How to trade with Dark Cloud Cover Candlestick Pattern.

Explanation.

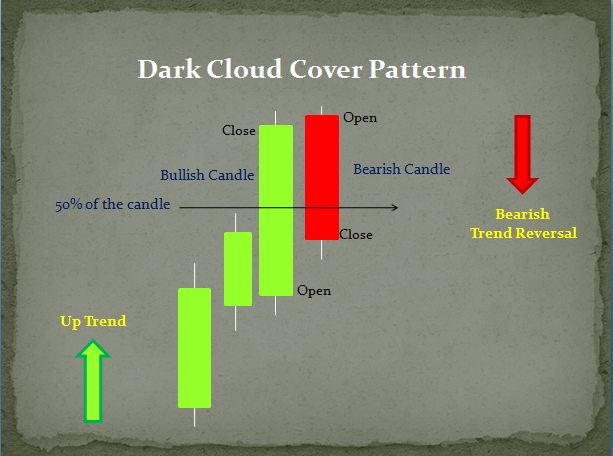

Dark Cloud Cover Candlestick Pattern kisi bhi stock ya currency chart par ek bearish reversal pattern hai. Ye usually uptrend ke baad aata hai. Is pattern me ek long green candlestick followed by ek long red candlestick hota hai. Red candlestick ki opening price green candlestick ki closing price se above hoti hai aur iski closing price green candlestick ki body me se at least 50% below hoti hai.

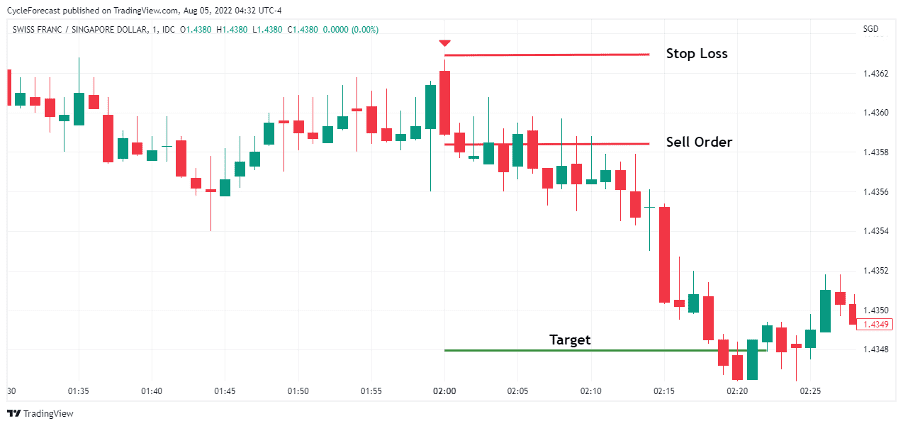

Agar aap Dark Cloud Cover Candlestick Pattern ko identify kar chuke hain to aapko sell entry point decide karna hoga. Iske liye aapko kuch factors consider karne honge jaise ki trend direction, support and resistance levels, price action, volume, aur indicators jaise ki Moving Averages, RSI, MACD etc.

Set Stop loss and Target.

Stop loss ko set karne ke liye aapko apne entry point se above ki ek level decide karni hogi. Agar aap ek conservative trader hain to aapko stop loss ke liye high of the bearish candlestick se thoda above level decide karna hoga. Agar aap ek aggressive trader hain to aapko stop loss ke liye high of the bullish candlestick se thoda above level decide karna hoga.

Target ko set karne ke liye aapko apne risk reward ratio ko decide karna hoga. Agar aap ek conservative trader hain to aapko risk reward ratio ko 1:2 ya 1:3 decide karna chahiye. Agar aap ek aggressive trader hain to aapko risk reward ratio ko 1:3 se 1:5 tak decide karna chahiye.

Main Points of Interest.

Dark Cloud Cover Candlestick Pattern ek bearish reversal pattern hai. Is pattern ko identify karne ke baad aap sell entry point decide kar sakte hain. Stop loss aur target ko set karne ke liye aapko apne risk reward ratio ko decide karna hoga.

Is pattern ko trade karne se pehle aapko trend direction, support and resistance levels, price action, volume, aur indicators jaise ki Moving Averages, RSI, MACD etc. ko consider karna chahiye.

Explanation.

Dark Cloud Cover Candlestick Pattern kisi bhi stock ya currency chart par ek bearish reversal pattern hai. Ye usually uptrend ke baad aata hai. Is pattern me ek long green candlestick followed by ek long red candlestick hota hai. Red candlestick ki opening price green candlestick ki closing price se above hoti hai aur iski closing price green candlestick ki body me se at least 50% below hoti hai.

Agar aap Dark Cloud Cover Candlestick Pattern ko identify kar chuke hain to aapko sell entry point decide karna hoga. Iske liye aapko kuch factors consider karne honge jaise ki trend direction, support and resistance levels, price action, volume, aur indicators jaise ki Moving Averages, RSI, MACD etc.

Set Stop loss and Target.

Stop loss ko set karne ke liye aapko apne entry point se above ki ek level decide karni hogi. Agar aap ek conservative trader hain to aapko stop loss ke liye high of the bearish candlestick se thoda above level decide karna hoga. Agar aap ek aggressive trader hain to aapko stop loss ke liye high of the bullish candlestick se thoda above level decide karna hoga.

Target ko set karne ke liye aapko apne risk reward ratio ko decide karna hoga. Agar aap ek conservative trader hain to aapko risk reward ratio ko 1:2 ya 1:3 decide karna chahiye. Agar aap ek aggressive trader hain to aapko risk reward ratio ko 1:3 se 1:5 tak decide karna chahiye.

Main Points of Interest.

Dark Cloud Cover Candlestick Pattern ek bearish reversal pattern hai. Is pattern ko identify karne ke baad aap sell entry point decide kar sakte hain. Stop loss aur target ko set karne ke liye aapko apne risk reward ratio ko decide karna hoga.

Is pattern ko trade karne se pehle aapko trend direction, support and resistance levels, price action, volume, aur indicators jaise ki Moving Averages, RSI, MACD etc. ko consider karna chahiye.

تبصرہ

Расширенный режим Обычный режим