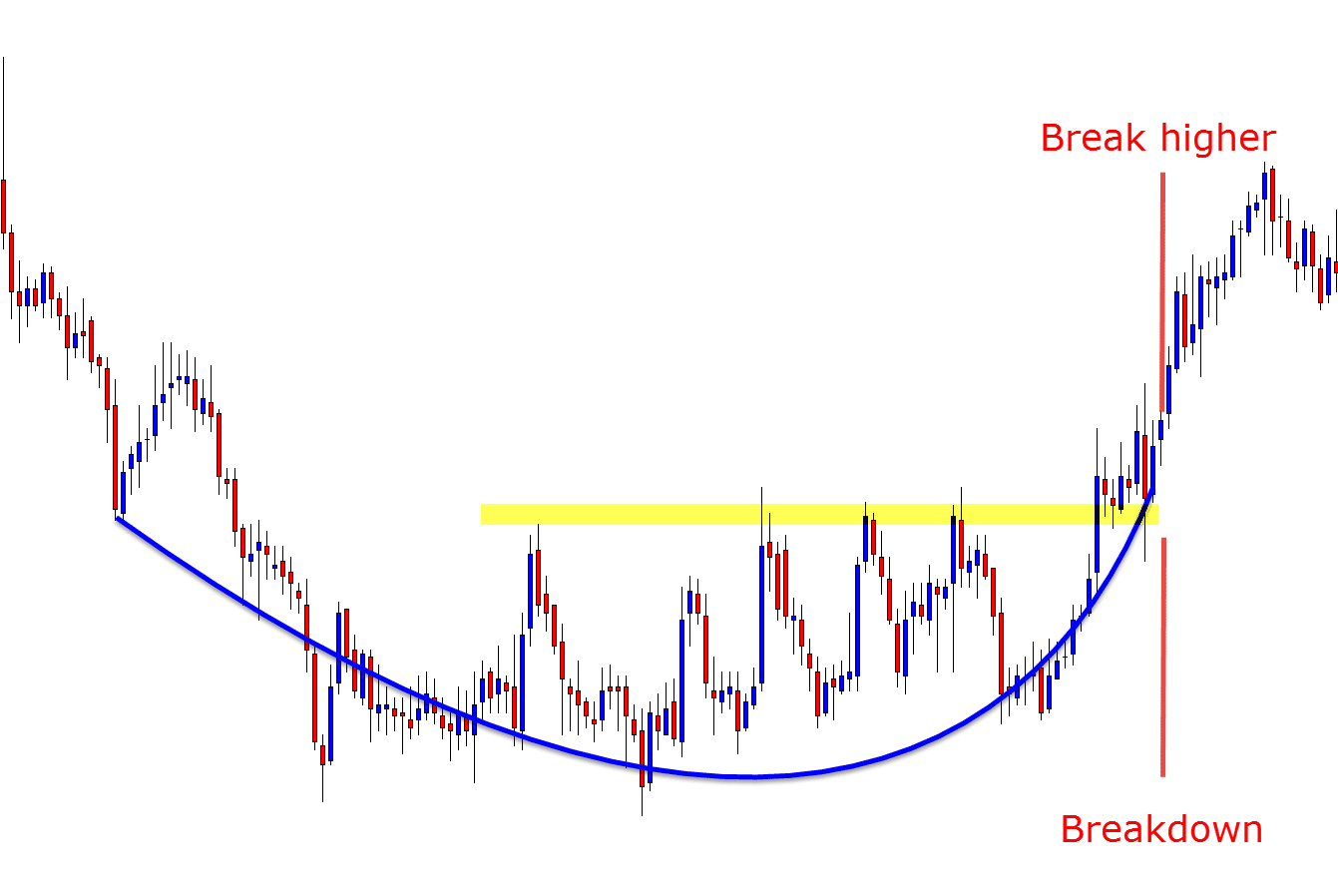

Rounded Bottom Candlestick pattern ek technical analysis pattern hai jo traders ke liye istemal hota hai taake wo kisi asset ki qeemat mein potential bullish reversals ko pehchanein. Ye pattern is nishaniyat se pehchaana jaata hai ke asset ki qeemat mein dhire dhire kami hoti hai, jise ek consolidation period ke baad puri tarah se form hone wala rounded bottom shape chart par banata hai. Traders is pattern ko talash karte hain kyun ke ye market sentiment mein bearish se bullish ki taraf shift hone ka ishaara ho sakta hai, jo ek potential buying opportunity ki nishani bhi ho sakta hai.

Characteristics of the Pattern

Rounded Bottom Candlestick pattern ka ek ahem pehlu ye hai ke ye dusri patterns ke muqablay mein zyada arse mein banta hai. Kuch patterns ke mukable jo sirf kuch din ya hafton mein hoti hain, Rounded Bottom pattern ko puri tarah banne mein kai hafton ya mahinon tak ka waqt lag sakta hai. Ye lamba timeframe aksar potential reversal mein quwwat ka nishaan hai, kyun ke is se market sentiment mein zyada significant shift aur gradual buying pressure ka akhzah hota hai.

Formation and Timeframe

Jab Rounded Bottom pattern ko tajziya kiya jaata hai, to traders aam tor par kuch main factors ko tasdiq karne ke liye dekhte hain. In elements mein se kuch shamil hain ek saaf downtrend jo pattern ke formation se pehle hota hai, ek rounded bottom shape jisme dhire dhire direction ka tabadla hota hai, aur pattern ke resistance level ke upar breakout. Is ke ilawa, traders supporting factors jaise ke pattern ke formation mein barhtay hue trading volume ko bhi dekhte hain, jo potential reversal ko aur bhi tasdiq kar sakta hai.

Key Elements for Confirmation

Rounded Bottom Candlestick pattern ke peeche kaafi hisaab hai market dynamics aur investor behavior ka. Downtrend phase mein, bechne wale market mein dominate karte hain, jo asset ki qeemat ko nicha dabaate hain. Lekin jab qeemat ek support level ko approach karti hai aur ek rounded bottom banane lagti hai, to buyers shuru mein lena shuru karte hain, nichli qeemat aur reversal ki potential ke jazbat se khiche jaate hain. Ye gradual shift selling pressure se buying pressure tak pattern ke shape mein nazar aati hai aur ye market sentiment mein ek tabadla ka ishaara karta hai.

Challenges in Trading the Pattern

Rounded Bottom pattern ko trade karne mein ek chunauti ye hai ke ise doosri mukhtalif patterns ya temporary price fluctuations se farq kaise kiya jaaye. Traders ko ehtiyaat se kaam lena chahiye taake wo ek temporary bounce ya consolidation ko asal Rounded Bottom reversal se ghalti na samjhein. Is risk ko kam karne ke liye, traders aksar mazeed technical indicators ya analysis techniques ka istemal karte hain pattern ki tasdiq ke liye aur apne trading decisions ko mazboot banate hain. Ek aise technique mein se ek hai Rounded Bottom pattern ko doosre technical indicators jaise ke moving averages, trend lines, ya momentum oscillators ke saath combine karna. Misal ke taur par, traders moving averages ka crossover ya bullish divergence in momentum indicators dekhte hain taake Rounded Bottom pattern ke indicated potential reversal ko tasdiq karein. Mazeed signals aur tasdiq ke factors ko shamil karke, traders apne trading setups ki reliability ko barha sakte hain aur false signals ke chances ko kam kar sakte hain.

Risk Management and Position Sizing

Rounded Bottom pattern ko trade karte waqt ek aur cheez ka khayal rakhna hai ke risk management aur position sizing ka ahmiyat. Jabki pattern ek potential bullish reversal ko indicate kar sakta hai, lekin hamesha ek risk hai ke market trader ke position ke khilaf jaaye. Isliye, traders ko stop-loss orders aur sahi position sizing ka istemal karna chahiye taake wo apna risk manage kar sakein aur apne capital ko bacha sakein. Iske alawa, traders ko position ko gradual taur par enter karna chahiye jab pattern develop hota hai, ek baar mein poora position enter karne ke bajaye, taake risk exposure ko kam kiya ja sake.

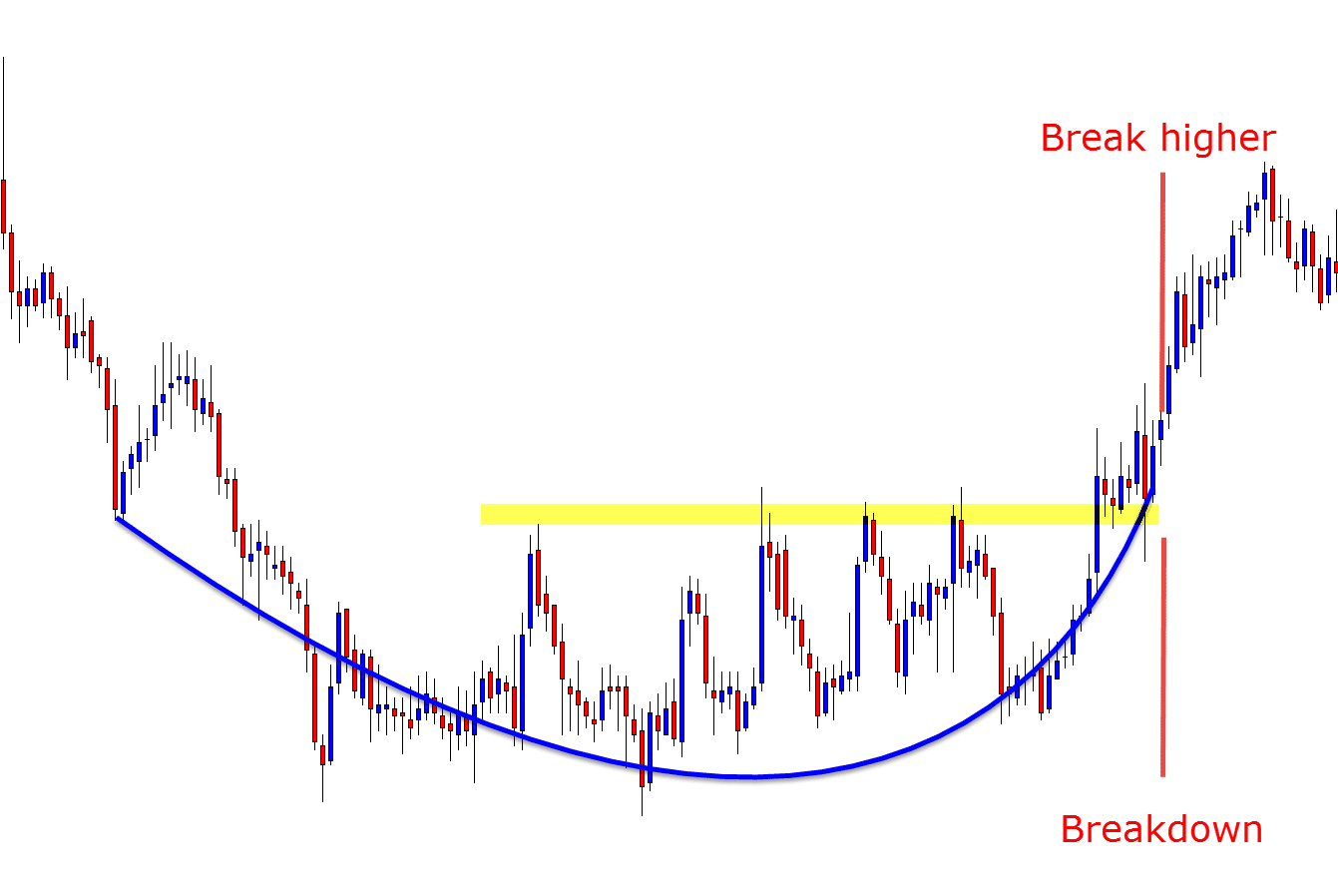

Rounded Bottom Candlestick pattern ek technical analysis pattern hai jo traders ke liye istemal hota hai taake wo asset prices mein potential bullish reversals ko pehchanein. Ye pattern ek gradual decline ke baad rounded bottom shape banata hai, jo bearish se bullish market sentiment mein shift ko signal karta hai. Traders mukhtalif elements ka tajziya karte hain aur confirmation techniques ka istemal karte hain pattern ko tasdiq karne aur inform ki gayi trading decisions ko banane ke liye. Risk management aur position sizing Rounded Bottom pattern ko trade karte waqt ahmiyat ke factors hain taake nuqsanat ko kam kiya ja sake aur trading outcomes ko optimize kiya ja sake.

Characteristics of the Pattern

Rounded Bottom Candlestick pattern ka ek ahem pehlu ye hai ke ye dusri patterns ke muqablay mein zyada arse mein banta hai. Kuch patterns ke mukable jo sirf kuch din ya hafton mein hoti hain, Rounded Bottom pattern ko puri tarah banne mein kai hafton ya mahinon tak ka waqt lag sakta hai. Ye lamba timeframe aksar potential reversal mein quwwat ka nishaan hai, kyun ke is se market sentiment mein zyada significant shift aur gradual buying pressure ka akhzah hota hai.

Formation and Timeframe

Jab Rounded Bottom pattern ko tajziya kiya jaata hai, to traders aam tor par kuch main factors ko tasdiq karne ke liye dekhte hain. In elements mein se kuch shamil hain ek saaf downtrend jo pattern ke formation se pehle hota hai, ek rounded bottom shape jisme dhire dhire direction ka tabadla hota hai, aur pattern ke resistance level ke upar breakout. Is ke ilawa, traders supporting factors jaise ke pattern ke formation mein barhtay hue trading volume ko bhi dekhte hain, jo potential reversal ko aur bhi tasdiq kar sakta hai.

Key Elements for Confirmation

Rounded Bottom Candlestick pattern ke peeche kaafi hisaab hai market dynamics aur investor behavior ka. Downtrend phase mein, bechne wale market mein dominate karte hain, jo asset ki qeemat ko nicha dabaate hain. Lekin jab qeemat ek support level ko approach karti hai aur ek rounded bottom banane lagti hai, to buyers shuru mein lena shuru karte hain, nichli qeemat aur reversal ki potential ke jazbat se khiche jaate hain. Ye gradual shift selling pressure se buying pressure tak pattern ke shape mein nazar aati hai aur ye market sentiment mein ek tabadla ka ishaara karta hai.

Challenges in Trading the Pattern

Rounded Bottom pattern ko trade karne mein ek chunauti ye hai ke ise doosri mukhtalif patterns ya temporary price fluctuations se farq kaise kiya jaaye. Traders ko ehtiyaat se kaam lena chahiye taake wo ek temporary bounce ya consolidation ko asal Rounded Bottom reversal se ghalti na samjhein. Is risk ko kam karne ke liye, traders aksar mazeed technical indicators ya analysis techniques ka istemal karte hain pattern ki tasdiq ke liye aur apne trading decisions ko mazboot banate hain. Ek aise technique mein se ek hai Rounded Bottom pattern ko doosre technical indicators jaise ke moving averages, trend lines, ya momentum oscillators ke saath combine karna. Misal ke taur par, traders moving averages ka crossover ya bullish divergence in momentum indicators dekhte hain taake Rounded Bottom pattern ke indicated potential reversal ko tasdiq karein. Mazeed signals aur tasdiq ke factors ko shamil karke, traders apne trading setups ki reliability ko barha sakte hain aur false signals ke chances ko kam kar sakte hain.

Risk Management and Position Sizing

Rounded Bottom pattern ko trade karte waqt ek aur cheez ka khayal rakhna hai ke risk management aur position sizing ka ahmiyat. Jabki pattern ek potential bullish reversal ko indicate kar sakta hai, lekin hamesha ek risk hai ke market trader ke position ke khilaf jaaye. Isliye, traders ko stop-loss orders aur sahi position sizing ka istemal karna chahiye taake wo apna risk manage kar sakein aur apne capital ko bacha sakein. Iske alawa, traders ko position ko gradual taur par enter karna chahiye jab pattern develop hota hai, ek baar mein poora position enter karne ke bajaye, taake risk exposure ko kam kiya ja sake.

Rounded Bottom Candlestick pattern ek technical analysis pattern hai jo traders ke liye istemal hota hai taake wo asset prices mein potential bullish reversals ko pehchanein. Ye pattern ek gradual decline ke baad rounded bottom shape banata hai, jo bearish se bullish market sentiment mein shift ko signal karta hai. Traders mukhtalif elements ka tajziya karte hain aur confirmation techniques ka istemal karte hain pattern ko tasdiq karne aur inform ki gayi trading decisions ko banane ke liye. Risk management aur position sizing Rounded Bottom pattern ko trade karte waqt ahmiyat ke factors hain taake nuqsanat ko kam kiya ja sake aur trading outcomes ko optimize kiya ja sake.

تبصرہ

Расширенный режим Обычный режим