Components of Keltner Channel

Keltner Channel ek aham technical analysis tool hai jo traders istemal karte hain taake market mein dakhil aur nikalne ke points ko pehchanein. Iska naam uske banane wale Chester Keltner ke naam par rakha gaya hai. Keltner Channel volatality ka concept istemal karta hai aur isme teen mukhya components hote hain: middle line, upper channel line, aur lower channel line. Traders aam tor par Keltner Channel ko apne trading strategies mein shamil karte hain taake market ki volatality, trends, aur potential price reversals ko samajh sakein.

Keltner Channel ka asal maqsad hai market ki volatality ko dekhte hue entry aur exit points ka pata lagana. Ismein middle line hoti hai jo aam tor par asset ki price ka ek simple moving average (SMA) hota hai ek mukarrar period ke doran. Period ke liye aam taur par 20, 50, ya 100 din ka chunaav hota hai, lekin traders is parameter ko apne trading style aur timeframe ke mutabiq adjust kar sakte hain. Middle line prevailing trend ka reference point ka kaam karti hai, jo dusre technical analysis tools mein SMA ke tor par hoti hai.

Calculation of Keltner Channel Lines

Keltner Channel ka upper channel line middle line mein ek multiple of the Average True Range (ATR) ko add karke calculate kiya jata hai. ATR market ki volatality ko measure karta hai ek mukarrar period ke doran. Ek multiple of the ATR ko middle line mein add karke, upper channel line expand aur contract hoti hai market ki volatality ke mutabiq. Zada multiple se wider bands hoti hain, jo zyada volatality ko indicate karte hain, jabki kam multiple se narrow bands hoti hain, jo kam volatality ko show karti hain.

Umbar se Keltner Channel ka lower channel line middle line mein ek multiple of the ATR ko subtract karke calculate kiya jata hai. Ye lower band traders ko potential support zone provide karta hai, kyun ke prices jo lower channel line ke qareeb aati hain ya usse touch karti hain, oversold conditions ya support levels se bounce hone ka indication deti hain.

Advantages of Keltner Channel

Keltner Channel ka ek main faida ye hai ke ye changing market conditions mein adapt ho sakta hai. Fixed-width bands jaise ke Bollinger Bands ke mukabil, Keltner Channel ke bands dynamically adjust hote hain market ki volatality ke mutabiq, jo price action ka ek zyada responsive view provide karta hai. Ye feature traders ke liye khaas faydemand hai jo short-term price movements aur volatality expansions par faida uthane ki koshish karte hain.

Using Keltner Channel in Trading Strategies

Traders aam tor par Keltner Channel ko doosre technical indicators ke saath combine karte hain taake trading signals ko validate karein aur potential entry aur exit points ko confirm karein. For example, kuch traders Keltner Channel ko momentum oscillators jaise ke Relative Strength Index (RSI) ya Moving Average Convergence Divergence (MACD) ke saath istemal karte hain taake overbought ya oversold conditions aur volatality levels ko assess karein.

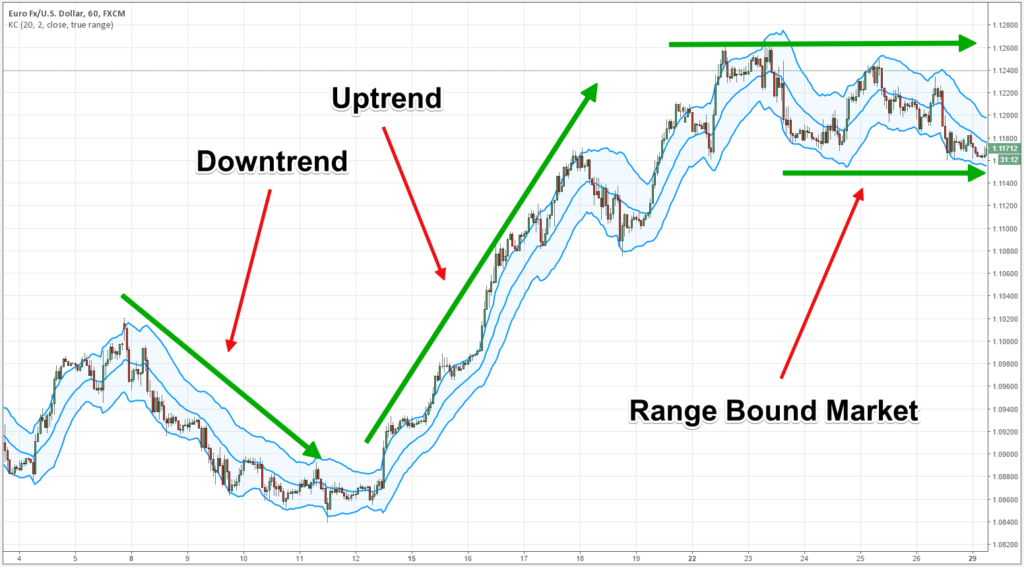

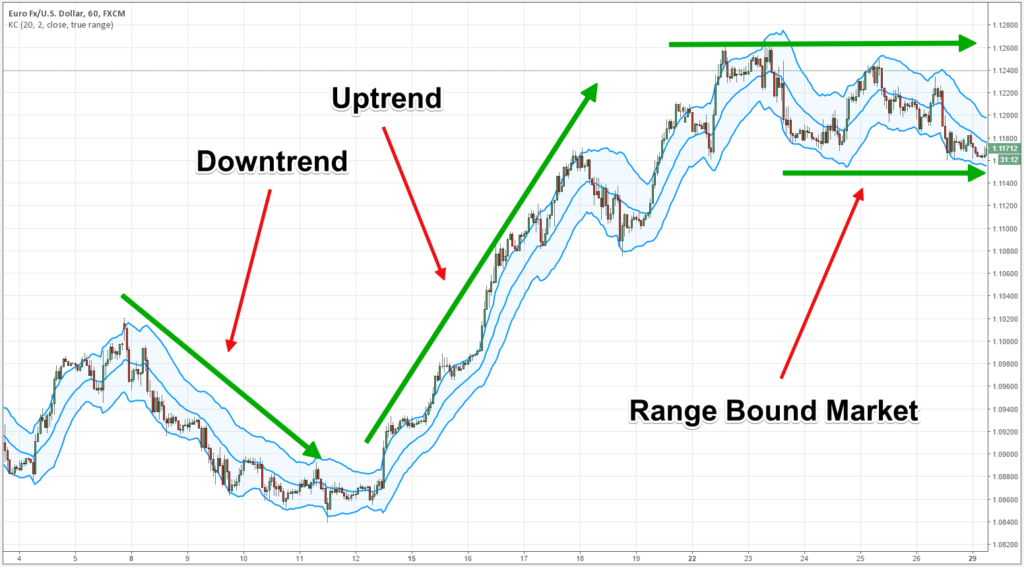

Keltner Channel ke signals ko interpret karna trader ke strategy aur timeframe ke mutabiq change ho sakta hai. Ek uptrend mein, traders price bounces ko lower channel line se potential buying opportunities ke tor par dekhte hain, considering ke ye level support offer karta hai prevailing trend direction ke saath indicated by the middle line. Contrarily, ek downtrend mein, traders upper channel line ko touches ya breaks ko potential shorting opportunities ke tor par dekh sakte hain, expecting a pullback from overbought conditions.

Keltner Channel Breakout Strategy

Ek popular trading strategy jo Keltner Channel ko involve karta hai, wo hai Keltner Channel Breakout strategy. Is strategy ka maqsad hai wo price movements ko capture karna jo channel ke boundaries ko break karte hain, signaling potential trend continuation ya reversal. Traders typically wait karte hain ek sustained breakout ke liye upper channel line ke upar ya lower channel line ke neeche, accompanied by increased volume aur momentum, to confirm the validity of the breakout signal.

Risk Management with Keltner Channel

Risk management trading mein bahut zaroori hai jab Keltner Channel ya koi bhi technical analysis tool ka istemal kiya jata hai. Traders ko stop-loss orders set karna chahiye aur unka risk-reward ratio define karna chahiye taake unka capital protect ho sake aur unki trading performance optimize ho sake. Additionally, Keltner Channel strategy ko historical data par backtest karna traders ko help karta hai taake wo iski effectiveness ko different market conditions ke neeche assess kar sakein aur empirical evidence ke base par apne approach ko refine kar sakein.

Keltner Channel ek versatile technical analysis tool hai jo traders ko valuable insights provide karta hai market ki volatality, trends, aur potential price reversals ke baare mein. Iska dynamic nature, adaptive bands, aur doosre indicators ke saath combination ise traders ke liye ek popular choice banata hai jo informed trading decisions lete hain aur opportunities ko capitalize karte hain financial markets ke dynamic duniya mein.

Keltner Channel ek aham technical analysis tool hai jo traders istemal karte hain taake market mein dakhil aur nikalne ke points ko pehchanein. Iska naam uske banane wale Chester Keltner ke naam par rakha gaya hai. Keltner Channel volatality ka concept istemal karta hai aur isme teen mukhya components hote hain: middle line, upper channel line, aur lower channel line. Traders aam tor par Keltner Channel ko apne trading strategies mein shamil karte hain taake market ki volatality, trends, aur potential price reversals ko samajh sakein.

Keltner Channel ka asal maqsad hai market ki volatality ko dekhte hue entry aur exit points ka pata lagana. Ismein middle line hoti hai jo aam tor par asset ki price ka ek simple moving average (SMA) hota hai ek mukarrar period ke doran. Period ke liye aam taur par 20, 50, ya 100 din ka chunaav hota hai, lekin traders is parameter ko apne trading style aur timeframe ke mutabiq adjust kar sakte hain. Middle line prevailing trend ka reference point ka kaam karti hai, jo dusre technical analysis tools mein SMA ke tor par hoti hai.

Calculation of Keltner Channel Lines

Keltner Channel ka upper channel line middle line mein ek multiple of the Average True Range (ATR) ko add karke calculate kiya jata hai. ATR market ki volatality ko measure karta hai ek mukarrar period ke doran. Ek multiple of the ATR ko middle line mein add karke, upper channel line expand aur contract hoti hai market ki volatality ke mutabiq. Zada multiple se wider bands hoti hain, jo zyada volatality ko indicate karte hain, jabki kam multiple se narrow bands hoti hain, jo kam volatality ko show karti hain.

Umbar se Keltner Channel ka lower channel line middle line mein ek multiple of the ATR ko subtract karke calculate kiya jata hai. Ye lower band traders ko potential support zone provide karta hai, kyun ke prices jo lower channel line ke qareeb aati hain ya usse touch karti hain, oversold conditions ya support levels se bounce hone ka indication deti hain.

Advantages of Keltner Channel

Keltner Channel ka ek main faida ye hai ke ye changing market conditions mein adapt ho sakta hai. Fixed-width bands jaise ke Bollinger Bands ke mukabil, Keltner Channel ke bands dynamically adjust hote hain market ki volatality ke mutabiq, jo price action ka ek zyada responsive view provide karta hai. Ye feature traders ke liye khaas faydemand hai jo short-term price movements aur volatality expansions par faida uthane ki koshish karte hain.

Using Keltner Channel in Trading Strategies

Traders aam tor par Keltner Channel ko doosre technical indicators ke saath combine karte hain taake trading signals ko validate karein aur potential entry aur exit points ko confirm karein. For example, kuch traders Keltner Channel ko momentum oscillators jaise ke Relative Strength Index (RSI) ya Moving Average Convergence Divergence (MACD) ke saath istemal karte hain taake overbought ya oversold conditions aur volatality levels ko assess karein.

Keltner Channel ke signals ko interpret karna trader ke strategy aur timeframe ke mutabiq change ho sakta hai. Ek uptrend mein, traders price bounces ko lower channel line se potential buying opportunities ke tor par dekhte hain, considering ke ye level support offer karta hai prevailing trend direction ke saath indicated by the middle line. Contrarily, ek downtrend mein, traders upper channel line ko touches ya breaks ko potential shorting opportunities ke tor par dekh sakte hain, expecting a pullback from overbought conditions.

Keltner Channel Breakout Strategy

Ek popular trading strategy jo Keltner Channel ko involve karta hai, wo hai Keltner Channel Breakout strategy. Is strategy ka maqsad hai wo price movements ko capture karna jo channel ke boundaries ko break karte hain, signaling potential trend continuation ya reversal. Traders typically wait karte hain ek sustained breakout ke liye upper channel line ke upar ya lower channel line ke neeche, accompanied by increased volume aur momentum, to confirm the validity of the breakout signal.

Risk Management with Keltner Channel

Risk management trading mein bahut zaroori hai jab Keltner Channel ya koi bhi technical analysis tool ka istemal kiya jata hai. Traders ko stop-loss orders set karna chahiye aur unka risk-reward ratio define karna chahiye taake unka capital protect ho sake aur unki trading performance optimize ho sake. Additionally, Keltner Channel strategy ko historical data par backtest karna traders ko help karta hai taake wo iski effectiveness ko different market conditions ke neeche assess kar sakein aur empirical evidence ke base par apne approach ko refine kar sakein.

Keltner Channel ek versatile technical analysis tool hai jo traders ko valuable insights provide karta hai market ki volatality, trends, aur potential price reversals ke baare mein. Iska dynamic nature, adaptive bands, aur doosre indicators ke saath combination ise traders ke liye ek popular choice banata hai jo informed trading decisions lete hain aur opportunities ko capitalize karte hain financial markets ke dynamic duniya mein.

تبصرہ

Расширенный режим Обычный режим