Forex spot rate kya hai aur yeh kaisay kaam karta hai?

forex spot rate currency trading ki duniya mein aik bunyadi tasawwur hai, jo taajiron aur sarmaya karon ke liye yaksaa ahmiyat rakhta hai. is ke bunyadi tor par, forex spot rate, jisay aksar sirf" spot rate" kaha jata hai, fori tarseel ya tasfia ke liye do krnsyon ke darmiyan mojooda sharah mubadla ki numaindagi karta hai. yeh woh sharah hai jis par mojooda waqt mein aik currency ko doosri currency mein tabdeel kya ja sakta hai, aur yeh woh bunyaad banata hai jis par poori forex market kaam karti hai .

taajiron ke liye, bakhabar faislay karne ke liye forex spot rate ko samjhna aur is ki qareeb se nigrani karna bohat zaroori hai. spot rats mein tabdeeli currency ki tijarat ke munafe par gehra assar daal sakti hai, jis se taajiron ke liye yeh zaroori ho jata hai ke woh un rats ko mutasir karne walay awamil ko samjhain aur un se un ke faiday ke liye kaisay faida uthaya ja sakta hai .

Understanding Forex Spot Rates

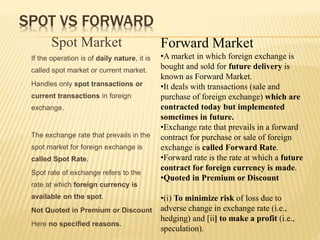

forex spot rate, jisay aksar sirf" spot rate" kaha jata hai, aik currency ki doosri currency ke fori tabadlay ya tarseel ke liye kisi khaas lamhay par murawaja sharah mubadla hai. yeh woh sharah hai jis par spot market mein krnsyon ki tijarat hoti hai, jis ka matlab hai ke lain deen do karobari dinon mein tay pa jata hai. forex spot rate frwd rate ke bilkul bar aks hai, jahan krnsyon ka tabadlah mustaqbil ki aik makhsoos tareekh par hota hai, aam tor par pehlay se mutayyan sharah mubadla ke sath .

forex spot rate ke tasawwur ki sadiiyon purani tareekh hai. maazi mein, is ka taayun bunyadi tor par makhsoos maqamat par krnsyon ke jismani tabadlay se hota tha, aksar maliyati marakaz ke qareeb. taham, jadeed forex market takneeki taraqqi ke sath numaya tor par tayyar hui hai. aalmi satah par fori currency ke tabadlay ki sahoolat faraham karte hue electronic tijarti plate forms mamool ban chuke hain. is irtiqa ne rasai aur likoyditi mein izafah kya hai, jis se tamam size ke afraad aur idaron ke liye forex market mein hissa lena mumkin ho gaya hai .

Factors Affecting Forex Spot Rates

forex spot rats bunyadi tor par talabb aur rasad ki quwatoon se tashkeel paate hain. usool seedha hai : jab kisi currency ki talabb is ki supply se ziyada ho jati hai, to is ki qader aam tor par barh jati hai, jis se spot rate mein izafah hota hai. is ke bar aks, agar kisi currency ki supply maang se barh jati hai, to is ki qader mein kami waqay hoti hai, jis ki wajah se spot rate kam hota hai. yeh harkiyaat mutadid awamil se mutasir hoti hain, Bashmole tijarti tawazun, sarmaye ka bahao, geographiyai siyasi waqeat, aur market ke jazbaat .

iqtisadi isharay aur khabron ke waqeat forex spot rate ko mutasir karne mein ahem kirdaar ada karte hain. gdp ke adaad o shumaar, rozgaar ki reports, afraat zar ke adaad o shumaar, aur sharah sood mein tabdeeli jaisay elanaat currency ki qadron par fori aur kaafi assar daal satke hain. tajir iqtisadi calendar ki qareeb se nigrani karte hain taakay yeh andaza lagaya ja sakay ke is terhan ki release un krnsyon ke spot rate par kis terhan assar andaaz ho sakti hain jin ki woh tijarat karte hain. ghair mutawaqqa ya ahem khabron ke waqeat, Bashmole geographiyai siyasi paish Raft ya qudrati afaat, bhi spot rate mein taiz raftaar aur khatir khuwa harkat ko mutharrak kar satke hain .

markazi bank apni monitory policion ke zariye apni mutaliqa krnsyon ke spot rate par kaafi assar o rasookh rakhtay hain. sharah sood, raqam ki farahmi, aur ghair mulki zar e mubadla ki manndi mein mudakhlat se mutaliq faislay currency ki qader ko mutasir kar satke hain. misaal ke tor par, markazi bank ki sharah sood mein izafah ghair mulki sarmaye ki aamad ko Raghib kar sakta hai, currency ki maang mein izafah aur spot rate ko barha sakta hai. is ke bar aks, markazi bank ki mdakhlton ko iqtisadi halaat ke jawab mein currency ki qader ko mustahkam karne ya is mein heera pheri ke liye ya makhsoos policy maqasid ke husool ke liye istemaal kya ja sakta hai

forex spot rate currency trading ki duniya mein aik bunyadi tasawwur hai, jo taajiron aur sarmaya karon ke liye yaksaa ahmiyat rakhta hai. is ke bunyadi tor par, forex spot rate, jisay aksar sirf" spot rate" kaha jata hai, fori tarseel ya tasfia ke liye do krnsyon ke darmiyan mojooda sharah mubadla ki numaindagi karta hai. yeh woh sharah hai jis par mojooda waqt mein aik currency ko doosri currency mein tabdeel kya ja sakta hai, aur yeh woh bunyaad banata hai jis par poori forex market kaam karti hai .

taajiron ke liye, bakhabar faislay karne ke liye forex spot rate ko samjhna aur is ki qareeb se nigrani karna bohat zaroori hai. spot rats mein tabdeeli currency ki tijarat ke munafe par gehra assar daal sakti hai, jis se taajiron ke liye yeh zaroori ho jata hai ke woh un rats ko mutasir karne walay awamil ko samjhain aur un se un ke faiday ke liye kaisay faida uthaya ja sakta hai .

Understanding Forex Spot Rates

forex spot rate, jisay aksar sirf" spot rate" kaha jata hai, aik currency ki doosri currency ke fori tabadlay ya tarseel ke liye kisi khaas lamhay par murawaja sharah mubadla hai. yeh woh sharah hai jis par spot market mein krnsyon ki tijarat hoti hai, jis ka matlab hai ke lain deen do karobari dinon mein tay pa jata hai. forex spot rate frwd rate ke bilkul bar aks hai, jahan krnsyon ka tabadlah mustaqbil ki aik makhsoos tareekh par hota hai, aam tor par pehlay se mutayyan sharah mubadla ke sath .

forex spot rate ke tasawwur ki sadiiyon purani tareekh hai. maazi mein, is ka taayun bunyadi tor par makhsoos maqamat par krnsyon ke jismani tabadlay se hota tha, aksar maliyati marakaz ke qareeb. taham, jadeed forex market takneeki taraqqi ke sath numaya tor par tayyar hui hai. aalmi satah par fori currency ke tabadlay ki sahoolat faraham karte hue electronic tijarti plate forms mamool ban chuke hain. is irtiqa ne rasai aur likoyditi mein izafah kya hai, jis se tamam size ke afraad aur idaron ke liye forex market mein hissa lena mumkin ho gaya hai .

Factors Affecting Forex Spot Rates

forex spot rats bunyadi tor par talabb aur rasad ki quwatoon se tashkeel paate hain. usool seedha hai : jab kisi currency ki talabb is ki supply se ziyada ho jati hai, to is ki qader aam tor par barh jati hai, jis se spot rate mein izafah hota hai. is ke bar aks, agar kisi currency ki supply maang se barh jati hai, to is ki qader mein kami waqay hoti hai, jis ki wajah se spot rate kam hota hai. yeh harkiyaat mutadid awamil se mutasir hoti hain, Bashmole tijarti tawazun, sarmaye ka bahao, geographiyai siyasi waqeat, aur market ke jazbaat .

iqtisadi isharay aur khabron ke waqeat forex spot rate ko mutasir karne mein ahem kirdaar ada karte hain. gdp ke adaad o shumaar, rozgaar ki reports, afraat zar ke adaad o shumaar, aur sharah sood mein tabdeeli jaisay elanaat currency ki qadron par fori aur kaafi assar daal satke hain. tajir iqtisadi calendar ki qareeb se nigrani karte hain taakay yeh andaza lagaya ja sakay ke is terhan ki release un krnsyon ke spot rate par kis terhan assar andaaz ho sakti hain jin ki woh tijarat karte hain. ghair mutawaqqa ya ahem khabron ke waqeat, Bashmole geographiyai siyasi paish Raft ya qudrati afaat, bhi spot rate mein taiz raftaar aur khatir khuwa harkat ko mutharrak kar satke hain .

markazi bank apni monitory policion ke zariye apni mutaliqa krnsyon ke spot rate par kaafi assar o rasookh rakhtay hain. sharah sood, raqam ki farahmi, aur ghair mulki zar e mubadla ki manndi mein mudakhlat se mutaliq faislay currency ki qader ko mutasir kar satke hain. misaal ke tor par, markazi bank ki sharah sood mein izafah ghair mulki sarmaye ki aamad ko Raghib kar sakta hai, currency ki maang mein izafah aur spot rate ko barha sakta hai. is ke bar aks, markazi bank ki mdakhlton ko iqtisadi halaat ke jawab mein currency ki qader ko mustahkam karne ya is mein heera pheri ke liye ya makhsoos policy maqasid ke husool ke liye istemaal kya ja sakta hai

تبصرہ

Расширенный режим Обычный режим