Forex trading ek aham maamla hai jo aksar logon ke liye samajhna mushkil ho sakta hai, khaaskar jab baat overbought aur oversold ki hoti hai. Yeh concepts trading mein istemal hone wale technical indicators hain jo market ke behaviour ko samajhne mein madadgar sabit ho sakte hain. Is essay mein, hum dekheinge ke overbought aur oversold kya hota hai aur kaise traders in concepts ka istemal karte hain forex trading mein.

Overbought aur Oversold ka Matlab:

Overbought aur oversold terms hote hain jo market ke price level ko describe karte hain. Overbought ka matlab hota hai ke ek particular asset ka price itna high ho gaya hai ke traders expect karte hain ke iska price ab neeche aane wala hai. Jabki oversold ka matlab hota hai ke ek asset ka price itna low ho gaya hai ke traders expect karte hain ke iska price ab upar jaane wala hai.

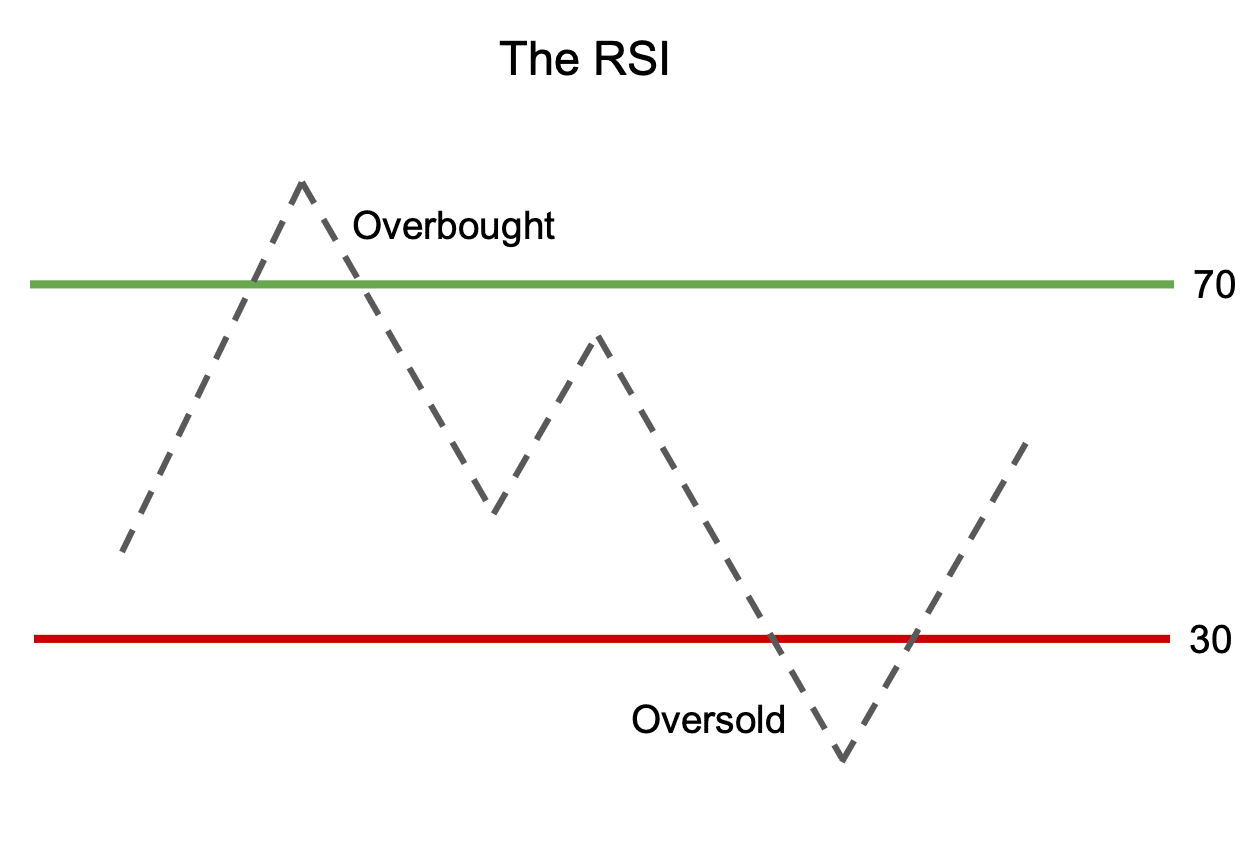

In terms ko samajhne ke liye, ek common indicator hai Relative Strength Index (RSI). RSI ek momentum oscillator hai jo asset ka overbought aur oversold levels ko measure karta hai. Jab RSI 70 ke upar chala jata hai, toh yeh indicate karta hai ke asset overbought ho sakta hai aur jab RSI 30 ke neeche jaata hai, toh yeh indicate karta hai ke asset oversold ho sakta hai.

Overbought aur Oversold ke Trading Strategies:

Overbought aur oversold levels ko samajh kar traders different strategies ka istemal karte hain. Overbought market mein, traders selling ya short positions lete hain expecting ke price ab neeche aayega. Oversold market mein, traders buying ya long positions lete hain expecting ke price ab upar jaayega.

Ek common strategy hai "mean reversion", jisme traders assume karte hain ke agar ek asset ka price overbought ya oversold ho gaya hai, toh uska price wapis mean value ke paas aayega. Is strategy mein traders price ke reversals ke liye wait karte hain aur phir opposite direction mein trades lete hain.

Conclusion:

Overbought aur oversold levels ko samajhna forex trading mein aham hai kyunki yeh traders ko market ke potential reversals aur price movements ke baare mein insight dete hain. Lekin, yeh indicators alone decision making mein istemal nahi kiye jaate; traders ko technical analysis ke saath fundamental analysis aur risk management ko bhi consider karna chahiye. Overall, overbought aur oversold concepts traders ko market dynamics ko samajhne mein madad karte hain aur efficient trading strategies develop karne mein help karte hain.

Overbought aur Oversold ka Matlab:

Overbought aur oversold terms hote hain jo market ke price level ko describe karte hain. Overbought ka matlab hota hai ke ek particular asset ka price itna high ho gaya hai ke traders expect karte hain ke iska price ab neeche aane wala hai. Jabki oversold ka matlab hota hai ke ek asset ka price itna low ho gaya hai ke traders expect karte hain ke iska price ab upar jaane wala hai.

In terms ko samajhne ke liye, ek common indicator hai Relative Strength Index (RSI). RSI ek momentum oscillator hai jo asset ka overbought aur oversold levels ko measure karta hai. Jab RSI 70 ke upar chala jata hai, toh yeh indicate karta hai ke asset overbought ho sakta hai aur jab RSI 30 ke neeche jaata hai, toh yeh indicate karta hai ke asset oversold ho sakta hai.

Overbought aur Oversold ke Trading Strategies:

Overbought aur oversold levels ko samajh kar traders different strategies ka istemal karte hain. Overbought market mein, traders selling ya short positions lete hain expecting ke price ab neeche aayega. Oversold market mein, traders buying ya long positions lete hain expecting ke price ab upar jaayega.

Ek common strategy hai "mean reversion", jisme traders assume karte hain ke agar ek asset ka price overbought ya oversold ho gaya hai, toh uska price wapis mean value ke paas aayega. Is strategy mein traders price ke reversals ke liye wait karte hain aur phir opposite direction mein trades lete hain.

Conclusion:

Overbought aur oversold levels ko samajhna forex trading mein aham hai kyunki yeh traders ko market ke potential reversals aur price movements ke baare mein insight dete hain. Lekin, yeh indicators alone decision making mein istemal nahi kiye jaate; traders ko technical analysis ke saath fundamental analysis aur risk management ko bhi consider karna chahiye. Overall, overbought aur oversold concepts traders ko market dynamics ko samajhne mein madad karte hain aur efficient trading strategies develop karne mein help karte hain.

تبصرہ

Расширенный режим Обычный режим