Market retest entry trading mein ek strategy hai jo keh yeh shamil karta hai keh aap ek price level ka intezar kartay hain jo pehle se support ya resistance ke tor par kaam karta hai, phir jab woh level dobara test hota hai toh trade mein shamil hotay hain. Yeh approach is baat par mabni hai keh yeh levels market ki memory mein ahem hote hain aur jab woh dobara dekhe jate hain toh price behavior ko influence karte hain. Traders retests ka istemal support ya resistance ki taqat ko confirm karne aur trades ko favorable risk-reward ratios ke saath enter karne ke liye karte hain. Market retest ko identify aur trade karne ka ilm successful trading strategies ke liye zaroori hai.

Understanding Support and Resistance Levels

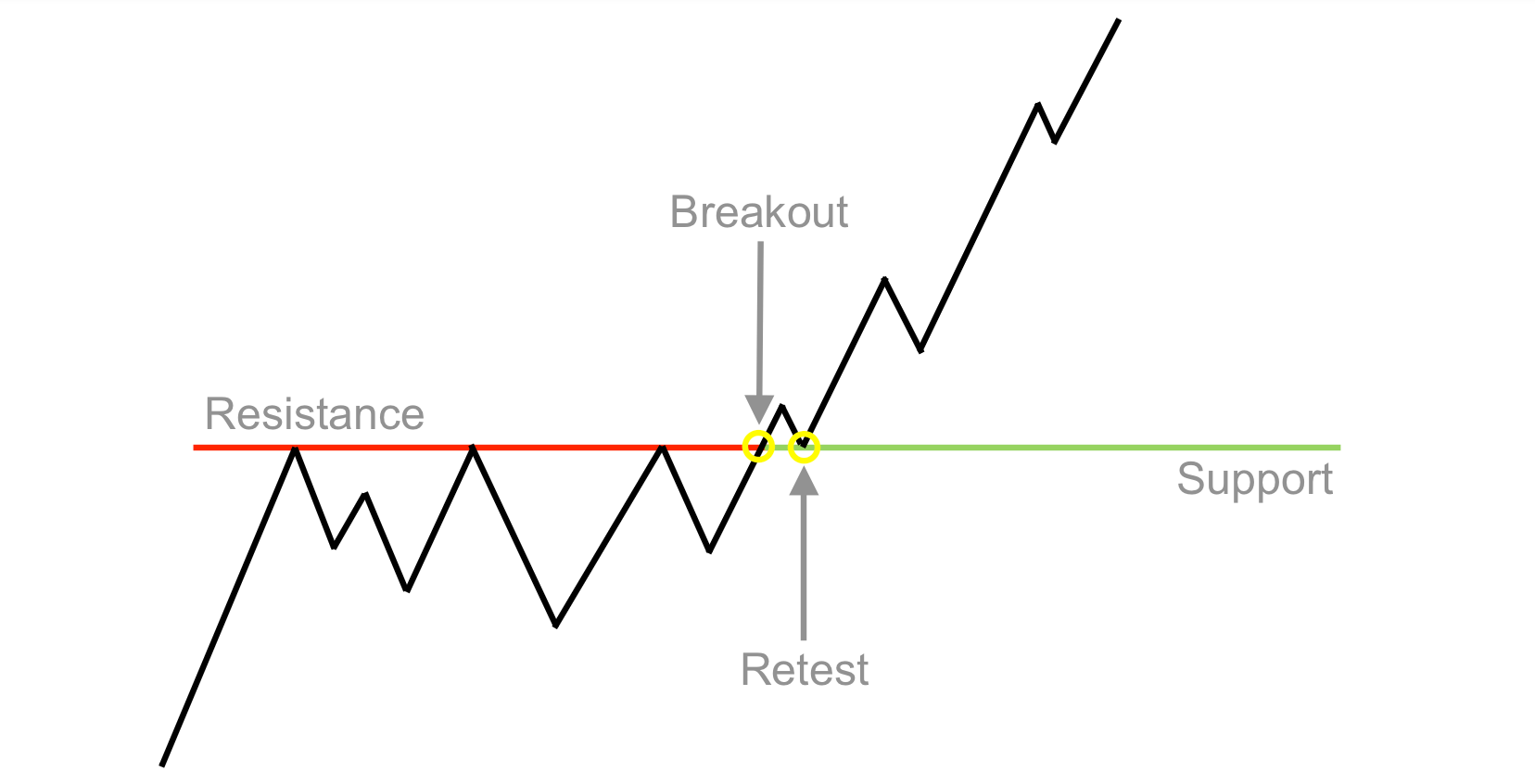

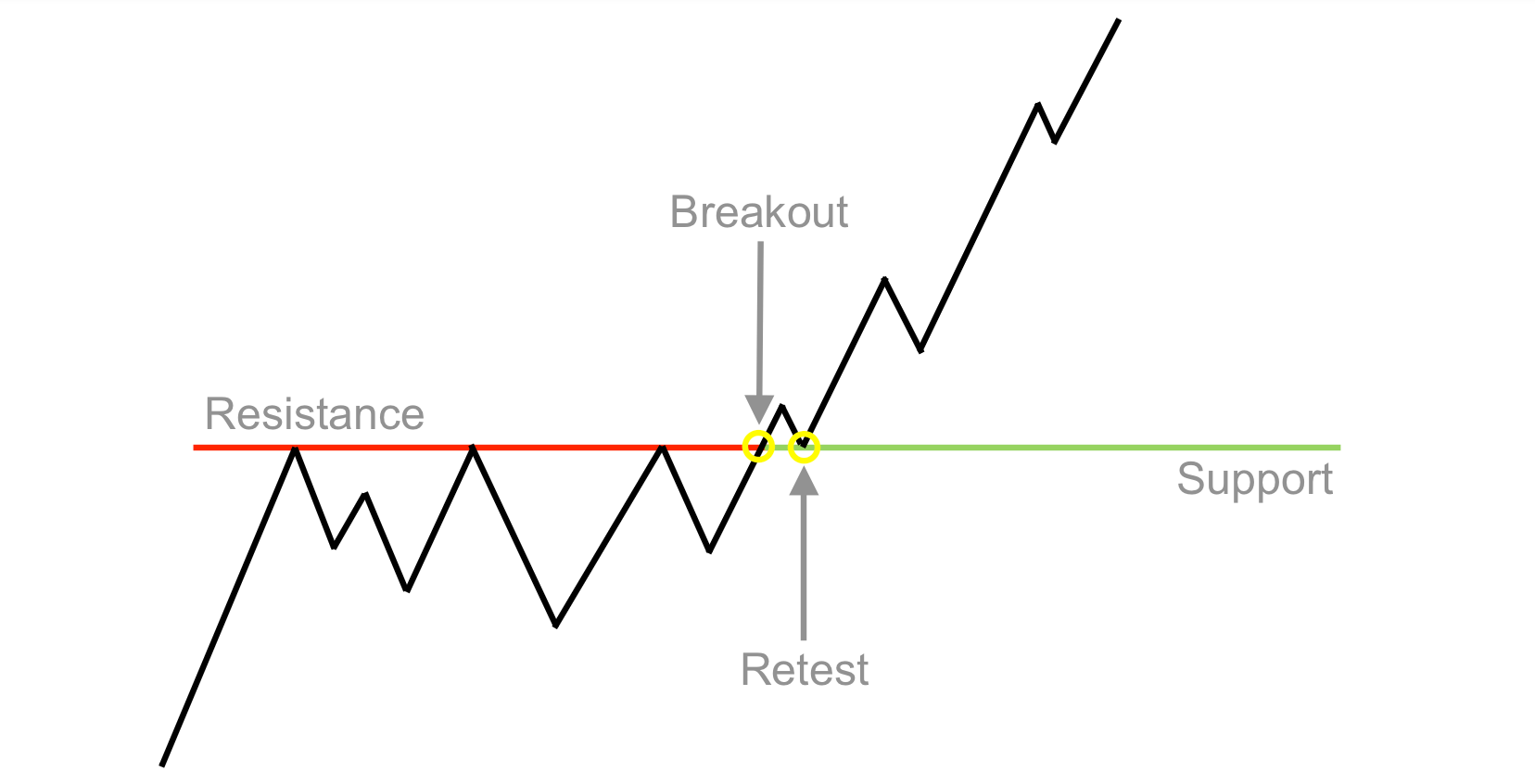

Market retest entry ka ek ahem concept hai support aur resistance levels ko samajhna. Support ek price level hai jahan buying interest itni strong hoti hai keh price ko mazeed girne se rok sakay. Yeh aksar ek downtrend ke baad hota hai aur asset ke liye ek potential turning point darust karta hai. Resistance, doosri taraf, ek price level hai jahan selling pressure itni strong hoti hai keh price ko mazeed barhne se rok sakay. Yeh aksar ek uptrend ke baad hota hai aur asset ke liye ek potential reversal ya consolidation phase darust karta hai.

Identifying Key Support and Resistance Levels

Jab market retests trade karte hain, traders areas ko dekhte hain jahan support ya resistance establish kiya gaya hai aur phir break hua hai. Yeh levels future price action ke liye key reference points ban jate hain. Retest tab hota hai jab price initial breakout ke baad inn levels ko dobara visit karta hai, traders ko breakout ki taqat ko assess karne aur market ke reaction ke basis par trades mein dakhil hone ka mauqa deta hai.

Technical Analysis Tools for Market Retests

Market retest entry effectively trade karne ke liye, traders aksar technical analysis tools ka istemal karte hain jaise trendlines, chart patterns, aur moving averages taakey key support aur resistance levels ko identify kar sakein. Trendlines ko draw kiya jata hai significant price points ko connect karke chart par, jaise uptrend ke liye swing lows ya downtrend ke liye swing highs. Yeh trendlines dynamic support ya resistance levels ka kaam karte hain jo price ko retest karta hai.

Chart patterns, jaise head and shoulders, double tops, aur triangles, bhi valuable insights provide karte hain potential support aur resistance levels ke liye. Breakouts in patterns ke baad jo retests hotay hain, woh high-probability trading opportunities provide karte hain. Moving averages, especially longer-term jaise 200-day moving average, strong support ya resistance zones ka kaam karte hain jo retests ke doran market participants ko attract karte hain.

Timing Market Retest Entries

Market retest entries ka timing trading success ke liye ahem hai. Traders aksar retest ka confirmation ka intezar karte hain, jaise ek candlestick pattern jo reversal signal karta hai ya phir bounce from the retest level. Common candlestick patterns jo retest entries mein use hotay hain woh hain bullish/bearish engulfing patterns, hammer/inverted hammer patterns, aur doji patterns. Yeh patterns, jab key levels ke sath combine hote hain, provide additional confirmation potential trade setups ke liye.

Risk Management in Market Retest Trading

Risk management trading market retests mein integral part hai. Traders ko apni risk tolerance define karni chahiye aur stop-loss orders set karna chahiye taakey potential losses ko limit kiya ja sake agar trade unke khilaf jaati hai. Stop-loss orders ko place kiya jata hai support levels ke neeche long trades ke liye aur resistance levels ke upar short trades ke liye, ensuring ke losses control mein rahein agar retest fail hota hai aur price reverse hoti hai.

Profit-Taking Strategies for Market Retests

Profit-taking strategies bhi ahem hain jab trading market retests karte hain. Traders Fibonacci extensions, pivot points, ya phir previous swing highs/lows ko potential targets ke tor par set kar sakte hain profits lene ke liye. Realistic profit targets set karke technical analysis aur market conditions ke basis par, traders gains lock kar sakte hain aur apni trades ko effectively manage kar sakte hain.

Market retest entries ko apply kiya ja sakta hai various trading styles mein, including swing trading, day trading, aur position trading. Swing traders daily ya weekly charts par key levels ke retests ko dekhte hain, multi-day price moves capture karne ke liye aim karte hain. Day traders intraday retests ko focus karte hain support ya resistance levels par, short-term price fluctuations ka faida uthate hue. Position traders longer-term view rakhte hain, monthly ya quarterly charts par retests ko dekhte hain major market trends ke basis par positions establish karne ke liye.

Psychological Factors in Market Retest Trading

Psychology trading market retests mein significant role play karta hai. Traders ko disciplined aur patient rehna chahiye, clear retest setups ke intezar mein jo strong confirmation signals ke saath ho. FOMO fear of missing out impulsive trades ko lead kar sakta hai jo proper analysis ke bina hoti hain aur losses ke risk ko increase karta hai. Ek systematic approach follow karke aur apne trading plan ko stick karke, traders emotional decision-making se bach sakte hain aur apni overall trading performance improve kar sakte hain.

Importance of Backtesting Market Retest Entry Strategies

Backtesting ko validate karne ke liye market retest entry strategies ke liye essential samjha jata hai. Traders historical price data ka use karke apne retest setups ko test kar sakte hain aur apni performance ko assess kar sakte hain over time. Past trades ko analyze karke, patterns ko identify karke, aur apne strategies ko accordingly adjust karke, traders apne edge ko trading market retests mein improve kar sakte hain.

Yeh yaad rakhna zaroori hai ke market conditions market retest entries ke effectiveness ko influence kar sakte hain. High volatility ya news events ke doran, retests zyada frequently aur zyada magnitude ke sath hotay hain, providing ample trading opportunities. Lekin low volatility ya choppy markets mein, retests reliable ho sakte hain, requiring traders ko apna approach aur risk management accordingly adjust karna padta hai. Market retest entry ek powerful trading strategy hai jo support aur resistance levels ko leverage karta hai high-probability trade setups identify karne ke liye. Traders jo retests ko identify karte hain, apne entries ka timing set karte hain, risk ko manage karte hain, aur profit-taking strategies execute karte hain, woh apni trading performance ko enhance kar sakte hain aur consistent profitability achieve kar sakte hain financial markets mein.

Understanding Support and Resistance Levels

Market retest entry ka ek ahem concept hai support aur resistance levels ko samajhna. Support ek price level hai jahan buying interest itni strong hoti hai keh price ko mazeed girne se rok sakay. Yeh aksar ek downtrend ke baad hota hai aur asset ke liye ek potential turning point darust karta hai. Resistance, doosri taraf, ek price level hai jahan selling pressure itni strong hoti hai keh price ko mazeed barhne se rok sakay. Yeh aksar ek uptrend ke baad hota hai aur asset ke liye ek potential reversal ya consolidation phase darust karta hai.

Identifying Key Support and Resistance Levels

Jab market retests trade karte hain, traders areas ko dekhte hain jahan support ya resistance establish kiya gaya hai aur phir break hua hai. Yeh levels future price action ke liye key reference points ban jate hain. Retest tab hota hai jab price initial breakout ke baad inn levels ko dobara visit karta hai, traders ko breakout ki taqat ko assess karne aur market ke reaction ke basis par trades mein dakhil hone ka mauqa deta hai.

Technical Analysis Tools for Market Retests

Market retest entry effectively trade karne ke liye, traders aksar technical analysis tools ka istemal karte hain jaise trendlines, chart patterns, aur moving averages taakey key support aur resistance levels ko identify kar sakein. Trendlines ko draw kiya jata hai significant price points ko connect karke chart par, jaise uptrend ke liye swing lows ya downtrend ke liye swing highs. Yeh trendlines dynamic support ya resistance levels ka kaam karte hain jo price ko retest karta hai.

Chart patterns, jaise head and shoulders, double tops, aur triangles, bhi valuable insights provide karte hain potential support aur resistance levels ke liye. Breakouts in patterns ke baad jo retests hotay hain, woh high-probability trading opportunities provide karte hain. Moving averages, especially longer-term jaise 200-day moving average, strong support ya resistance zones ka kaam karte hain jo retests ke doran market participants ko attract karte hain.

Timing Market Retest Entries

Market retest entries ka timing trading success ke liye ahem hai. Traders aksar retest ka confirmation ka intezar karte hain, jaise ek candlestick pattern jo reversal signal karta hai ya phir bounce from the retest level. Common candlestick patterns jo retest entries mein use hotay hain woh hain bullish/bearish engulfing patterns, hammer/inverted hammer patterns, aur doji patterns. Yeh patterns, jab key levels ke sath combine hote hain, provide additional confirmation potential trade setups ke liye.

Risk Management in Market Retest Trading

Risk management trading market retests mein integral part hai. Traders ko apni risk tolerance define karni chahiye aur stop-loss orders set karna chahiye taakey potential losses ko limit kiya ja sake agar trade unke khilaf jaati hai. Stop-loss orders ko place kiya jata hai support levels ke neeche long trades ke liye aur resistance levels ke upar short trades ke liye, ensuring ke losses control mein rahein agar retest fail hota hai aur price reverse hoti hai.

Profit-Taking Strategies for Market Retests

Profit-taking strategies bhi ahem hain jab trading market retests karte hain. Traders Fibonacci extensions, pivot points, ya phir previous swing highs/lows ko potential targets ke tor par set kar sakte hain profits lene ke liye. Realistic profit targets set karke technical analysis aur market conditions ke basis par, traders gains lock kar sakte hain aur apni trades ko effectively manage kar sakte hain.

Market retest entries ko apply kiya ja sakta hai various trading styles mein, including swing trading, day trading, aur position trading. Swing traders daily ya weekly charts par key levels ke retests ko dekhte hain, multi-day price moves capture karne ke liye aim karte hain. Day traders intraday retests ko focus karte hain support ya resistance levels par, short-term price fluctuations ka faida uthate hue. Position traders longer-term view rakhte hain, monthly ya quarterly charts par retests ko dekhte hain major market trends ke basis par positions establish karne ke liye.

Psychological Factors in Market Retest Trading

Psychology trading market retests mein significant role play karta hai. Traders ko disciplined aur patient rehna chahiye, clear retest setups ke intezar mein jo strong confirmation signals ke saath ho. FOMO fear of missing out impulsive trades ko lead kar sakta hai jo proper analysis ke bina hoti hain aur losses ke risk ko increase karta hai. Ek systematic approach follow karke aur apne trading plan ko stick karke, traders emotional decision-making se bach sakte hain aur apni overall trading performance improve kar sakte hain.

Importance of Backtesting Market Retest Entry Strategies

Backtesting ko validate karne ke liye market retest entry strategies ke liye essential samjha jata hai. Traders historical price data ka use karke apne retest setups ko test kar sakte hain aur apni performance ko assess kar sakte hain over time. Past trades ko analyze karke, patterns ko identify karke, aur apne strategies ko accordingly adjust karke, traders apne edge ko trading market retests mein improve kar sakte hain.

Yeh yaad rakhna zaroori hai ke market conditions market retest entries ke effectiveness ko influence kar sakte hain. High volatility ya news events ke doran, retests zyada frequently aur zyada magnitude ke sath hotay hain, providing ample trading opportunities. Lekin low volatility ya choppy markets mein, retests reliable ho sakte hain, requiring traders ko apna approach aur risk management accordingly adjust karna padta hai. Market retest entry ek powerful trading strategy hai jo support aur resistance levels ko leverage karta hai high-probability trade setups identify karne ke liye. Traders jo retests ko identify karte hain, apne entries ka timing set karte hain, risk ko manage karte hain, aur profit-taking strategies execute karte hain, woh apni trading performance ko enhance kar sakte hain aur consistent profitability achieve kar sakte hain financial markets mein.

تبصرہ

Расширенный режим Обычный режим