Smart money trading ka tareeqa us tasawwur par mabni hai ke bare institutional investors, hedge funds, aur doosray aise market participants jo ke behtareen maloomat aur resources ke saath tajziya kar sakte hain, unke paas financial markets mein faida uthane ka aham faida hota hai. Ye smart money khiladi aksar apne liye khas darjaton mein jo paise ko istemaal karna hai, woh kar sakte hain, thorough research aur analysis, aur strategically apni positioning ko market ke harek harkat ke tajziya se pehle karte hain. Smart money strategies farogh paane wale hote hain aur yeh aik range ki techniques aur approaches ko shamil karta hai.

Fundamental Analysis

Smart money investors aksar fundamental analysis ka sahara lete hain takay assets ka asli value assess kiya ja sake. Is mein ek company ke financial statements, industry trends, competitive positioning, management quality, aur macroeconomic factors ko study kiya jata hai jo ke iski performance ko affect kar sakte hain. Fundamental metrics ke base par undervalued ya overvalued assets ko identify karke, smart money investors informed investment decisions le sakte hain.

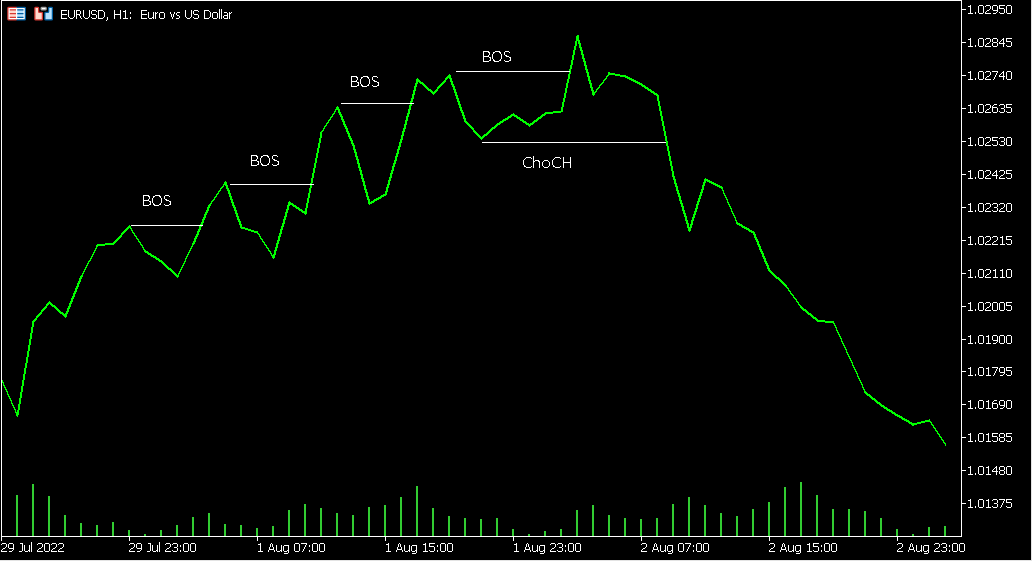

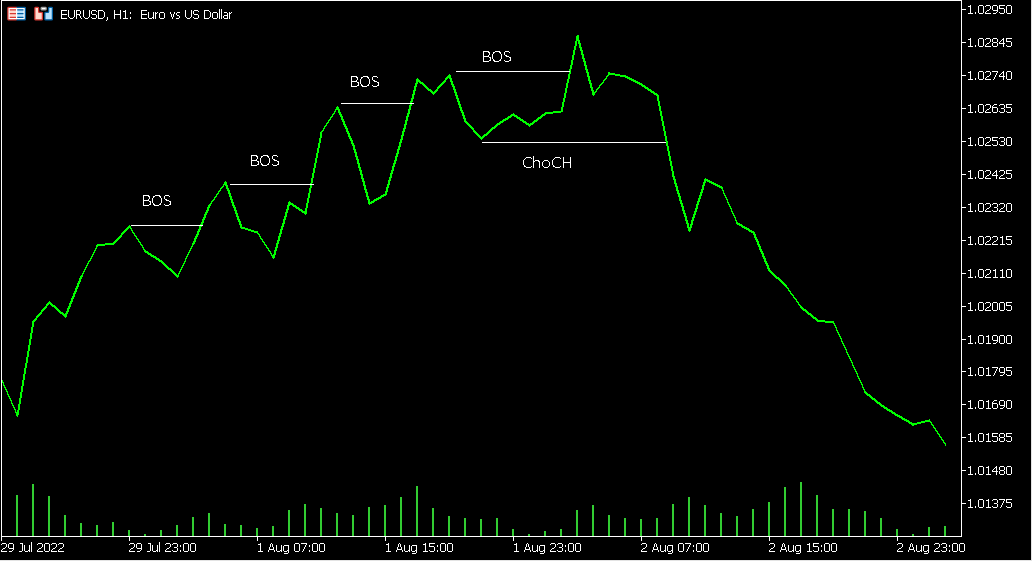

Technical Analysis

Fundamental analysis ke saath, smart money traders technical analysis ka bhi istemal karte hain takay price patterns, trends, aur market sentiment ko tajziya kar sakein. Woh advanced charting techniques ka istemal karte hain, jaise ke moving averages, support aur resistance levels, volume analysis, aur oscillators, takay potential entry aur exit points ko trades ke liye identify kar sakein. Technical analysis smart money investors ko market psychology ka andaza karne mein madad karta hai aur price action aur market dynamics ke base par decisions lene mein madad karta hai.

Market Sentiment Analysis

Market sentiment ko samajhna smart money traders ke liye zaroori hai. Woh news, social media, economic indicators, aur geopolitical developments ko monitor karte hain takay investor sentiment ko samajh sakein aur broader market environment ko assess kar sakein. Sentiment mein shifts ko identify karne se, smart money investors market trends ko anticipate kar sakte hain aur accordingly apni positioning ko set kar sakte hain.

Risk Management

Smart money investors apne capital ko protect karne aur returns ko maximize karne ke liye risk management ko prioritise karte hain. Woh sophisticated risk management techniques ka istemal karte hain, jaise ke position sizing, stop-loss orders, hedging strategies, aur portfolio diversification, takay potential losses ko mitigate kar sakein aur risk-adjusted returns ko optimize kar sakein. Risk management smart money trading strategies ka ek mukhya pehlu hai jo ke capital preservation ki ahmiyat ko stress karta hai.

Market Manipulation

Jab ke ethical ya legal nahi, lekin kuch smart money players market manipulation tactics ka istemal kar sakte hain takay prices ko influence karein aur favorable trading opportunities ko create kar sakein. Isme false information phelana, coordinated trading activities ka aayojan karna, ya market inefficiencies ko exploit karna shamil ho sakta hai. Lekin yaad rakhiye ke market manipulation mana hai aur iska regulatory consequences ke liye serious repercussions ho sakte hain.

High-Frequency Trading (HFT)

Smart money investors aksar high-frequency trading strategies ka istemal karte hain, jisme advanced algorithms aur technology ka leverage hota hai trades ko rapidly execute karne aur short-term market inefficiencies ko capitalize karne ke liye. HFT algorithms badi data quantities ko analyze kar sakte hain, patterns ko identify kar sakte hain, aur trades ko microseconds mein execute kar sakte hain, chhote price discrepancies ko market mein advantage lene ke liye.

Dark Pools and Private Markets

Smart money investors dark pools aur private markets mein bhi participate kar sakte hain, jahan trading off-exchange aur public scrutiny se door hoti hai. Dark pools institutional investors ko large block trades ko execute karne ka mauqa deti hain bina market prices ko impact kiye, anonymity aur liquidity provide karte hue. Private markets, jaise private equity aur venture capital, smart money investors ko private companies mein invest karne ka mauqa deti hain before they go public.

Contrarian Investing

Contrarian investing bhi aik strategy hai jo smart money players istemal karte hain. Isme prevailing market sentiment ya consensus expectations ke khilaaf positions ko lena shamil hota hai. Smart money investors kabhi kabhi buy karte hain jab log sell kar rahe hote hain (aur vice versa) market conditions, valuations, ya economic fundamentals ke contrarian view ke basis par.

Event-Based Trading

Smart money investors corporate events, economic announcements, geopolitical developments, aur doosray catalysts ko closely monitor karte hain jo assets ke prices ko impact kar sakte hain. Event-based trading market opportunities ko capitalize karne mein madadgar hota hai jo specific events, jaise ke earnings releases, mergers and acquisitions, regulatory changes, ya geopolitical crises, se arise hote hain. In events ko anticipate aur jaldi se react karke, smart money traders profits generate kar sakte hain.

Long-Term Investing

Jab ke smart money strategies often short-term trading aur opportunistic plays ko shamil karte hain, bohot se institutional investors long-term investing par bhi focus karte hain. Woh strong growth potential ke sath undervalued assets ko identify karte hain, diversified portfolios banate hain, aur wealth creation ke liye waqt ke sath patient approach ko adopt karte hain. Long-term investing fundamental analysis aur strategic asset allocation principles ke saath align hota hai. Smart money trading ka tareeqa ek wide range ki techniques aur approaches ko shamil karta hai, jisme fundamental aur technical analysis, market sentiment analysis, risk management, market manipulation (though unethical and illegal), high-frequency trading, dark pools aur private markets mein participate karna, contrarian investing, event-based trading, aur long-term investing shamil hain. Smart money investors apni insights, resources, aur market expertise ka faida uthate hue competitive edge hasil karte hain aur financial markets mein superior returns generate karte hain.

Fundamental Analysis

Smart money investors aksar fundamental analysis ka sahara lete hain takay assets ka asli value assess kiya ja sake. Is mein ek company ke financial statements, industry trends, competitive positioning, management quality, aur macroeconomic factors ko study kiya jata hai jo ke iski performance ko affect kar sakte hain. Fundamental metrics ke base par undervalued ya overvalued assets ko identify karke, smart money investors informed investment decisions le sakte hain.

Technical Analysis

Fundamental analysis ke saath, smart money traders technical analysis ka bhi istemal karte hain takay price patterns, trends, aur market sentiment ko tajziya kar sakein. Woh advanced charting techniques ka istemal karte hain, jaise ke moving averages, support aur resistance levels, volume analysis, aur oscillators, takay potential entry aur exit points ko trades ke liye identify kar sakein. Technical analysis smart money investors ko market psychology ka andaza karne mein madad karta hai aur price action aur market dynamics ke base par decisions lene mein madad karta hai.

Market Sentiment Analysis

Market sentiment ko samajhna smart money traders ke liye zaroori hai. Woh news, social media, economic indicators, aur geopolitical developments ko monitor karte hain takay investor sentiment ko samajh sakein aur broader market environment ko assess kar sakein. Sentiment mein shifts ko identify karne se, smart money investors market trends ko anticipate kar sakte hain aur accordingly apni positioning ko set kar sakte hain.

Risk Management

Smart money investors apne capital ko protect karne aur returns ko maximize karne ke liye risk management ko prioritise karte hain. Woh sophisticated risk management techniques ka istemal karte hain, jaise ke position sizing, stop-loss orders, hedging strategies, aur portfolio diversification, takay potential losses ko mitigate kar sakein aur risk-adjusted returns ko optimize kar sakein. Risk management smart money trading strategies ka ek mukhya pehlu hai jo ke capital preservation ki ahmiyat ko stress karta hai.

Market Manipulation

Jab ke ethical ya legal nahi, lekin kuch smart money players market manipulation tactics ka istemal kar sakte hain takay prices ko influence karein aur favorable trading opportunities ko create kar sakein. Isme false information phelana, coordinated trading activities ka aayojan karna, ya market inefficiencies ko exploit karna shamil ho sakta hai. Lekin yaad rakhiye ke market manipulation mana hai aur iska regulatory consequences ke liye serious repercussions ho sakte hain.

High-Frequency Trading (HFT)

Smart money investors aksar high-frequency trading strategies ka istemal karte hain, jisme advanced algorithms aur technology ka leverage hota hai trades ko rapidly execute karne aur short-term market inefficiencies ko capitalize karne ke liye. HFT algorithms badi data quantities ko analyze kar sakte hain, patterns ko identify kar sakte hain, aur trades ko microseconds mein execute kar sakte hain, chhote price discrepancies ko market mein advantage lene ke liye.

Dark Pools and Private Markets

Smart money investors dark pools aur private markets mein bhi participate kar sakte hain, jahan trading off-exchange aur public scrutiny se door hoti hai. Dark pools institutional investors ko large block trades ko execute karne ka mauqa deti hain bina market prices ko impact kiye, anonymity aur liquidity provide karte hue. Private markets, jaise private equity aur venture capital, smart money investors ko private companies mein invest karne ka mauqa deti hain before they go public.

Contrarian Investing

Contrarian investing bhi aik strategy hai jo smart money players istemal karte hain. Isme prevailing market sentiment ya consensus expectations ke khilaaf positions ko lena shamil hota hai. Smart money investors kabhi kabhi buy karte hain jab log sell kar rahe hote hain (aur vice versa) market conditions, valuations, ya economic fundamentals ke contrarian view ke basis par.

Event-Based Trading

Smart money investors corporate events, economic announcements, geopolitical developments, aur doosray catalysts ko closely monitor karte hain jo assets ke prices ko impact kar sakte hain. Event-based trading market opportunities ko capitalize karne mein madadgar hota hai jo specific events, jaise ke earnings releases, mergers and acquisitions, regulatory changes, ya geopolitical crises, se arise hote hain. In events ko anticipate aur jaldi se react karke, smart money traders profits generate kar sakte hain.

Long-Term Investing

Jab ke smart money strategies often short-term trading aur opportunistic plays ko shamil karte hain, bohot se institutional investors long-term investing par bhi focus karte hain. Woh strong growth potential ke sath undervalued assets ko identify karte hain, diversified portfolios banate hain, aur wealth creation ke liye waqt ke sath patient approach ko adopt karte hain. Long-term investing fundamental analysis aur strategic asset allocation principles ke saath align hota hai. Smart money trading ka tareeqa ek wide range ki techniques aur approaches ko shamil karta hai, jisme fundamental aur technical analysis, market sentiment analysis, risk management, market manipulation (though unethical and illegal), high-frequency trading, dark pools aur private markets mein participate karna, contrarian investing, event-based trading, aur long-term investing shamil hain. Smart money investors apni insights, resources, aur market expertise ka faida uthate hue competitive edge hasil karte hain aur financial markets mein superior returns generate karte hain.

تبصرہ

Расширенный режим Обычный режим