Deep Details.

Forex trading mein mazboot market trend ek aham factor hai jis se traders ki earning aur investments par gehra asar hota hai. Is article mein hum is topic par ghaur kareinge aur ye bhi samjhenge ke mazboot market trend kya hai aur kyun ye itna zaroori hai.

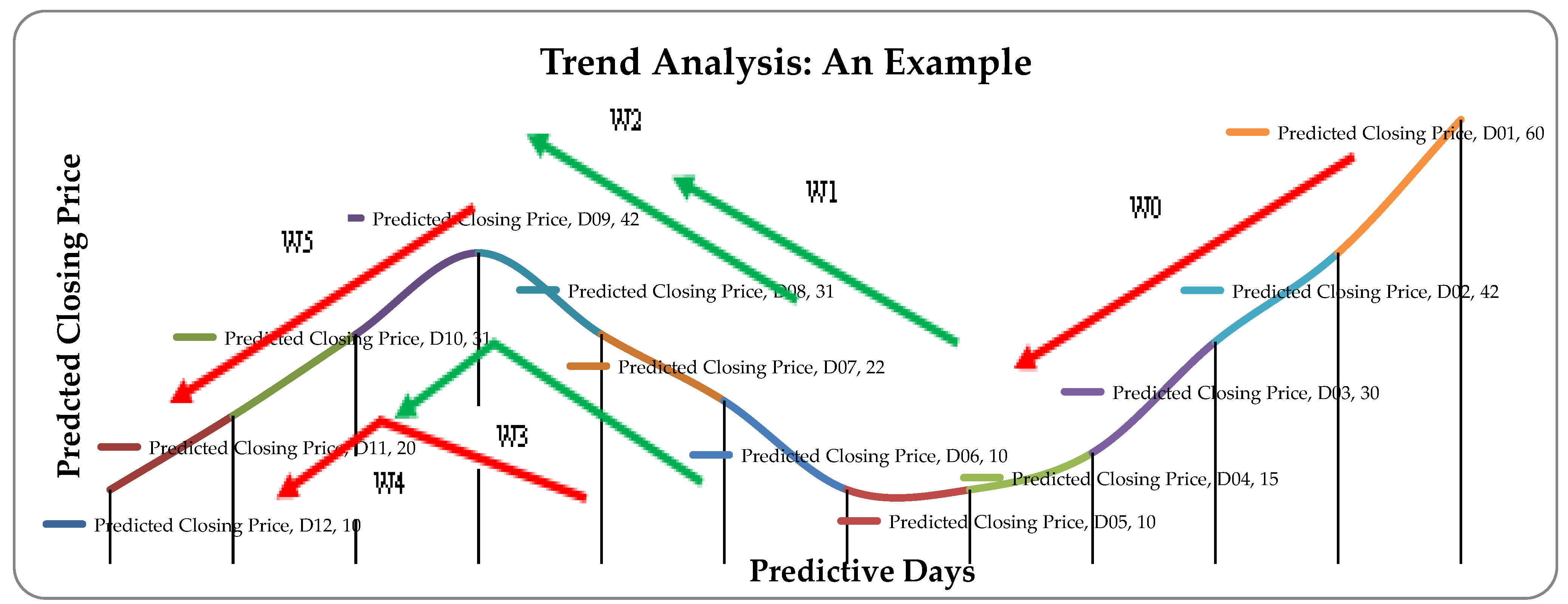

Market trend ka matlab hota hai ke market ki direction kis taraf hai. Agar market upar ki taraf ja raha hai to iska matlab hai ke bullish trend hai aur agar market niche ki taraf ja raha hai to ye bearish trend hai. Market trend ka analysis traders ke liye bohot zaroori hota hai kyun ke is se unhe pata chalta hai ke kis taraf market move ho raha hai aur unhe apni trading strategies ko us ke mutabiq adjust karna hota hai.

Agar market mein mazboot trend hai to is se traders ko bohot faida hota hai kyun ke is mein unhe pata chalta hai ke market ki direction kis taraf hai aur is ke mutabiq unhe trading karne ki salahiyat milti hai. Is ke ilawa, mazboot trend mein traders ko market mein confidence hota hai aur unhe apni trading decisions ko le kar confident feel hota hai.

Mazboot market trend ka pata karne ke liye traders ko market ke movement ko closely observe karna hota hai aur is ke ilawa technical analysis ka use karna hota hai. Technical analysis mein traders market ki past performance ko analyze karte hain aur is se unhe market ki direction ka pata chalta hai.

Main Facts.

Forex trading mein mazboot market trend ka hona bohot zaroori hai kyun ke is se traders ki trading decisions aur investments par gehra asar hota hai. Is ke liye traders ko market ki direction ko closely observe karna hota hai aur technical analysis ka use karna hota hai.

Forex trading mein mazboot market trend ek aham factor hai jis se traders ki earning aur investments par gehra asar hota hai. Is article mein hum is topic par ghaur kareinge aur ye bhi samjhenge ke mazboot market trend kya hai aur kyun ye itna zaroori hai.

Market trend ka matlab hota hai ke market ki direction kis taraf hai. Agar market upar ki taraf ja raha hai to iska matlab hai ke bullish trend hai aur agar market niche ki taraf ja raha hai to ye bearish trend hai. Market trend ka analysis traders ke liye bohot zaroori hota hai kyun ke is se unhe pata chalta hai ke kis taraf market move ho raha hai aur unhe apni trading strategies ko us ke mutabiq adjust karna hota hai.

Agar market mein mazboot trend hai to is se traders ko bohot faida hota hai kyun ke is mein unhe pata chalta hai ke market ki direction kis taraf hai aur is ke mutabiq unhe trading karne ki salahiyat milti hai. Is ke ilawa, mazboot trend mein traders ko market mein confidence hota hai aur unhe apni trading decisions ko le kar confident feel hota hai.

Mazboot market trend ka pata karne ke liye traders ko market ke movement ko closely observe karna hota hai aur is ke ilawa technical analysis ka use karna hota hai. Technical analysis mein traders market ki past performance ko analyze karte hain aur is se unhe market ki direction ka pata chalta hai.

Main Facts.

Forex trading mein mazboot market trend ka hona bohot zaroori hai kyun ke is se traders ki trading decisions aur investments par gehra asar hota hai. Is ke liye traders ko market ki direction ko closely observe karna hota hai aur technical analysis ka use karna hota hai.

تبصرہ

Расширенный режим Обычный режим