Forex Mein Regression Channel:

Forex trading mein traders aur investors ke liye kisi bhi instrument ke price trends ko samajhna aur predict karna behad ahem hai. Regression channel ek aham technical analysis tool hai jo price trends ko analyze karne aur future movements ko forecast karne mein madad deta hai. Chaliye dekhte hain ke regression channel kya hai aur forex trading mein iska istemal kaise hota hai.

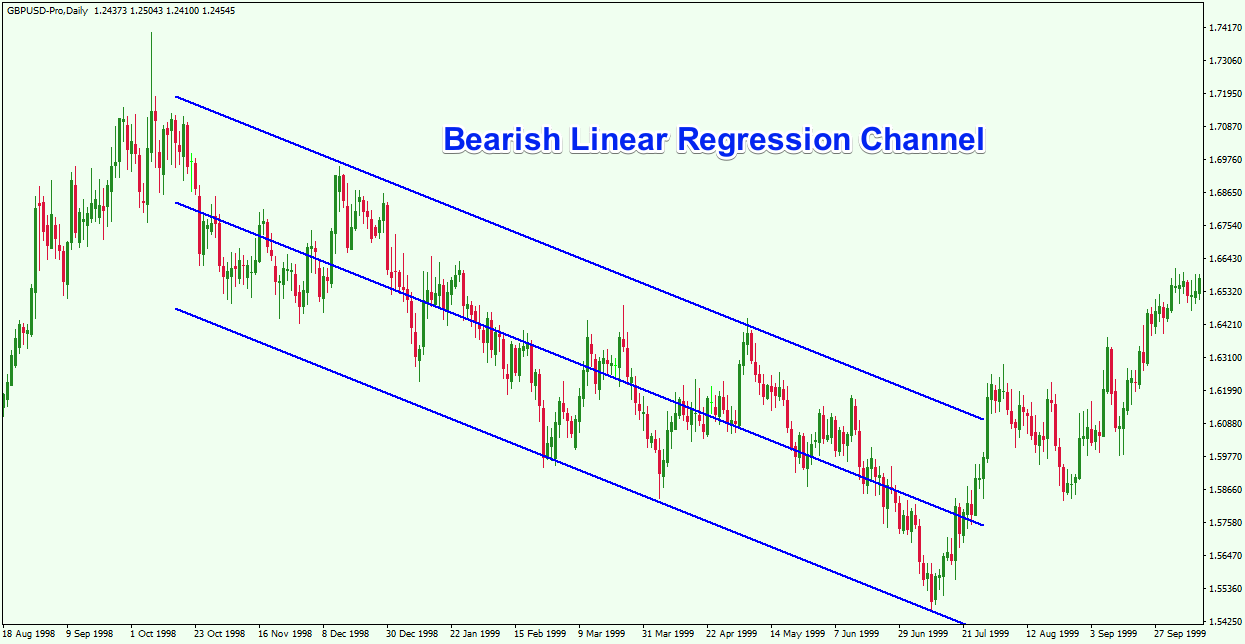

Regression Channel Kya Hai?

Regression channel ek statistical concept hai jo price trends ko visualize karne ke liye istemal kiya jata hai. Ye channel do parallel trend lines se bana hota hai jo asset ke price ke around plot kiye jate hain. Ek line upper price movements ko represent karti hai jabki doosri line lower price movements ko represent karti hai. Regression channel ko plotting ke liye regression analysis ka istemal kiya jata hai.

Kaise Banata Hai Regression Channel?

Regression channel banane ke liye traders ko kuch steps follow karne hote hain:

- Data Collection: Sab se pehle, traders ko sufficient historical price data collect karna hota hai jis par wo regression channel plot karna chahte hain.

- Regression Analysis: Phir traders ko regression analysis ka istemal karte hue best-fit trend line ko calculate karna hota hai. Ye trend line price movements ke average ko darust karta hai.

- Upper aur Lower Bands: Best-fit trend line ke around, traders doosri lines plot karte hain jo kuch standard deviations ke multiples hote hain. Ye lines upper aur lower bands ko darust karte hain.

- Plotting: Upper aur lower bands ko plot karke regression channel complete hota hai.

Forex Trading Mein Regression Channel Ka Istemal:

Regression channel ka istemal karke traders kuch important points ka analysis kar sakte hain:

- Trend Identification: Regression channel ke zariye traders trend direction ko identify kar sakte hain. Agar price upper band ke qareeb hai, to uptrend indicate hota hai, jabki agar price lower band ke qareeb hai, to downtrend indicate hota hai.

- Support aur Resistance Levels: Regression channel ke bands support aur resistance levels ka darust pata lagane mein madad karte hain. Price upper band se nikalta hai to resistance level ban jata hai, jabki agar price lower band se nikalta hai to support level ban jata hai.

- Entry aur Exit Points: Regression channel ke istemal se traders entry aur exit points tay kar sakte hain. Price upper band se nikalne par sell positions le sakte hain, jabki price lower band se nikalne par buy positions le sakte hain.

Regression channel ek mufeed tool hai forex trading mein price trends ko analyze karne aur trading decisions ko improve karne ke liye. Lekin hamesha yaad rahe ke kisi bhi single indicator ya tool par pura bharosa na karein aur doosre technical indicators aur analysis tools ka bhi istemal karein. Iske alawa, risk management ka bhi khayal rakhein aur market ke dynamics ko samajhne ke liye practice aur research karein.

تبصرہ

Расширенный режим Обычный режим