Pending Order Strategy

zair-e iltiwa order ki hikmat e amli forex traders ke darmiyan khasi maqboliat haasil kar chuki hai. yeh sorat e haal kaam ke aisay gُr ki aala muaser pazeeri ke baais peda hui jo market ke shrikِ car se nafsiati dabao ko kam karti aur qeemat mein taiz raftaar utaar charhao ki sorat e haal mein munafe bakhash muahiday kholti hai. is hikmat e amli ki madad se, forex trading se honay wala munafe kayi gina barh sakta hai. usay nah sirf naye anay walay, balkay pesha warana mahireen bhi trading ki muaser pazeeri mein izafay ke liye istemaal kar saktay hain .

How to effectively use the pending order strategy

apne kaam mein is hikmat e amli ke durust istemaal ke liye, aap ko aisi qeemat ka taayun karna chahiye jo order ki takmeel, khasare ke tadaraq aur munafa ke husool ke options aur order ke arsa mojoodgi ka sabab banay .

lehaza, zair-e iltiwa order ki hikmat e amli darj zail iqdamaat ki takmeel par mabni hoti hai :

dakhla points ka taayun. un ka taayun karne ke kayi tareeqay hain. aik tareeqa ibtidayi dakhla points ka taayun karna hai. is ke liye, tridr ko bunyadi qeemat ki ziyada se ziyada aur kam se kam had ki nishandahi karna hogi, jis par pounchanay ke baad, yeh rujhan mumkina tor par apni harkat jari rakhay ga .

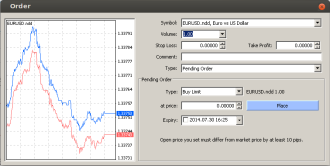

pending-order-type-en.webp

agar qeemat kuch waqt ke liye qeemat ke aik zariye mein harkat kere, to tridr kisi aik simt mein khlal ki tawaqqa ke sath order ke pemanay muratab karsaktha hai. baaz auqaat ziraltwa orders is umeed ke sath rakhna maqool hota hai ke muawnat ya muzahmat ke amal mein khlal waqay hoga .

is ke ilawa, kharidari ki had aur farokht ki had ke orders dena bhi mumkin hai. inhen is tawaqqa par diya jata hai ke qeemat kisi makhsoos nuqtay par aaye gi, jahan kharidari ki had ke liye qeemat mojooda qeemat se kam hogi, aur farokht ki had ke liye buland tar hogi, aur mojooda rujhan ki simt mein chali jaye gi. zair-e iltiwa orders ki kharidari ke tadaruk ke liye, yeh tawaqqa ki jati hai ke taizi ki soorat mein qeemat musalsal harkat kere gi, yani qeemat mein izafah hoga. farokht ke tadaruk ke liye har cheez is ke bar aks hogi, mandi ki soorat mein qeemat ko musalsal harkat karna hogi aur uss satah ki janib mazeed kami aana hogi jis par order diya ja raha hai .

agla tareeqa khabron ka istemaal hai. tridr ko paishgi tor par barri khabar ke ajra ke waqt aur mojooda qeemat ke muqablay mein ziyada ya kam qeemat par order dainay ka ilm hona chahiye. khabar ki tasdeeq ke baad, yeh rujhan apni harkat jari rakhay گا؛ bsortِ deegar mukhalif simt mein harkat Pazeer hojaye ga. dono sooraton mein, order ki takmeel amal mein aaye gi .

khasaray ke tadaruk ka order dena. yeh order tridr ki trading hikmat e amli aur raqam ke intizam o insramke baad diya jata hai .

munafe ke husool ka order dena. is ka pemana tridr ke azaim aur makhsoos currency ke ishtiraaki jore ki mojooda market sorat e haal par munhasir hota hai. aap ko mumkina munafe ke hajam aur rujhan ki mukhalif simt mein harkat ke imkaan ka andaza lagana chahiye .

karobari arsae hayat ka order karna. bayan kardah hikmat e amli ka yeh pehlu bunyadi ahmiyat ka haamil hai. aap ko tridr ki janib se muratab kardah paimaanon par zair-e iltiwa order ki takmeel ke liye is ki muddat-e ekhtataam ka taayun karna hoga. bsortِ deegar, order ko tridr ki trading hikmat e amli par injaam nahi diya jasakay ga .

aisi hi millti jalti barikion ko zair-e ghhor lakar, yeh seekhna mumkin hai ke zair-e iltiwa order ki hikmat e amli ko muaser tor par kaisay istemaal kya jaye aur forex trading ke nataij mein kionkar izafah kya jaye

zair-e iltiwa order ki hikmat e amli forex traders ke darmiyan khasi maqboliat haasil kar chuki hai. yeh sorat e haal kaam ke aisay gُr ki aala muaser pazeeri ke baais peda hui jo market ke shrikِ car se nafsiati dabao ko kam karti aur qeemat mein taiz raftaar utaar charhao ki sorat e haal mein munafe bakhash muahiday kholti hai. is hikmat e amli ki madad se, forex trading se honay wala munafe kayi gina barh sakta hai. usay nah sirf naye anay walay, balkay pesha warana mahireen bhi trading ki muaser pazeeri mein izafay ke liye istemaal kar saktay hain .

How to effectively use the pending order strategy

apne kaam mein is hikmat e amli ke durust istemaal ke liye, aap ko aisi qeemat ka taayun karna chahiye jo order ki takmeel, khasare ke tadaraq aur munafa ke husool ke options aur order ke arsa mojoodgi ka sabab banay .

lehaza, zair-e iltiwa order ki hikmat e amli darj zail iqdamaat ki takmeel par mabni hoti hai :

dakhla points ka taayun. un ka taayun karne ke kayi tareeqay hain. aik tareeqa ibtidayi dakhla points ka taayun karna hai. is ke liye, tridr ko bunyadi qeemat ki ziyada se ziyada aur kam se kam had ki nishandahi karna hogi, jis par pounchanay ke baad, yeh rujhan mumkina tor par apni harkat jari rakhay ga .

pending-order-type-en.webp

agar qeemat kuch waqt ke liye qeemat ke aik zariye mein harkat kere, to tridr kisi aik simt mein khlal ki tawaqqa ke sath order ke pemanay muratab karsaktha hai. baaz auqaat ziraltwa orders is umeed ke sath rakhna maqool hota hai ke muawnat ya muzahmat ke amal mein khlal waqay hoga .

is ke ilawa, kharidari ki had aur farokht ki had ke orders dena bhi mumkin hai. inhen is tawaqqa par diya jata hai ke qeemat kisi makhsoos nuqtay par aaye gi, jahan kharidari ki had ke liye qeemat mojooda qeemat se kam hogi, aur farokht ki had ke liye buland tar hogi, aur mojooda rujhan ki simt mein chali jaye gi. zair-e iltiwa orders ki kharidari ke tadaruk ke liye, yeh tawaqqa ki jati hai ke taizi ki soorat mein qeemat musalsal harkat kere gi, yani qeemat mein izafah hoga. farokht ke tadaruk ke liye har cheez is ke bar aks hogi, mandi ki soorat mein qeemat ko musalsal harkat karna hogi aur uss satah ki janib mazeed kami aana hogi jis par order diya ja raha hai .

agla tareeqa khabron ka istemaal hai. tridr ko paishgi tor par barri khabar ke ajra ke waqt aur mojooda qeemat ke muqablay mein ziyada ya kam qeemat par order dainay ka ilm hona chahiye. khabar ki tasdeeq ke baad, yeh rujhan apni harkat jari rakhay گا؛ bsortِ deegar mukhalif simt mein harkat Pazeer hojaye ga. dono sooraton mein, order ki takmeel amal mein aaye gi .

khasaray ke tadaruk ka order dena. yeh order tridr ki trading hikmat e amli aur raqam ke intizam o insramke baad diya jata hai .

munafe ke husool ka order dena. is ka pemana tridr ke azaim aur makhsoos currency ke ishtiraaki jore ki mojooda market sorat e haal par munhasir hota hai. aap ko mumkina munafe ke hajam aur rujhan ki mukhalif simt mein harkat ke imkaan ka andaza lagana chahiye .

karobari arsae hayat ka order karna. bayan kardah hikmat e amli ka yeh pehlu bunyadi ahmiyat ka haamil hai. aap ko tridr ki janib se muratab kardah paimaanon par zair-e iltiwa order ki takmeel ke liye is ki muddat-e ekhtataam ka taayun karna hoga. bsortِ deegar, order ko tridr ki trading hikmat e amli par injaam nahi diya jasakay ga .

aisi hi millti jalti barikion ko zair-e ghhor lakar, yeh seekhna mumkin hai ke zair-e iltiwa order ki hikmat e amli ko muaser tor par kaisay istemaal kya jaye aur forex trading ke nataij mein kionkar izafah kya jaye

تبصرہ

Расширенный режим Обычный режим