Explained.

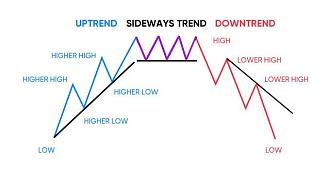

Forex trading ek aisa maaloom hai jo market ki tabdeeliyon ko mukhtalif tarah se handle karta hai. Ek trader ke liye, market ki tabdeeliyan ek challenge ho sakti hain, jis me sideways market ek aisa challenge hai jo traders ko apni trading strategy me tabdeeli ka samna karna padta hai. Sideways market ke khatre kuch is tarah hain:

Less Trading Opportunities.

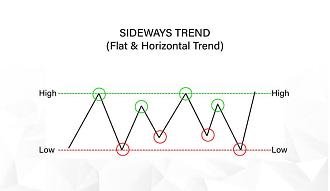

Sideways market me, trading opportunities kam ho sakte hain kyunki market ki movement slow hoti hai. Jitni movement ho, utni hi opportunities hote hain, aur sideways market me movement kam hoti hai.

False Breakouts.

Sideways market me, false breakouts hone ke khatre hote hain. Jab market sideways move karta hai, toh breakouts ki possibility banti hai jisme traders apne orders ko lagate hain, lekin jab market ki movement wapas sideways ho jaati hai, toh false breakouts ka khtra bhi banta hai.

Stop Losses.

Sideways market me, stop losses ko lagana bhi mushkil ho sakta hai. Jab market sideways move karta hai, toh stop losses ko lagana trader ke liye mushkil ho jaata hai kyunki market ki movement unpredictable hoti hai.

Market Volatility.

Sideways market me, market volatility bhi banti hai. Jab market sideways move karta hai, toh market ki volatility bhi badh jaati hai, jisme traders ko apni trading strategy ko adjust karna padta hai.

Trading Psychology.

Sideways market me, trading psychology bhi affect ho sakti hai. Jab traders ko pata chalta hai ki market sideways move kar raha hai, toh unka confidence bhi kam ho jaata hai kyunki unhe trading opportunities ki kami ka pata chalta hai.

Main Points.

Sideways market forex trading ke liye ek challenge ban sakta hai jisme traders ko apni trading strategy ko adjust karna padta hai. Sideways market ke khatre, kam trading opportunities, false breakouts, stop losses, market volatility aur trading psychology ke khatre hote hain. Traders ko in khatron se bachne ke liye market ki movement ko monitor karna chahiye aur apni trading strategy ko adjust karna chahiye.

Forex trading ek aisa maaloom hai jo market ki tabdeeliyon ko mukhtalif tarah se handle karta hai. Ek trader ke liye, market ki tabdeeliyan ek challenge ho sakti hain, jis me sideways market ek aisa challenge hai jo traders ko apni trading strategy me tabdeeli ka samna karna padta hai. Sideways market ke khatre kuch is tarah hain:

Less Trading Opportunities.

Sideways market me, trading opportunities kam ho sakte hain kyunki market ki movement slow hoti hai. Jitni movement ho, utni hi opportunities hote hain, aur sideways market me movement kam hoti hai.

False Breakouts.

Sideways market me, false breakouts hone ke khatre hote hain. Jab market sideways move karta hai, toh breakouts ki possibility banti hai jisme traders apne orders ko lagate hain, lekin jab market ki movement wapas sideways ho jaati hai, toh false breakouts ka khtra bhi banta hai.

Stop Losses.

Sideways market me, stop losses ko lagana bhi mushkil ho sakta hai. Jab market sideways move karta hai, toh stop losses ko lagana trader ke liye mushkil ho jaata hai kyunki market ki movement unpredictable hoti hai.

Market Volatility.

Sideways market me, market volatility bhi banti hai. Jab market sideways move karta hai, toh market ki volatility bhi badh jaati hai, jisme traders ko apni trading strategy ko adjust karna padta hai.

Trading Psychology.

Sideways market me, trading psychology bhi affect ho sakti hai. Jab traders ko pata chalta hai ki market sideways move kar raha hai, toh unka confidence bhi kam ho jaata hai kyunki unhe trading opportunities ki kami ka pata chalta hai.

Main Points.

Sideways market forex trading ke liye ek challenge ban sakta hai jisme traders ko apni trading strategy ko adjust karna padta hai. Sideways market ke khatre, kam trading opportunities, false breakouts, stop losses, market volatility aur trading psychology ke khatre hote hain. Traders ko in khatron se bachne ke liye market ki movement ko monitor karna chahiye aur apni trading strategy ko adjust karna chahiye.

تبصرہ

Расширенный режим Обычный режим