Introduction to Commodity Channel Index (CCI)

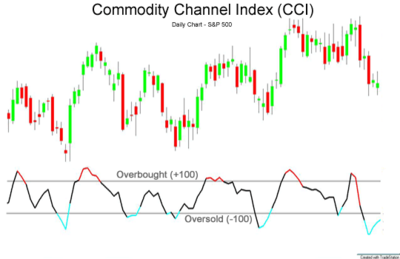

Commodity Channel Index (CCI) ek popular technical analysis indicator hai jo traders ke liye istemal hota hai taake wo potential changes in price direction, overbought or oversold conditions, aur fashion ki power ko identify kar sakein. Donald Lambert ne overdue Nineteen Seventies esulting CCI values primary line ke ird gird vary karte hain, jo ke normally 0 par set ki jati hai, aur indicate karte hain ke asset apni common charge ke upar ya area of interest change kar raha hai. Positive CCI values suggest karte hain ke asset ka rate apni average ke upar hai, jo ke potential overbought situations ko imply karte hain, jabke terrible values yeh display karte hain ke price apni average ke niche hai, jo ke oversold situations ko advocate karte hain. Traders frequently severe CCI readings, jaise ke values above +100 ya under -one hundred, ko capacity indicators ke tor par dekhte hain jo overextended rate movements ko signal kar sakte hain jo ek reversal ke pehle indicator ho sakte hain. Isko increase kiya tha aur CCI ne diverse financial markets mein, jaise ke shares, commodities, currencies, aur cryptocurrencies, mein sizable use hasil ki hai. Iski versatility aur simplicity se yeh amateur aur experienced investors dono ke liye ek precious device hai.

Calculation Formula and Core Concept

Commodity Channel Index ka core idea hai ke yeh asset ka cutting-edge charge, uska transferring common, aur uska standard deviation degree karta hai. CCI ko calculate karne ka formula kuch steps ko contain karta hai. Sabse pehle, standard charge (TP) calculate kiya jata hai, jo ke asset ka excessive, low, aur close fees ka average hota hai ek unique duration ke dauran, Despite its effectiveness, Commodity Channel Index ki boundaries hain aur yeh false signals ya whipsaws se immune nahi hai, mainly choppy ya variety-sure markets mein. Jaise ke koi bhi technical indicator, CCI tab pleasant kaam karta hai jab ise dusre gear aur analysis techniques ke saath use kiya jaye ek complete trading strategy ke hisab se. Aur traders ko CCI ka inherent lagging nature ka bhi dhyan rakhna chahiye, jo ke yeh suggest karta hai ke alerts price flow begin hone ke baad in place of uske pehle ho sakte hain.

Overbought aur oversold conditions ko discover karne ke ilawa, Commodity Channel Index ko purchase aur promote signals generate karne ke liye bhi use kiya ja sakta hai. Ek commonplace approach yeh hai ke CCI aur asset ke price ke darmiyan divergences ko dekha jaye. Bullish divergence tab hoti hai jab rate ek new low banata hai, lekin CCI ek higher low shape karta hai, jo ke weakening promoting strain ko indicate karta hai aur ek ability reversal ko signal karta hai. Oppositely, bearish divergence tab hoti hai jab charge ek new excessive banata hai, lekin CCI ek decrease high shape karta hai, jo ke waning buying momentum ko signal karta hai aur ek feasible downturn ko suggest karta hai. Generally 20 durations istemal hoti hai. Next, traditional prices ka easy shifting common (SMA) bhi same duration ke liye calculate kiya jata hai. Phir, suggest absolute deviationCCI indicator ki calculation mukhtalif steps par mabni hoti hai. Sab se pehle, ek mukhtalif waqt ke liye common fee calculate kiya jata hai, jo typically 20 intervals ke liye hota hai. Phir, is average price se present day fee ko subtract kiya jata hai. Uske baad, ek steady issue se is difference ko multiply kiya jata hai, jo volatility ko regulate karta hai. Final step mein, is result ka ek moving common calculate kiya jata hai. Is system ke natije mein CCI ka very last value nikalta h (MAD) ko calculate kiya jata hai taake typical charges ka transferring average se variability measure ho sake. CCI ko phir derive kiya jata hai typical fee aur transferring average ke beech ka difference ko mean absolute deviation ka more than one divide karke.

Commodity Channel Index (CCI) ek popular technical analysis indicator hai jo traders ke liye istemal hota hai taake wo potential changes in price direction, overbought or oversold conditions, aur fashion ki power ko identify kar sakein. Donald Lambert ne overdue Nineteen Seventies esulting CCI values primary line ke ird gird vary karte hain, jo ke normally 0 par set ki jati hai, aur indicate karte hain ke asset apni common charge ke upar ya area of interest change kar raha hai. Positive CCI values suggest karte hain ke asset ka rate apni average ke upar hai, jo ke potential overbought situations ko imply karte hain, jabke terrible values yeh display karte hain ke price apni average ke niche hai, jo ke oversold situations ko advocate karte hain. Traders frequently severe CCI readings, jaise ke values above +100 ya under -one hundred, ko capacity indicators ke tor par dekhte hain jo overextended rate movements ko signal kar sakte hain jo ek reversal ke pehle indicator ho sakte hain. Isko increase kiya tha aur CCI ne diverse financial markets mein, jaise ke shares, commodities, currencies, aur cryptocurrencies, mein sizable use hasil ki hai. Iski versatility aur simplicity se yeh amateur aur experienced investors dono ke liye ek precious device hai.

Calculation Formula and Core Concept

Commodity Channel Index ka core idea hai ke yeh asset ka cutting-edge charge, uska transferring common, aur uska standard deviation degree karta hai. CCI ko calculate karne ka formula kuch steps ko contain karta hai. Sabse pehle, standard charge (TP) calculate kiya jata hai, jo ke asset ka excessive, low, aur close fees ka average hota hai ek unique duration ke dauran, Despite its effectiveness, Commodity Channel Index ki boundaries hain aur yeh false signals ya whipsaws se immune nahi hai, mainly choppy ya variety-sure markets mein. Jaise ke koi bhi technical indicator, CCI tab pleasant kaam karta hai jab ise dusre gear aur analysis techniques ke saath use kiya jaye ek complete trading strategy ke hisab se. Aur traders ko CCI ka inherent lagging nature ka bhi dhyan rakhna chahiye, jo ke yeh suggest karta hai ke alerts price flow begin hone ke baad in place of uske pehle ho sakte hain.

Overbought aur oversold conditions ko discover karne ke ilawa, Commodity Channel Index ko purchase aur promote signals generate karne ke liye bhi use kiya ja sakta hai. Ek commonplace approach yeh hai ke CCI aur asset ke price ke darmiyan divergences ko dekha jaye. Bullish divergence tab hoti hai jab rate ek new low banata hai, lekin CCI ek higher low shape karta hai, jo ke weakening promoting strain ko indicate karta hai aur ek ability reversal ko signal karta hai. Oppositely, bearish divergence tab hoti hai jab charge ek new excessive banata hai, lekin CCI ek decrease high shape karta hai, jo ke waning buying momentum ko signal karta hai aur ek feasible downturn ko suggest karta hai. Generally 20 durations istemal hoti hai. Next, traditional prices ka easy shifting common (SMA) bhi same duration ke liye calculate kiya jata hai. Phir, suggest absolute deviationCCI indicator ki calculation mukhtalif steps par mabni hoti hai. Sab se pehle, ek mukhtalif waqt ke liye common fee calculate kiya jata hai, jo typically 20 intervals ke liye hota hai. Phir, is average price se present day fee ko subtract kiya jata hai. Uske baad, ek steady issue se is difference ko multiply kiya jata hai, jo volatility ko regulate karta hai. Final step mein, is result ka ek moving common calculate kiya jata hai. Is system ke natije mein CCI ka very last value nikalta h (MAD) ko calculate kiya jata hai taake typical charges ka transferring average se variability measure ho sake. CCI ko phir derive kiya jata hai typical fee aur transferring average ke beech ka difference ko mean absolute deviation ka more than one divide karke.

تبصرہ

Расширенный режим Обычный режим