Introduction to Money Market Breakout Trading

Money Market Breakout ek trading strategy hai jo ke finance markets mein, khas tor par foreign exchange forex aur stock markets mein significant price movements ko identify aur capitalize karne par tawajju deti hai. Ye strategy breakouts ke concept par mabni hai, jo ke tab hotay hain jab kisi asset ka price ek predefined support ya resistance level se guzar jata hai. Money Market Breakout strategies traders mein popular hain kyunki inka potential hota hai ke wo large profits capture kar saken during periods of heightened volatility and price momentum.

Key Principles of Money Market Breakout Trading

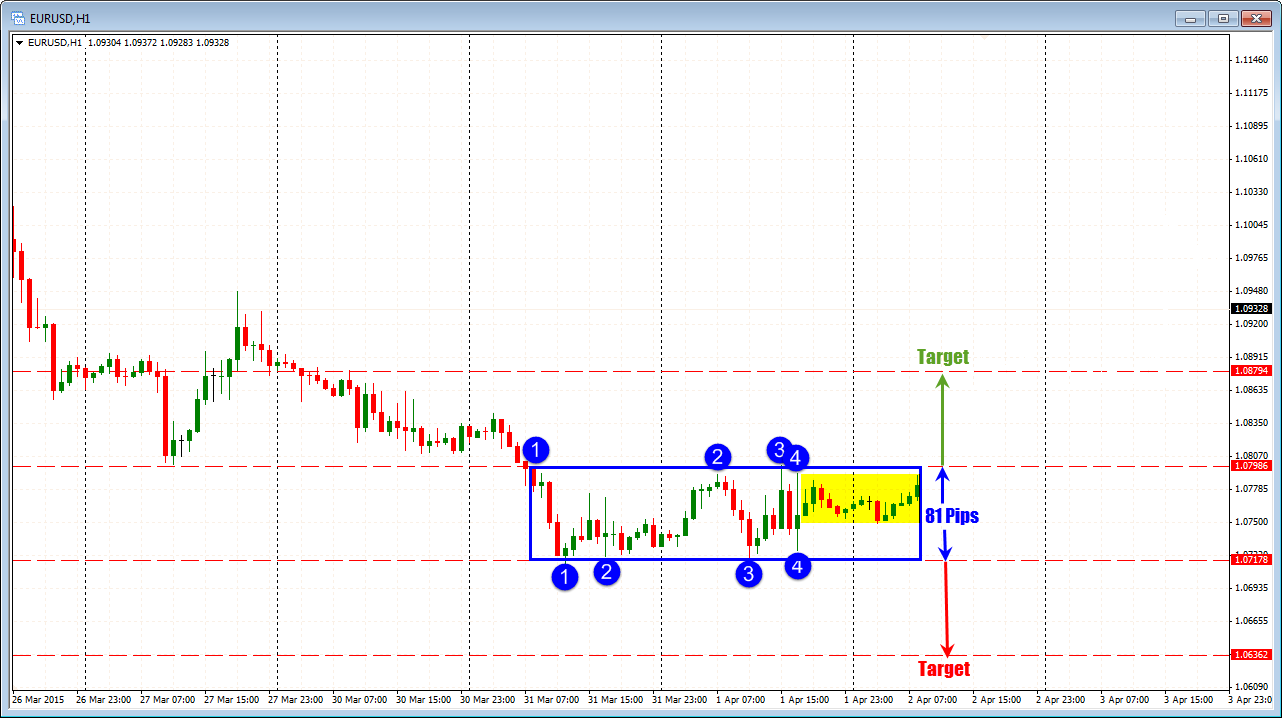

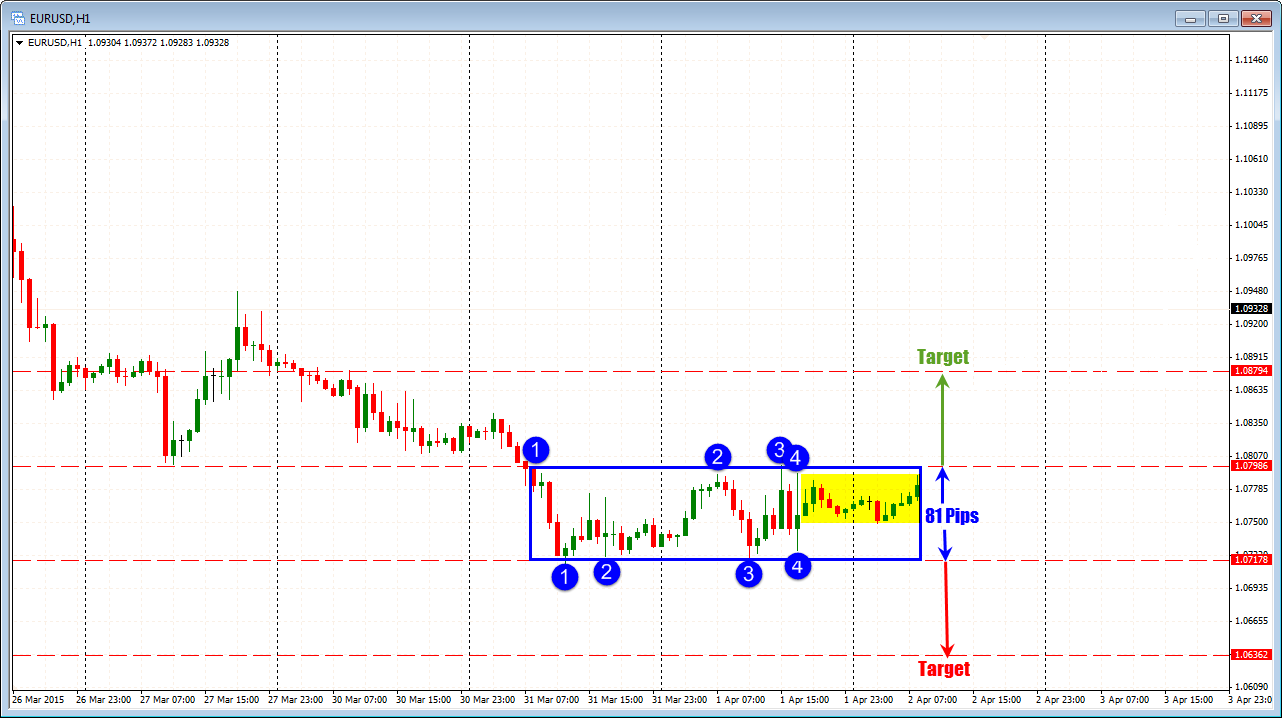

Money Market Breakout trading ka aik key principle hai key support aur resistance levels ko identify karna. Support levels wo price levels hain jahan asset ko buying interest milta hai, jisse wo further girne se roka ja sakta hai. Resistance levels, dusri taraf, wo price levels hain jahan selling pressure aksar nazar aati hai, jo asset ko higher nahi jane deti. Traders jo Money Market Breakout strategies use karte hain wo aksar technical analysis tools jese trendlines, moving averages, aur Fibonacci retracement levels ka istemal karte hain key ye key price levels ko identify kar sakein.

Identifying Support and Resistance Levels

Jab key support aur resistance levels identify ho jate hain, traders breakout opportunities ke liye dekhte hain. Breakout tab hota hai jab asset ka price ek support ya resistance level se guzar jata hai, jo ke market sentiment mein ek potential change ko signal karta hai aur ek significant price movement ka potential banata hai. Traders jo Money Market Breakout strategies use karte hain wo aksar ek confirmed breakout ka wait karte hain, jo ke aksar increased trading volume aur price volatility ke sath hota hai, before entering a trade.

Breakout Opportunities in Money Market Breakout Trading

Money Market Breakout strategies mein kai variations hain, including trend-following breakouts aur range-bound breakouts. Trend-following breakouts wo hotay hain jo market trend ki direction mein trade karte hain, jahan traders breakout ko dekhte hain jo trend ki continuation ko confirm karta hai. Range-bound breakouts, dusri taraf, wo hotay hain jo ek defined price range ke andar trade karte hain, jahan traders breakout ko dekhte hain jo range se ek potential breakout ko signal karta hai.

Variations of Money Market Breakout Strategies

Money Market Breakout trading ka aik challenge ye hai ke false breakouts aur valid breakouts mein farq karna. False breakouts tab hotay hain jab price briefly ek support ya resistance level se guzar jata hai lekin phir direction change ho jata hai, jisse wo traders jo breakout par trade karte hain unko trap kar leta hai. False breakouts ke risk ko kam karne ke liye, traders aksar additional technical indicators ka istemal karte hain ya confirmation signals ka wait karte hain before entering a trade.

Risk Management in Money Market Breakout Trading

Risk management bhi ek critical aspect hai Money Market Breakout trading ka. Kyunki breakouts aksar significant price movements result kar sakte hain, traders ko stop-loss orders ka istemal karna chahiye taake potential losses ko limit kiya ja sake agar trade unke khilaf ho jata hai. Additionally, traders position sizing techniques ka bhi istemal karte hain taake har trade unke overall trading capital ka ek manageable portion represent kare. Money Market Breakout strategies ko various financial markets mein apply kiya ja sakta hai, including forex, stocks, commodities, aur cryptocurrencies. Lekin, traders ko apne strategies ko adapt karna zaroori hai specific characteristics ke sath har market ke, jese trading hours, liquidity, aur volatility ke.

Money Market Breakout Strategies in Forex Trading

Forex trading mein, Money Market Breakout strategies commonly use hoti hain to capitalize on major economic announcements ya geopolitical events jo ke currency pairs mein significant price movements trigger kar sakte hain. Traders breakout par focus karte hain jo key economic data releases ke baad hota hai, jese non-farm payroll reports ya central bank interest rate decisions. Stock trading mein bhi, Money Market Breakout strategies individual stocks ya broader market indices mein apply kiya ja sakta hai. Traders breakout ko dekhte hain following earnings announcements, corporate news, ya technical chart patterns jo ek potential price breakout ko suggest karte hain.

Money Market Breakout Strategies in Commodities Trading

Commodities trading bhi Money Market Breakout strategies ke opportunities offer karta hai, particularly markets jese crude oil, gold, aur silver. Commodities ke prices mein breakout hone ki wajah supply and demand dynamics, geopolitical tensions, ya macroeconomic conditions mein changes ho sakti hai.

Money Market Breakout Strategies in Commodities Trading

Cryptocurrency trading mein bhi interest barhti ja rahi hai, offering volatile price movements aur opportunities for Money Market Breakout strategies. Traders cryptocurrency markets mein breakout par focus karte hain major digital assets jese Bitcoin, Ethereum, aur Litecoin mein, jo market sentiment, regulatory developments, aur technological advancements ki wajah se driven ho sakte hain.

Money Market Breakout trading ek strategy hai jo significant price movements ko identify aur capitalize karne par tawajju deti hai financial markets mein. Key support aur resistance levels ko identify karke aur confirmed breakouts ka wait karke, traders potentially large profits capture kar sakte hain during periods of heightened volatility and price momentum. Lekin, traders ko false breakouts ka bhi dhyan rakhna chahiye aur robust risk management practices ko implement karna chahiye apne capital ko protect karne ke liye.

Money Market Breakout ek trading strategy hai jo ke finance markets mein, khas tor par foreign exchange forex aur stock markets mein significant price movements ko identify aur capitalize karne par tawajju deti hai. Ye strategy breakouts ke concept par mabni hai, jo ke tab hotay hain jab kisi asset ka price ek predefined support ya resistance level se guzar jata hai. Money Market Breakout strategies traders mein popular hain kyunki inka potential hota hai ke wo large profits capture kar saken during periods of heightened volatility and price momentum.

Key Principles of Money Market Breakout Trading

Money Market Breakout trading ka aik key principle hai key support aur resistance levels ko identify karna. Support levels wo price levels hain jahan asset ko buying interest milta hai, jisse wo further girne se roka ja sakta hai. Resistance levels, dusri taraf, wo price levels hain jahan selling pressure aksar nazar aati hai, jo asset ko higher nahi jane deti. Traders jo Money Market Breakout strategies use karte hain wo aksar technical analysis tools jese trendlines, moving averages, aur Fibonacci retracement levels ka istemal karte hain key ye key price levels ko identify kar sakein.

Identifying Support and Resistance Levels

Jab key support aur resistance levels identify ho jate hain, traders breakout opportunities ke liye dekhte hain. Breakout tab hota hai jab asset ka price ek support ya resistance level se guzar jata hai, jo ke market sentiment mein ek potential change ko signal karta hai aur ek significant price movement ka potential banata hai. Traders jo Money Market Breakout strategies use karte hain wo aksar ek confirmed breakout ka wait karte hain, jo ke aksar increased trading volume aur price volatility ke sath hota hai, before entering a trade.

Breakout Opportunities in Money Market Breakout Trading

Money Market Breakout strategies mein kai variations hain, including trend-following breakouts aur range-bound breakouts. Trend-following breakouts wo hotay hain jo market trend ki direction mein trade karte hain, jahan traders breakout ko dekhte hain jo trend ki continuation ko confirm karta hai. Range-bound breakouts, dusri taraf, wo hotay hain jo ek defined price range ke andar trade karte hain, jahan traders breakout ko dekhte hain jo range se ek potential breakout ko signal karta hai.

Variations of Money Market Breakout Strategies

Money Market Breakout trading ka aik challenge ye hai ke false breakouts aur valid breakouts mein farq karna. False breakouts tab hotay hain jab price briefly ek support ya resistance level se guzar jata hai lekin phir direction change ho jata hai, jisse wo traders jo breakout par trade karte hain unko trap kar leta hai. False breakouts ke risk ko kam karne ke liye, traders aksar additional technical indicators ka istemal karte hain ya confirmation signals ka wait karte hain before entering a trade.

Risk Management in Money Market Breakout Trading

Risk management bhi ek critical aspect hai Money Market Breakout trading ka. Kyunki breakouts aksar significant price movements result kar sakte hain, traders ko stop-loss orders ka istemal karna chahiye taake potential losses ko limit kiya ja sake agar trade unke khilaf ho jata hai. Additionally, traders position sizing techniques ka bhi istemal karte hain taake har trade unke overall trading capital ka ek manageable portion represent kare. Money Market Breakout strategies ko various financial markets mein apply kiya ja sakta hai, including forex, stocks, commodities, aur cryptocurrencies. Lekin, traders ko apne strategies ko adapt karna zaroori hai specific characteristics ke sath har market ke, jese trading hours, liquidity, aur volatility ke.

Money Market Breakout Strategies in Forex Trading

Forex trading mein, Money Market Breakout strategies commonly use hoti hain to capitalize on major economic announcements ya geopolitical events jo ke currency pairs mein significant price movements trigger kar sakte hain. Traders breakout par focus karte hain jo key economic data releases ke baad hota hai, jese non-farm payroll reports ya central bank interest rate decisions. Stock trading mein bhi, Money Market Breakout strategies individual stocks ya broader market indices mein apply kiya ja sakta hai. Traders breakout ko dekhte hain following earnings announcements, corporate news, ya technical chart patterns jo ek potential price breakout ko suggest karte hain.

Money Market Breakout Strategies in Commodities Trading

Commodities trading bhi Money Market Breakout strategies ke opportunities offer karta hai, particularly markets jese crude oil, gold, aur silver. Commodities ke prices mein breakout hone ki wajah supply and demand dynamics, geopolitical tensions, ya macroeconomic conditions mein changes ho sakti hai.

Money Market Breakout Strategies in Commodities Trading

Cryptocurrency trading mein bhi interest barhti ja rahi hai, offering volatile price movements aur opportunities for Money Market Breakout strategies. Traders cryptocurrency markets mein breakout par focus karte hain major digital assets jese Bitcoin, Ethereum, aur Litecoin mein, jo market sentiment, regulatory developments, aur technological advancements ki wajah se driven ho sakte hain.

Money Market Breakout trading ek strategy hai jo significant price movements ko identify aur capitalize karne par tawajju deti hai financial markets mein. Key support aur resistance levels ko identify karke aur confirmed breakouts ka wait karke, traders potentially large profits capture kar sakte hain during periods of heightened volatility and price momentum. Lekin, traders ko false breakouts ka bhi dhyan rakhna chahiye aur robust risk management practices ko implement karna chahiye apne capital ko protect karne ke liye.

تبصرہ

Расширенный режим Обычный режим