Support and Resistance

Support aur Resistance (S&R) ek technical analysis technique hai jo traders ko stock ke price movements ko predict karne mein madad karta hai. Yah technique is assumption par based hai ki jab koi stock ek specific price level tak pahunchta hai, to woh level price ko support ya resistance kar sakta hai.

Support Level woh price level hota hai jahan par buyers ki demand zyada hoti hai, aur yeh demand price ko girne se rokati hai. Jab koi stock support level tak pahunchta hai, to traders aksar ise kharidne lagte hain, jisse price phir se badh sakta hai.

Resistance Level woh price level hota hai jahan par sellers ki supply zyada hoti hai, aur yeh supply price ko badhne se rokati hai. Jab koi stock resistance level tak pahunchta hai, to traders aksar ise bechne lagte hain, jisse price phir se gir sakta hai.

S&R Levels ko Identify Karne ke Liye Kuch Methods hain:

S&R Levels ka Use Karke Trading

S&R levels ka use karke traders kuch trading strategies ko implement kar sakte hain:

S&R Levels ke Faide

S&R levels ka use karne ke kai faide hain:

S&R Levels ke Nuksan

S&R levels ka use karne ke kuch nuksan bhi hain:

Support aur Resistance (S&R) ek technical analysis technique hai jo traders ko stock ke price movements ko predict karne mein madad karta hai. Yah technique is assumption par based hai ki jab koi stock ek specific price level tak pahunchta hai, to woh level price ko support ya resistance kar sakta hai.

Support Level woh price level hota hai jahan par buyers ki demand zyada hoti hai, aur yeh demand price ko girne se rokati hai. Jab koi stock support level tak pahunchta hai, to traders aksar ise kharidne lagte hain, jisse price phir se badh sakta hai.

Resistance Level woh price level hota hai jahan par sellers ki supply zyada hoti hai, aur yeh supply price ko badhne se rokati hai. Jab koi stock resistance level tak pahunchta hai, to traders aksar ise bechne lagte hain, jisse price phir se gir sakta hai.

S&R Levels ko Identify Karne ke Liye Kuch Methods hain:

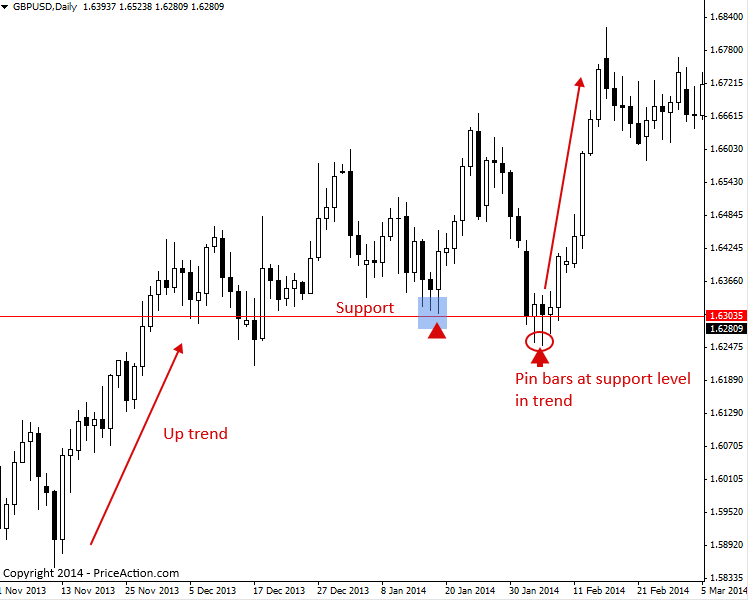

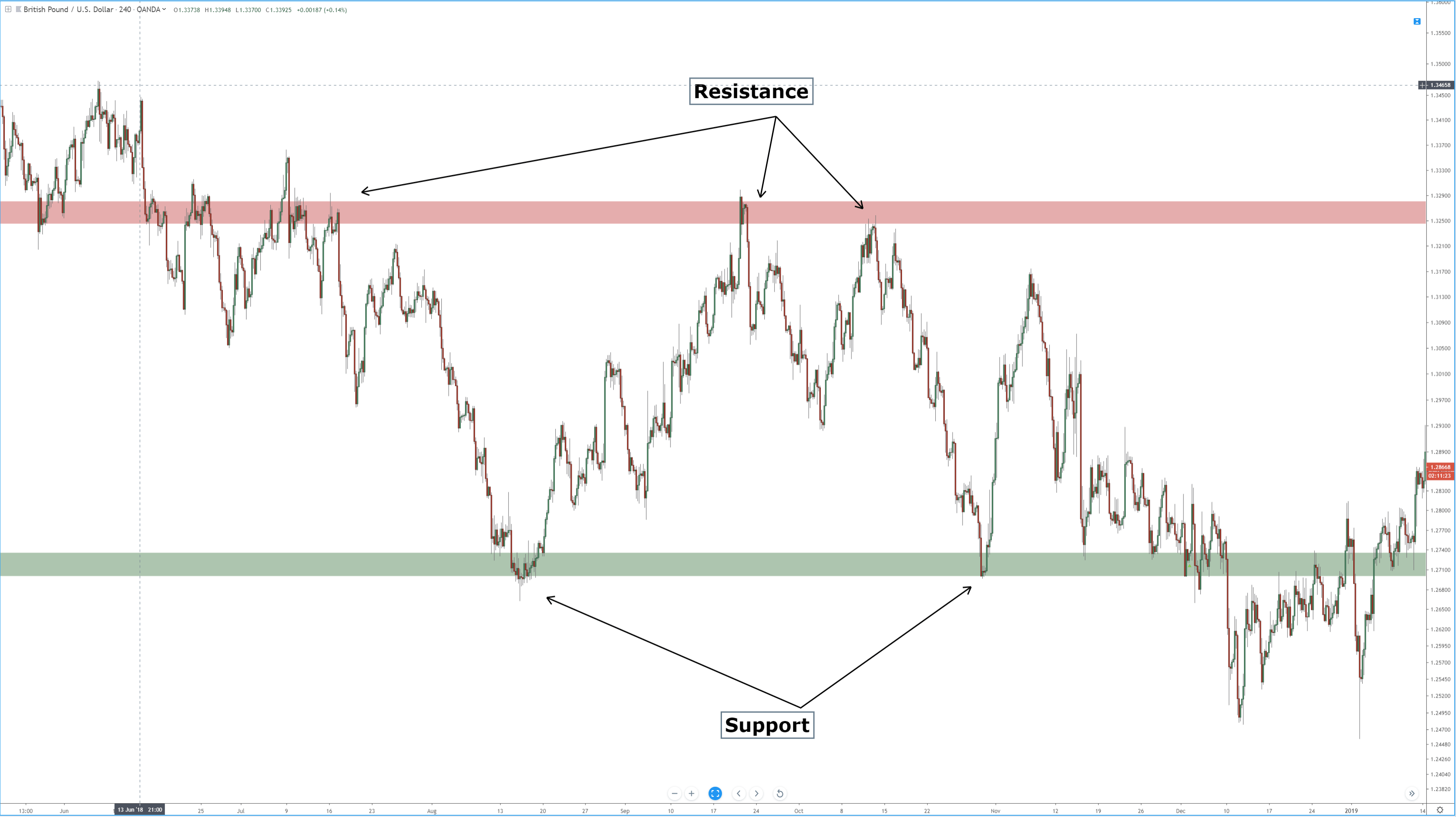

- Horizontal Lines: Yah S&R levels ko identify karne ka sabse basic method hai. Is method mein, traders charts par horizontal lines draw karte hain jahan par price pahle bhi support ya resistance kar chuka hai.

- Trend Lines: Yah S&R levels ko identify karne ka ek aur common method hai. Is method mein, traders charts par trend lines draw karte hain jo price movement ki direction ko show karte hain. Trend lines ke slope se pata chalta hai ki trend uptrend hai, downtrend hai, ya sideways hai.

- Moving Averages: Moving averages S&R levels ko identify karne ke liye ek technical indicator hain. Moving averages price ke average ko calculate karte hain ek specific period ke liye. Jab price moving average ko cross karta hai, to yeh support ya resistance ka signal ho sakta hai.

S&R Levels ka Use Karke Trading

S&R levels ka use karke traders kuch trading strategies ko implement kar sakte hain:

- Buy at Support: Yah strategy is assumption par based hai ki jab koi stock support level tak pahunchta hai, to price phir se badhne ka chance zyada hota hai. Isliye, traders support level par stocks ko kharidne lagte hain.

- Sell at Resistance: Yah strategy is assumption par based hai ki jab koi stock resistance level tak pahunchta hai, to price phir se girne ka chance zyada hota hai. Isliye, traders resistance level par stocks ko bechne lagte hain.

- Breakout Trading: Yah strategy is assumption par based hai ki jab koi stock support ya resistance level ko break karta hai, to price mein ek significant move hone ki probability hoti hai. Isliye, traders breakout ke baad direction mein stocks ko kharidte ya bechte hain.

S&R Levels ke Faide

S&R levels ka use karne ke kai faide hain:

- Yeh traders ko potential entry aur exit points ko identify karne mein madad kar sakte hain.

- Yeh traders ko risk ko manage karne mein madad kar sakte hain.

- Yeh traders ko profit potential ko maximize karne mein madad kar sakte hain.

S&R Levels ke Nuksan

S&R levels ka use karne ke kuch nuksan bhi hain:

- Yeh 100% accurate nahin hain.

- Inka use karne ke liye experience aur practice ki zarurat hoti hai.

- Kuch cases mein, S&R levels false signals de sakte hain.

تبصرہ

Расширенный режим Обычный режим