Triple Zigzag pattern ek complex corrective wave pattern hai jo traders technical analysis mein istemal karte hain taake potential market reversals ya continuation patterns ko pehchaan sakein. Ye pattern Elliott Wave Theory par mabni hai, jo kehta hai ke financial markets repetitive patterns ya waves mein move karte hain. Triple Zigzag pattern teen mukhtalif Zigzag corrective waves se mil kar banta hai, har ek ko A-B-C label diya jata hai, khaas taur par unki pehchaan aur identification ke liye khaas rules hote hain. Is pattern ko samajhna traders ko market movements ko pehle se samajhne aur informed trading decisions lene mein madad karta hai.

Elliott Wave Theory Ka Jaaiza

Triple Zigzag pattern ke baare mein samajhne se pehle, Elliott Wave Theory ke basic concepts ko samajhna zaroori hai. Ye theory Ralph Nelson Elliott ne 1930s mein develop ki thi, jo kehti hai ke market prices main trend ki direction mein five waves mein move karti hain, phir uske khilaf teen corrective waves follow karte hain. Ye waves bade patterns banate hain jinhe traders analyze karke future price movements ka forecast karte hain.

Five-wave pattern mein teen impulse waves hote hain (jo ke 1, 3, aur 5 number se label kiye jate hain) jo trend ki direction mein move karte hain, aur do corrective waves hote hain jo ke 2 aur 4 number se label kiye jate hain jo trend ke khilaf move karte hain. Ye corrective waves typically A-B-C label se label kiye jate hain, jahan wave A aur wave C trend ke opposite direction mein move karte hain aur wave B trend ki direction mein move karta hai.

Zigzag Corrections Ka Samajhna

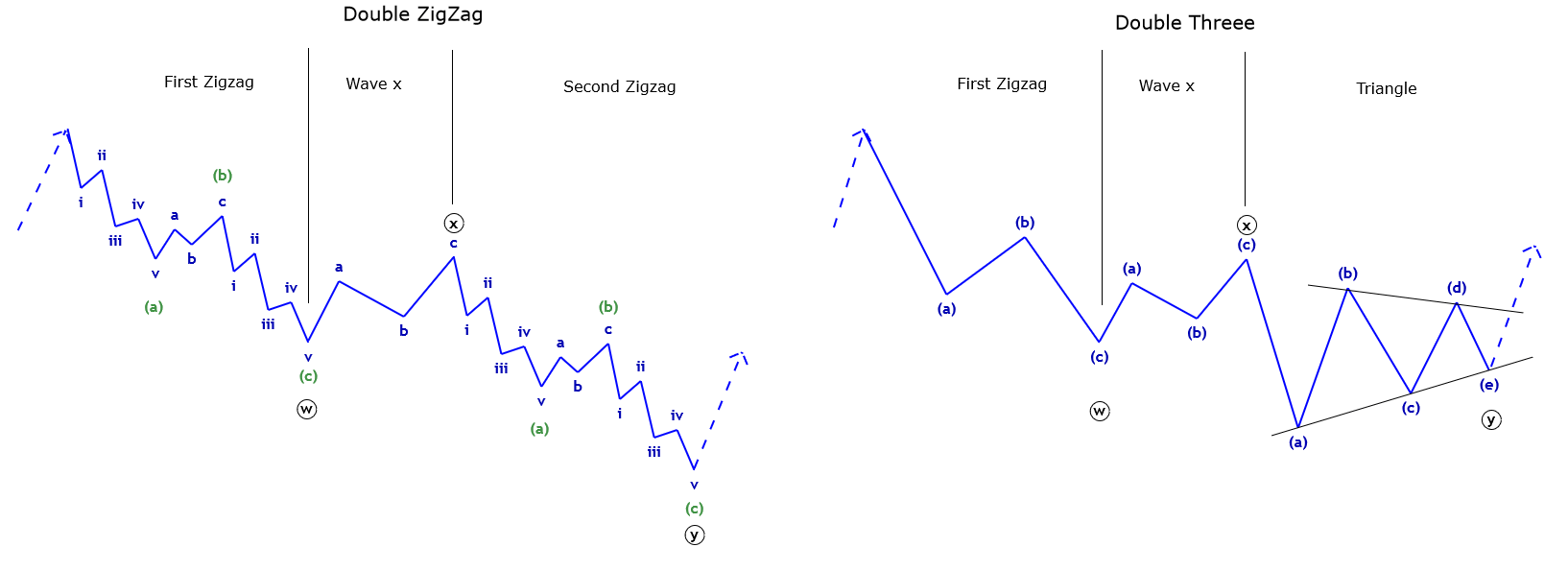

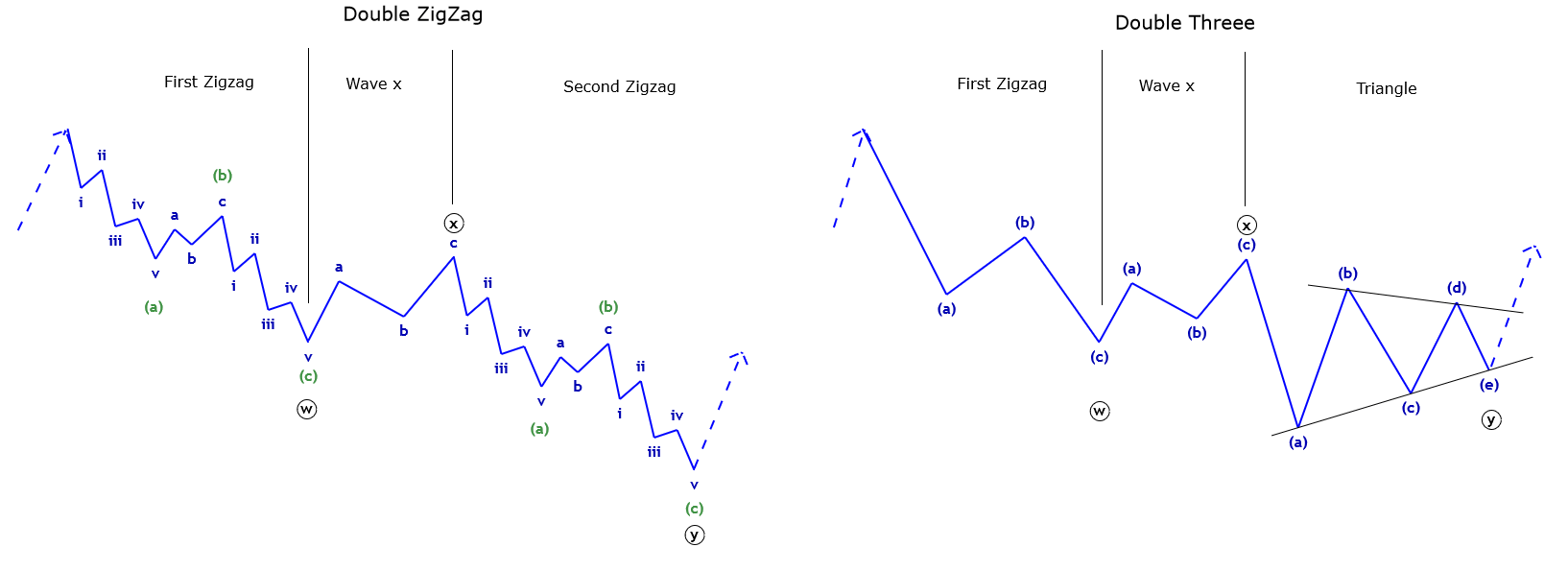

Zigzag correction Elliott Wave Theory ke andar sabse common corrective wave patterns mein se ek hai. Ismein teen-wave structure hoti hai jo A-B-C label se label ki jati hai, jahan wave A aur wave C main trend ke opposite direction mein move karte hain, aur wave B ek corrective wave hota hai jo ke wave A ka ek hissa retrace karta hai. Uptrend mein, wave A aur wave C downward moves hote hain, jabki downtrend mein, ye upward moves hote hain.

Zigzag correction ki key characteristics mein shaamil hain:

Triple Zigzag pattern standard Zigzag correction ka extension hai. Ismein ek single Zigzag correction ki jagah teen consecutive Zigzag corrections hote hain, jo ke A-B-C label se label kiye jate hain, aur ek complex corrective wave structure banate hain. Har Zigzag correction ke andar Triple Zigzag pattern mein apni A-B-C structure hoti hai, jo ke overall pattern ko depth aur complexity deti hai.

Triple Zigzag pattern kaise unfold hota hai, uska explanation yeh hai:

Ek sahi Triple Zigzag pattern ko pehchanne ke liye, traders ko kuch khaas rules aur guidelines ko follow karna chahiye:

Traders Triple Zigzag patterns ka istemal karte hain taake potential reversal points ya continuation patterns ko pehchaan sakein. Ek complete Triple Zigzag pattern hone par aksar ye indicate karta hai ke ek complex correction ka khatam hone wala hai aur main trend ka phir se shuru hone wala hai.

Yahan kuch trading implications hain Triple Zigzag pattern ke liye:

Ek Triple Zigzag pattern ka example samajhne ke liye, ek hypothetical price chart ko consider karte hain kisi financial instrument jaise ki stock ya currency pair ke liye:

Triple Zigzag pattern ek complex corrective wave pattern hai jo Elliott Wave Theory par mabni hai, aur teen consecutive Zigzag corrections aur connecting waves se bana hota hai. Traders is pattern ko istemal karte hain potential trend reversals ya continuation patterns ko pehchane ke liye, aur iske identification ke liye khaas rules aur guidelines ko follow karte hain. Triple Zigzag pattern ke structure aur implications ko samajh kar, traders apni technical analysis ko enhance kar sakte hain aur informed trading decisions le sakte hain.

Elliott Wave Theory Ka Jaaiza

Triple Zigzag pattern ke baare mein samajhne se pehle, Elliott Wave Theory ke basic concepts ko samajhna zaroori hai. Ye theory Ralph Nelson Elliott ne 1930s mein develop ki thi, jo kehti hai ke market prices main trend ki direction mein five waves mein move karti hain, phir uske khilaf teen corrective waves follow karte hain. Ye waves bade patterns banate hain jinhe traders analyze karke future price movements ka forecast karte hain.

Five-wave pattern mein teen impulse waves hote hain (jo ke 1, 3, aur 5 number se label kiye jate hain) jo trend ki direction mein move karte hain, aur do corrective waves hote hain jo ke 2 aur 4 number se label kiye jate hain jo trend ke khilaf move karte hain. Ye corrective waves typically A-B-C label se label kiye jate hain, jahan wave A aur wave C trend ke opposite direction mein move karte hain aur wave B trend ki direction mein move karta hai.

Zigzag Corrections Ka Samajhna

Zigzag correction Elliott Wave Theory ke andar sabse common corrective wave patterns mein se ek hai. Ismein teen-wave structure hoti hai jo A-B-C label se label ki jati hai, jahan wave A aur wave C main trend ke opposite direction mein move karte hain, aur wave B ek corrective wave hota hai jo ke wave A ka ek hissa retrace karta hai. Uptrend mein, wave A aur wave C downward moves hote hain, jabki downtrend mein, ye upward moves hote hain.

Zigzag correction ki key characteristics mein shaamil hain:

- Wave A: Ye initial move trend ke khilaf hota hai, often sharp aur impulsive hota hai.

- Wave B: Ye wave ek portion ko wave A ka retrace karta hai lekin uske starting point ko exceed nahi karta.

- Wave C: Ye final wave Zigzag pattern ko complete karta hai, jo ke wave A ke opposite direction mein move karta hai lekin aam tor par kam momentum ke saath.

Triple Zigzag pattern standard Zigzag correction ka extension hai. Ismein ek single Zigzag correction ki jagah teen consecutive Zigzag corrections hote hain, jo ke A-B-C label se label kiye jate hain, aur ek complex corrective wave structure banate hain. Har Zigzag correction ke andar Triple Zigzag pattern mein apni A-B-C structure hoti hai, jo ke overall pattern ko depth aur complexity deti hai.

Triple Zigzag pattern kaise unfold hota hai, uska explanation yeh hai:

- First Zigzag (A-B-C): Triple Zigzag pattern ka pehla Zigzag correction, jo standalone Zigzag correction ke tarah hota hai, jisme wave A, wave B, aur wave C hote hain.

- Second Zigzag (A-B-C): Pehle Zigzag ko complete karne ke baad, market ek aur Zigzag correction karta hai, jo ke wave X ke tor par label kiya jata hai, jo ke ek connecting wave hoti hai. Ye wave aksar simple corrective pattern jaise flat ya triangle hoti hai.

- Third Zigzag (A-B-C): Wave X ke baad, market ek teesra Zigzag correction karta hai, jo ke pehle do ke tarah hota hai, jisme wave A, wave B, aur wave C hote hain.

Ek sahi Triple Zigzag pattern ko pehchanne ke liye, traders ko kuch khaas rules aur guidelines ko follow karna chahiye:

- Teen Zigzag Corrections: Pattern mein teen consecutive Zigzag corrections (A-B-C) hone chahiye jo ek connecting wave X se separate hote hain.

- Wave C Restrictions: Har Zigzag correction ka wave C pehle Zigzag ke wave A ke end tak nahi jana chahiye.

- Wave B Structure: Har Zigzag correction ke andar wave B ek corrective wave hona chahiye jo ke wave A ka ek hissa retrace karta hai lekin uske starting point ko exceed nahi karta.

- Connecting Wave X: Wave X ek connecting wave hoti hai jo ke pehle do Zigzag corrections ko connect karti hai. Ye typically flat ya triangle jaise simple correction hoti hai.

- Overall Structure: Pattern mein teen Zigzag corrections ke alawa wave X ke saath clear aur recognizable structure honi chahiye, jo ke ek complex corrective wave pattern ko banati hai.

Traders Triple Zigzag patterns ka istemal karte hain taake potential reversal points ya continuation patterns ko pehchaan sakein. Ek complete Triple Zigzag pattern hone par aksar ye indicate karta hai ke ek complex correction ka khatam hone wala hai aur main trend ka phir se shuru hone wala hai.

Yahan kuch trading implications hain Triple Zigzag pattern ke liye:

- Reversal Signals: Ek complete Triple Zigzag pattern potential reversal ko indicate karta hai market mein. For example, agar pattern ek lambi uptrend ke baad banta hai, to ye downside trend ki taraf indicate kar sakta hai.

- Continuation Patterns: Kuch cases mein, Triple Zigzag pattern ek larger corrective structure ke andar continuation pattern ke roop mein act karta hai. Traders overall Elliott Wave count ko analyze karte hain ke ye pattern current trend ka continuation suggest kar raha hai ya nahi.

- Entry aur Exit Points: Traders Triple Zigzag pattern ko pehchaan karne ke baad entry opportunities dhundhte hain, aur trades place karte hain anticipated trend reversal ya continuation ke direction mein. Stop-loss orders pattern ke completion point ke baad place kiye jate hain takay risk ko manage kiya ja sake.

- Confirmation Signals: Traders additional technical indicators ya price action confirmation ka istemal karte hain Triple Zigzag patterns ko validate karne ke liye. Ye indicators trendline breaks, candlestick patterns, ya momentum indicators jaise ho sakte hain.

Ek Triple Zigzag pattern ka example samajhne ke liye, ek hypothetical price chart ko consider karte hain kisi financial instrument jaise ki stock ya currency pair ke liye:

- First Zigzag (A-B-C): Market mein ek sharp decline hota hai (wave A), phir ek partial retracement hota hai (wave B), aur phir ek aur decline hoti hai (wave C).

- Connecting Wave X: Pehle Zigzag ko complete karne ke baad, market ek connecting wave X banata hai, jo ke flat ya triangle correction ho sakta hai.

- Second Zigzag (A-B-C): Wave X ke baad, market ek aur Zigzag correction karta hai, jisme wave A pehle Zigzag ke wave C ke opposite direction mein move karta hai.

- Connecting Wave X2: Doosri connecting wave X pehli connecting wave ke tarah hoti hai.

- Third Zigzag (A-B-C): Final Zigzag correction Triple Zigzag pattern ko complete karta hai, jisme wave C pehle Zigzag ke wave A ke end tak jaata hai lekin usse aage nahi badhta.

Triple Zigzag pattern ek complex corrective wave pattern hai jo Elliott Wave Theory par mabni hai, aur teen consecutive Zigzag corrections aur connecting waves se bana hota hai. Traders is pattern ko istemal karte hain potential trend reversals ya continuation patterns ko pehchane ke liye, aur iske identification ke liye khaas rules aur guidelines ko follow karte hain. Triple Zigzag pattern ke structure aur implications ko samajh kar, traders apni technical analysis ko enhance kar sakte hain aur informed trading decisions le sakte hain.

تبصرہ

Расширенный режим Обычный режим