FALLING WINDOW PATTERN KIA HAI?

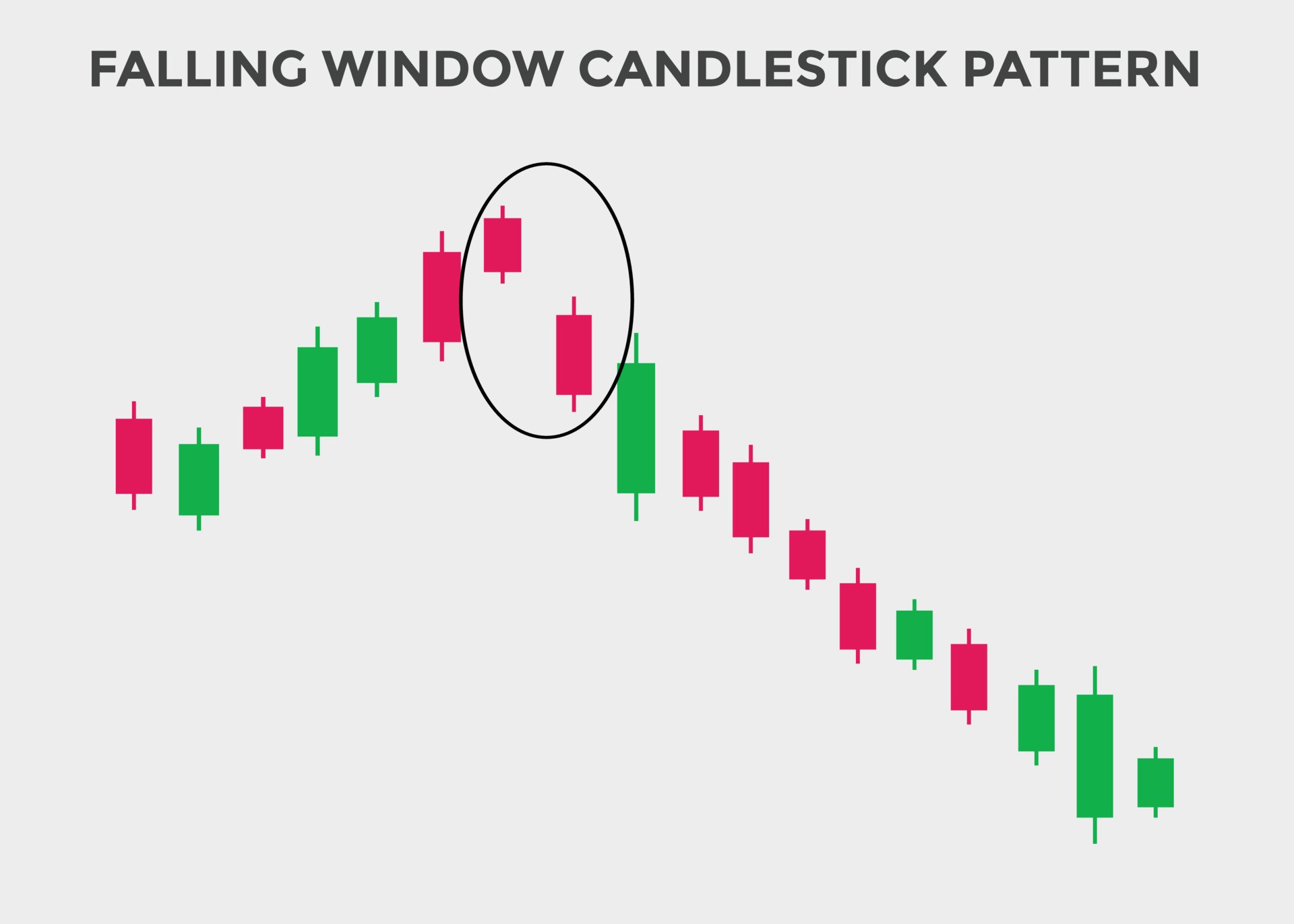

Forex mein, "Falling Window Pattern" ek mumkin candlestick pattern hai jo technical analysis mein istemal hota hai. Ye pattern ek bearish continuation pattern hai, jo market trend ke downward movement ko darust karta hai. Is pattern ko pehchan'na asani se hota hai aur traders isay market ke bearish momentum ko anticipate karne ke liye istemal karte hain.

Pattern Ki Pechan:

Falling Window Pattern ko dekhne ke liye, traders ko chart par ek gap dekhne ki zarurat hoti hai. Ye gap typically ek downward movement ke baad aata hai, jab ek candle ki closing price pehle candle ki opening price se neeche hoti hai. Is tarah ka gap market mein sudden selling pressure ya phir kisi event ki wajah se ho sakta hai.

Samajh Aur Tafsiliat:

Jab Falling Window Pattern dekha jata hai, traders market ke bearish momentum ko samajhte hain. Yeh pattern dikhaata hai ke sellers market ko control kar rahe hain aur prices neeche jaane ki tendency hai. Is pattern ke baad, traders bearish positions enter kar sakte hain ya phir existing positions ko strengthen kar sakte hain.

Trading Strategy:

Traders Falling Window Pattern ko apni trading strategy mein istemal karte hain. Jab ye pattern dekha jaata hai, traders sell positions enter kar sakte hain ya phir short positions ko strengthen kar sakte hain, expecting ke market ke downward trend continue hoga. Stop-loss orders lagana bhi important hota hai taake nuksan se bacha ja sake.

Conclusion:

Falling Window Pattern ek important bearish continuation pattern hai jo Forex trading mein istemal hota hai. Traders is pattern ko samajh kar market ke potential bearish movements ko anticipate kar sakte hain aur apni trading strategies ko improve kar sakte hain. Is pattern ko samajhne ke liye, traders ko candlestick charts par focus rakhna zaroori hai aur market ki movements ko closely monitor karna chahiye.

Forex mein, "Falling Window Pattern" ek mumkin candlestick pattern hai jo technical analysis mein istemal hota hai. Ye pattern ek bearish continuation pattern hai, jo market trend ke downward movement ko darust karta hai. Is pattern ko pehchan'na asani se hota hai aur traders isay market ke bearish momentum ko anticipate karne ke liye istemal karte hain.

Pattern Ki Pechan:

Falling Window Pattern ko dekhne ke liye, traders ko chart par ek gap dekhne ki zarurat hoti hai. Ye gap typically ek downward movement ke baad aata hai, jab ek candle ki closing price pehle candle ki opening price se neeche hoti hai. Is tarah ka gap market mein sudden selling pressure ya phir kisi event ki wajah se ho sakta hai.

Samajh Aur Tafsiliat:

Jab Falling Window Pattern dekha jata hai, traders market ke bearish momentum ko samajhte hain. Yeh pattern dikhaata hai ke sellers market ko control kar rahe hain aur prices neeche jaane ki tendency hai. Is pattern ke baad, traders bearish positions enter kar sakte hain ya phir existing positions ko strengthen kar sakte hain.

Trading Strategy:

Traders Falling Window Pattern ko apni trading strategy mein istemal karte hain. Jab ye pattern dekha jaata hai, traders sell positions enter kar sakte hain ya phir short positions ko strengthen kar sakte hain, expecting ke market ke downward trend continue hoga. Stop-loss orders lagana bhi important hota hai taake nuksan se bacha ja sake.

Conclusion:

Falling Window Pattern ek important bearish continuation pattern hai jo Forex trading mein istemal hota hai. Traders is pattern ko samajh kar market ke potential bearish movements ko anticipate kar sakte hain aur apni trading strategies ko improve kar sakte hain. Is pattern ko samajhne ke liye, traders ko candlestick charts par focus rakhna zaroori hai aur market ki movements ko closely monitor karna chahiye.

تبصرہ

Расширенный режим Обычный режим