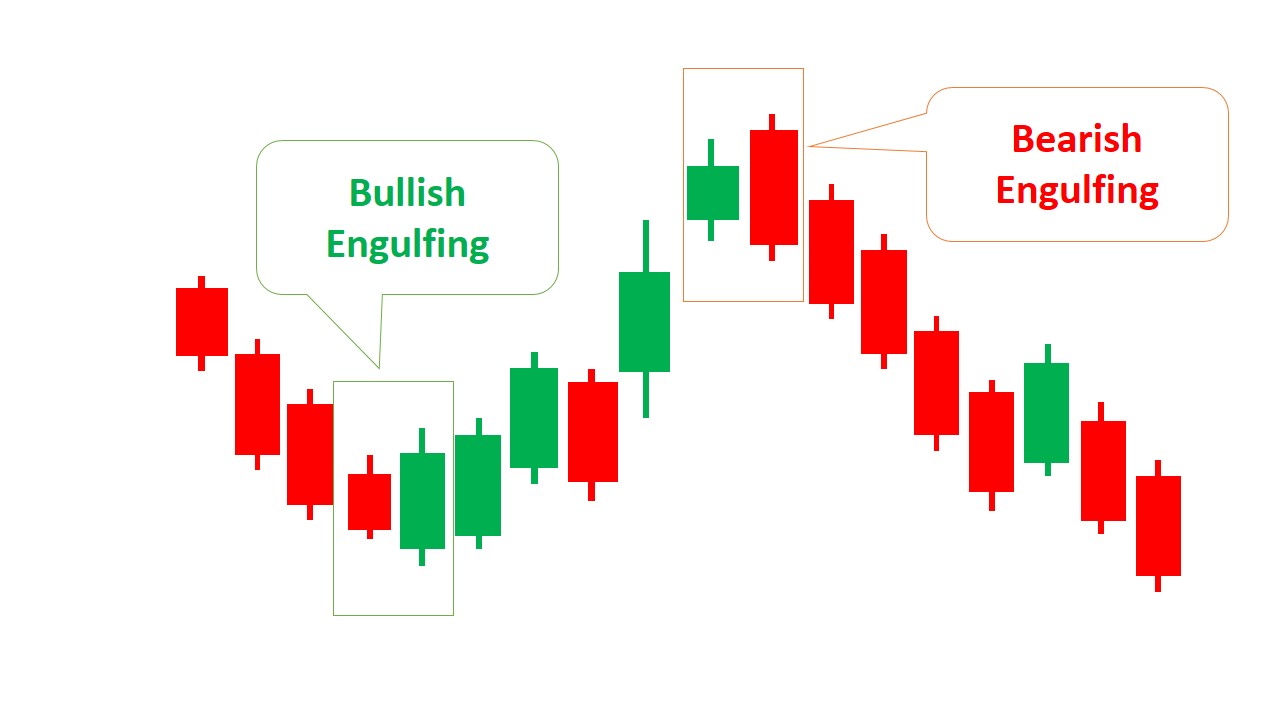

- Detail Pattern of Engulfing Candlesticks

- Bullish Engulfing Pattern

- Bearish Engulfing Pattern

- Trading Strategy

Ager ya ap ka pahla dora hai, tu is bat ko yaqeni banaye or uper kay link par click kar kay sawalat ko parh lain, Ap ko post karnay say pahalay register honay pary ga, registration link par click kar kay. Payghamat daikhnay kay lea forum ko muntakhib karain.

تبصرہ

Расширенный режим Обычный режим