Pivot Points Trading introduction.

Pivot points trading ek strategy hai jisme traders market ke price movements aur trends ko analyze karte hain. Is strategy ka maqsad future price movements ko predict karna aur trading decisions lena hota hai.Pivot points trading ek effective aur popular trading strategy hai, lekin iska istemal karne se pehle traders ko market ko samajhna aur risks ko tawajju dena zaroori hai. Agar sahi tarah se istemal kiya jaye, toh ye traders ko market mein successful hone mein madadgar sabit ho sakta hai. Is liye, har trader ko apni research aur analysis ke sath pivot points ka istemal karne ki salahiyat hasil karni chahiye.

What are Pivot Points.

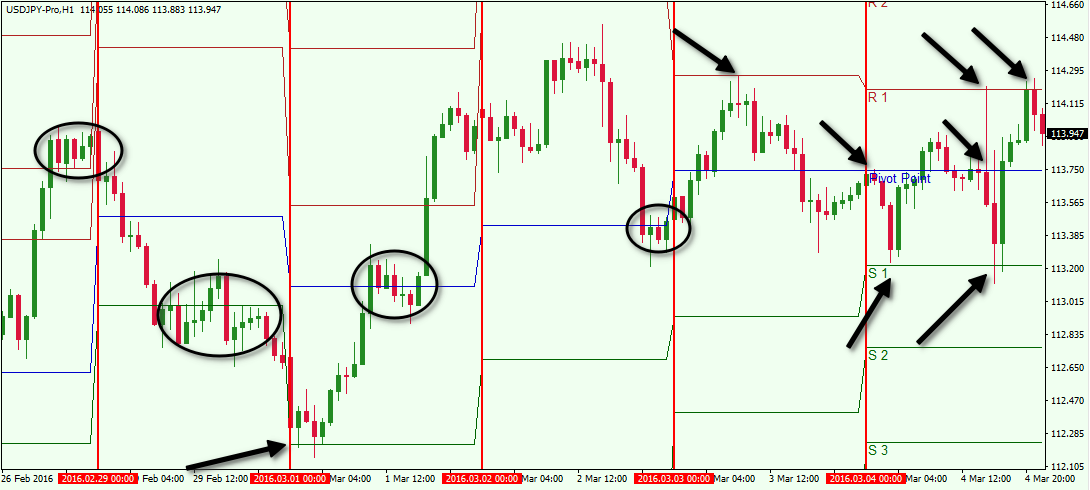

Pivot points market ke reference points hote hain jo market ke previous day ke high, low, aur close prices par based hote hain. Inko calculate karne ke liye, kuch simple formulas istemal kiye jate hain.

Trading Strategy.

Pivot points trading ka maqsad market ke reversals ko identify karna hai. Agar current price pivot point ke neeche hai, toh bearish trend ka signal mil sakta hai, jabke agar current price pivot point ke upar hai, toh ye bullish trend ka indication ho sakta hai.

Pivot Points Types.

Pivot points trading mein kuch mukhtalif qisam ke points istemal kiye jate hain jaise Classical Pivot Points, Fibonacci Pivot Points, aur Camarilla Pivot Points.

Advantages.

Pivot points trading ka istemal karne ke kuch faide hain jaise trend analysis, entry aur exit points ka pata lagana, aur risk management.

Challenges.

Pivot points trading ke bawajood, kuch challenges bhi hote hain jaise market volatility, false signals, aur historical data dependence.

Pivot points trading ek effective aur popular trading strategy hai, lekin iska istemal karne se pehle traders ko market ko samajhna aur risks ko tawajju dena zaroori hai. Agar sahi tarah se istemal kiya jaye, toh ye traders ko market mein successful hone mein madadgar sabit ho sakta hai. Is liye, har trader ko apni research aur analysis ke sath pivot points ka istemal karne ki salahiyat hasil karni chahiye.

Pivot points trading ek strategy hai jisme traders market ke price movements aur trends ko analyze karte hain. Is strategy ka maqsad future price movements ko predict karna aur trading decisions lena hota hai.Pivot points trading ek effective aur popular trading strategy hai, lekin iska istemal karne se pehle traders ko market ko samajhna aur risks ko tawajju dena zaroori hai. Agar sahi tarah se istemal kiya jaye, toh ye traders ko market mein successful hone mein madadgar sabit ho sakta hai. Is liye, har trader ko apni research aur analysis ke sath pivot points ka istemal karne ki salahiyat hasil karni chahiye.

What are Pivot Points.

Pivot points market ke reference points hote hain jo market ke previous day ke high, low, aur close prices par based hote hain. Inko calculate karne ke liye, kuch simple formulas istemal kiye jate hain.

Trading Strategy.

Pivot points trading ka maqsad market ke reversals ko identify karna hai. Agar current price pivot point ke neeche hai, toh bearish trend ka signal mil sakta hai, jabke agar current price pivot point ke upar hai, toh ye bullish trend ka indication ho sakta hai.

Pivot Points Types.

Pivot points trading mein kuch mukhtalif qisam ke points istemal kiye jate hain jaise Classical Pivot Points, Fibonacci Pivot Points, aur Camarilla Pivot Points.

Advantages.

Pivot points trading ka istemal karne ke kuch faide hain jaise trend analysis, entry aur exit points ka pata lagana, aur risk management.

Challenges.

Pivot points trading ke bawajood, kuch challenges bhi hote hain jaise market volatility, false signals, aur historical data dependence.

Pivot points trading ek effective aur popular trading strategy hai, lekin iska istemal karne se pehle traders ko market ko samajhna aur risks ko tawajju dena zaroori hai. Agar sahi tarah se istemal kiya jaye, toh ye traders ko market mein successful hone mein madadgar sabit ho sakta hai. Is liye, har trader ko apni research aur analysis ke sath pivot points ka istemal karne ki salahiyat hasil karni chahiye.

تبصرہ

Расширенный режим Обычный режим