Dynamics momentum indicator

Dynamics Momentum Indicator: Market Ki Taqat Ka Ehtemal

Market analysis ke liye mukhtalif tools aur indicators istemal kiye jate hain taake traders ko market ki movements ka behtar andaza ho sake. Dynamics Momentum Indicator bhi un tools mein se ek hai jo traders ke liye ahem hai. Is article mein hum Dynamics Momentum Indicator ke baray mein tafseel se guftagu karenge.

Dynamics Momentum Indicator Kya Hai?

Dynamics Momentum Indicator ek technical analysis tool hai jo market ke momentum ko measure karta hai. Is indicator ka maqsad yeh hota hai ke market ke uptrends aur downtrends ko samajhne mein madad faraham karna. Dynamics Momentum Indicator, market ke price movements ko analyze karta hai aur un movements mein mojood taqat ya pressure ko zahir karta hai.

Dynamics Momentum Indicator Ki Tafseelat

Dynamics Momentum Indicator ko samajhne ke liye kuch ahem points ko mad e nazar rakhna zaroori hai:

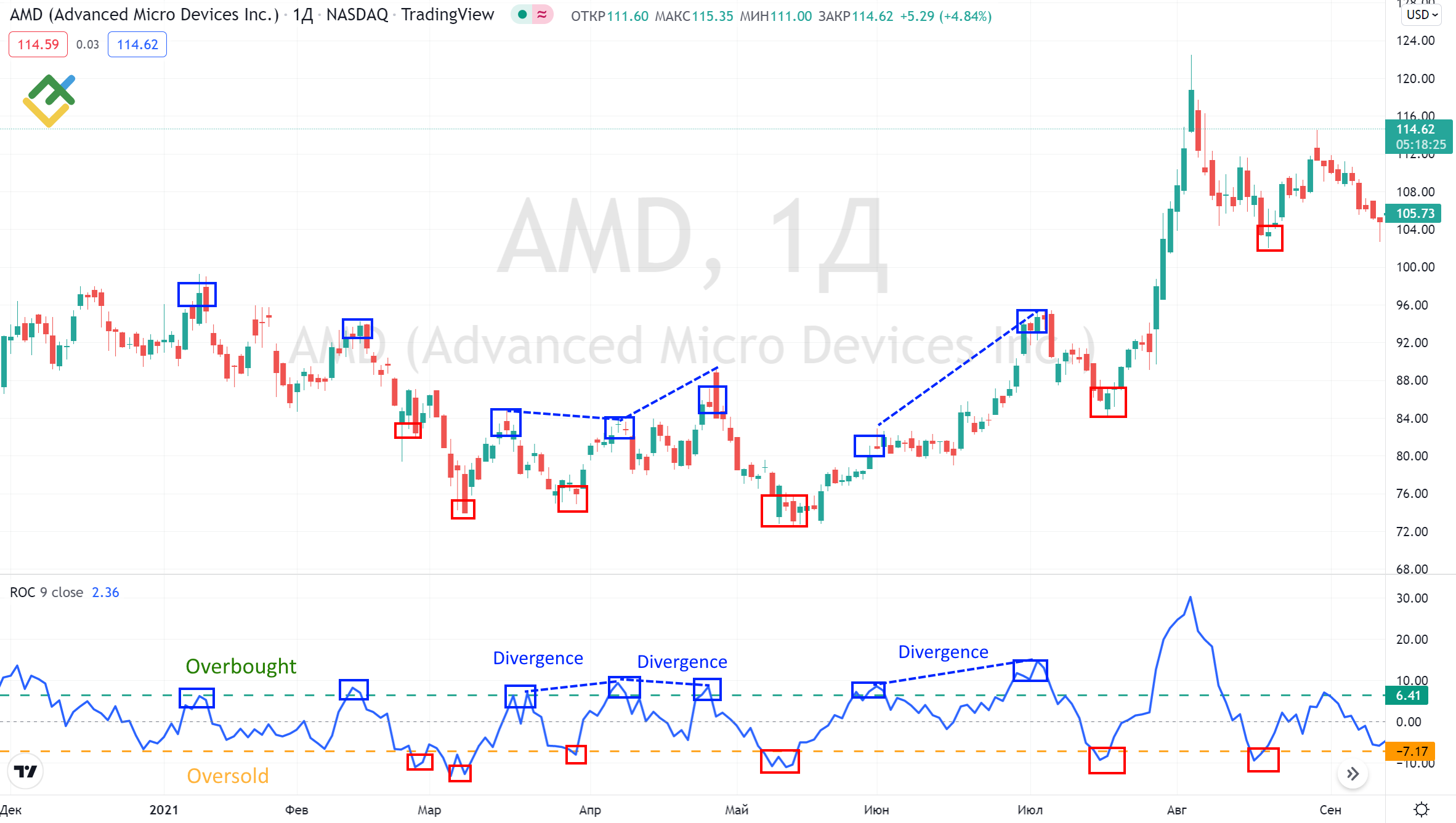

- Calculation: Dynamics Momentum Indicator ka calculation price ke recent movements par mabni hota hai. Is indicator mein typically short-term aur long-term averages ka istemal hota hai taake market ke momentum ko samjha ja sake.

- Interpretation: Is indicator ki values ko samajhne ke liye, traders ko kisi bhi sudden ya drastic change ko observe karna chahiye. Agar Dynamics Momentum Indicator ki value barh rahi hai, to yeh indicate karta hai ke market ka momentum tez ho raha hai. Jabke agar yeh value gir rahi hai, to yeh show karta hai ke market ke momentum mein kami aayi hai.

- Crossings: Dynamics Momentum Indicator ke short-term aur long-term averages ke crossings bhi ahem hote hain. Jab short-term average long-term average ko upar se cross karta hai, to yeh bullish signal hai, jabke agar short-term average long-term average ko neeche se cross karta hai, to yeh bearish signal hai.

Dynamics Momentum Indicator Ka Istemal

Dynamics Momentum Indicator ko trading decisions ke liye istemal karne se pehle kuch zaroori points ko mad e nazar rakhna zaroori hai:

- Confirmation: Is indicator ko istemal karne se pehle, confirmatory signals ka intezar karna zaroori hai taake false signals se bacha ja sake.

- Trend Analysis: Dynamics Momentum Indicator ko trend analysis ke sath istemal karna zaroori hai. Agar market uptrend mein hai aur Dynamics Momentum Indicator bhi bullish signals faraham kar raha hai, to yeh confirm karta hai ke uptrend jari hai.

- Risk Management: Har trading strategy ke sath risk management ka taalluq hota hai. Dynamics Momentum Indicator ke signals ko istemal karte waqt, stop-loss orders ka istemal karna zaroori hai taake nuqsaan se bacha ja sake.

Ikhtitami Guftagu

Dynamics Momentum Indicator ek powerful tool hai jo traders ko market ke momentum ko samajhne mein madad deta hai. Is indicator ko samajh kar, traders apne trading strategies ko refine kar sakte hain aur market movements ko behtar taur par samajh sakte hain. Magar yaad rakhiye ke har indicator ki tarah, Dynamics Momentum Indicator ko bhi dusre technical indicators aur market analysis tools ke saath istemal karna zaroori hai taake sahi trading decisions liye ja sakein.

تبصرہ

Расширенный режим Обычный режим