Liquidity aur Volatility Trading

Forex market ka sabse important concept hai Liquidity aur Volatility. In dono hi factors ko samajhna bahut zaroori hai trading ke liye. Is article main hum in dono factors ke bare main roman urdu main baat karenge.

Liquidity:

Liquidity ka matlab hota hai ki market main kitni easily aur quickly buyers aur sellers available hai. Forex market ka liquidity level bahut high hota hai, kyunki yaha par daily $6 trillion ki trading volume hoti hai. Isliye, forex market main traders ko apni positions ko enter aur exit karne main koi problem nahi hoti hai.

Advantage

Liquidity ek bahut bada advantage hai forex trading ke liye. Yeh traders ko market main apne positions ko easily manage karne ki flexibility deta hai. Bina kisi slippage ke, traders apni positions ko enter aur exit kar sakte hai. Isliye, forex market main traders ko apni positions ko manage karne ke liye jyada time aur flexibility milta hai.

Volatility:

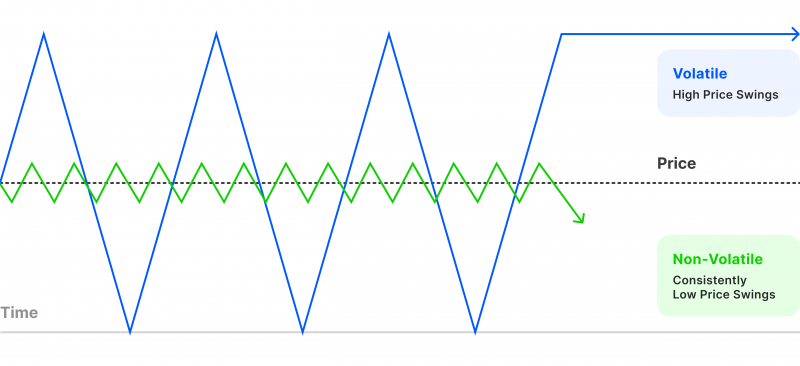

Volatility ka matlab hota hai ki market main kitni jyada fluctuations hai. Iska matlab hota hai ki kitna jyada price movement ho raha hai market main. Forex market main volatility level bahut high hota hai, kyunki yaha par bahut jyada economic events aur news release hote hai. Isliye, forex market main price movements bahut jyada hote hai.

Volatility ka ek bada advantage hai ki traders ko bahut jyada opportunities milte hai profit kamane ke liye. Isliye, traders ko market main apni positions ko easily manage karne ki flexibility milti hai. Bahut jyada volatility ke samay main, traders ko apni positions ko closely monitor karna chahiye, kyunki sudden price movements ke wajah se unki positions ko hit ho sakta hai.

Conclusion:

Liquidity aur volatility, dono hi factors bahut important hai trading ke liye. Forex market main, liquidity level bahut high hota hai, jisse traders ko apni positions ko easily manage karne ki flexibility milti hai. Volatility level bhi bahut high hota hai, jisse traders ko bahut jyada opportunities milte hai profit kamane ke liye. Agar traders in dono factors ko samajh lete hai, toh woh forex market main bahut acche results achieve kar sakte hai.

Forex market ka sabse important concept hai Liquidity aur Volatility. In dono hi factors ko samajhna bahut zaroori hai trading ke liye. Is article main hum in dono factors ke bare main roman urdu main baat karenge.

Liquidity:

Liquidity ka matlab hota hai ki market main kitni easily aur quickly buyers aur sellers available hai. Forex market ka liquidity level bahut high hota hai, kyunki yaha par daily $6 trillion ki trading volume hoti hai. Isliye, forex market main traders ko apni positions ko enter aur exit karne main koi problem nahi hoti hai.

Advantage

Liquidity ek bahut bada advantage hai forex trading ke liye. Yeh traders ko market main apne positions ko easily manage karne ki flexibility deta hai. Bina kisi slippage ke, traders apni positions ko enter aur exit kar sakte hai. Isliye, forex market main traders ko apni positions ko manage karne ke liye jyada time aur flexibility milta hai.

Volatility:

Volatility ka matlab hota hai ki market main kitni jyada fluctuations hai. Iska matlab hota hai ki kitna jyada price movement ho raha hai market main. Forex market main volatility level bahut high hota hai, kyunki yaha par bahut jyada economic events aur news release hote hai. Isliye, forex market main price movements bahut jyada hote hai.

Volatility ka ek bada advantage hai ki traders ko bahut jyada opportunities milte hai profit kamane ke liye. Isliye, traders ko market main apni positions ko easily manage karne ki flexibility milti hai. Bahut jyada volatility ke samay main, traders ko apni positions ko closely monitor karna chahiye, kyunki sudden price movements ke wajah se unki positions ko hit ho sakta hai.

Conclusion:

Liquidity aur volatility, dono hi factors bahut important hai trading ke liye. Forex market main, liquidity level bahut high hota hai, jisse traders ko apni positions ko easily manage karne ki flexibility milti hai. Volatility level bhi bahut high hota hai, jisse traders ko bahut jyada opportunities milte hai profit kamane ke liye. Agar traders in dono factors ko samajh lete hai, toh woh forex market main bahut acche results achieve kar sakte hai.

تبصرہ

Расширенный режим Обычный режим