculate karna hai.

Risk ko calculate karne ke liye aap ko apne stop loss level ko note karna hai. Stop loss level, aap ke trade mein aik level hota hai jis se aap apne trade ko close karte hain agar market aap ke favor mein nahi jata.

Reward ko calculate karne ke liye aap ko apne profit level ko note karna hai. Profit level, aap ke trade mein aik level hota hai jis se aap apne trade ko close karte hain agar market aap ke favor mein jata hai.

Risk/Reward Ratio How to Use ?

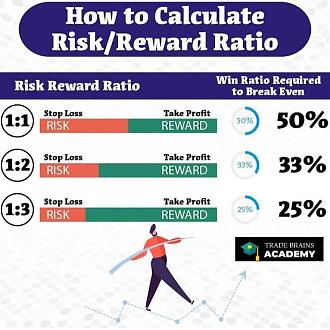

Risk/reward ratio ko use karne ke liye aap ko apne trades ko select karte waqt is ko consider karna chahiye. Agar aap ka risk/reward ratio 1:2 hai to is ka matlab hai ke aap apne trade mein 1 pip ka risk le rahe hain aur 2 pip ka reward expect kar rahe hain.

Agar aap ka risk/reward ratio 1:3 hai to is ka matlab hai ke aap apne trade mein 1 pip ka risk le rahe hain aur 3 pip ka reward expect kar rahe hain.

End Words.

Forex trading mein risk/reward ratio ko calculate karna bohat zaroori hai. Is se aap ko pata chale ga ke aap ka trade kitna profitable hai aur aap kitna loss bardasht kar sakte hain. Aap ko apne trades ko select karte waqt is ko consider karna chahiye. Agar aap ka risk/reward ratio 1:2 hai to is ka matlab hai ke aap apne trade mein 1 pip ka risk le rahe hain aur 2 pip ka reward expect kar rahe hain.

Forex trading mein risk/reward ratio ko calculate karna bohat zaroori hai. Is se aap ko pata chale ga ke aap ka trade kitna profitable hai aur aap kitna loss bardasht kar sakte hain. Is article mein hum aap ko batayenge ke aap forex trading mein risk/reward ratio ko kaise calculate kar sakte hain.

Risk/Reward Ratio ?

Risk/reward ratio, forex trading mein aik strategy hai jo traders use karte hain apne trades ki profitability ko measure karne ke liye. Is ko use kar ke traders apne trades ko analyse karte hain aur ye decide karte hain ke un ko kis trade mein invest karna chahiye aur kis trade se door rehna chahiye.

Risk/Reward Ratio how to Calculate ?

Risk/reward ratio ko calculate karna bohat asan hai. Aap ko sirf apne trade ki entry aur exit points ko note karna hai aur phir aap ko apne risk aur reward ko calculate karna hai.

Risk ko calculate karne ke liye aap ko apne stop loss level ko note karna hai. Stop loss level, aap ke trade mein aik level hota hai jis se aap apne trade ko close karte hain agar market aap ke favor mein nahi jata.

Reward ko calculate karne ke liye aap ko apne profit level ko note karna hai. Profit level, aap ke trade mein aik level hota hai jis se aap apne trade ko close karte hain agar market aap ke favor mein jata hai.

Risk/Reward Ratio How to Use ?

Risk/reward ratio ko use karne ke liye aap ko apne trades ko select karte waqt is ko consider karna chahiye. Agar aap ka risk/reward ratio 1:2 hai to is ka matlab hai ke aap apne trade mein 1 pip ka risk le rahe hain aur 2 pip ka reward expect kar rahe hain.

Agar aap ka risk/reward ratio 1:3 hai to is ka matlab hai ke aap apne trade mein 1 pip ka risk le rahe hain aur 3 pip ka reward expect kar rahe hain.

End Words.

Forex trading mein risk/reward ratio ko calculate karna bohat zaroori hai. Is se aap ko pata chale ga ke aap ka trade kitna profitable hai aur aap kitna loss bardasht kar sakte hain. Aap ko apne trades ko select karte waqt is ko consider karna chahiye. Agar aap ka risk/reward ratio 1:2 hai to is ka matlab hai ke aap apne trade mein 1 pip ka risk le rahe hain aur 2 pip ka reward expect kar rahe hain.

تبصرہ

Расширенный режим Обычный режим