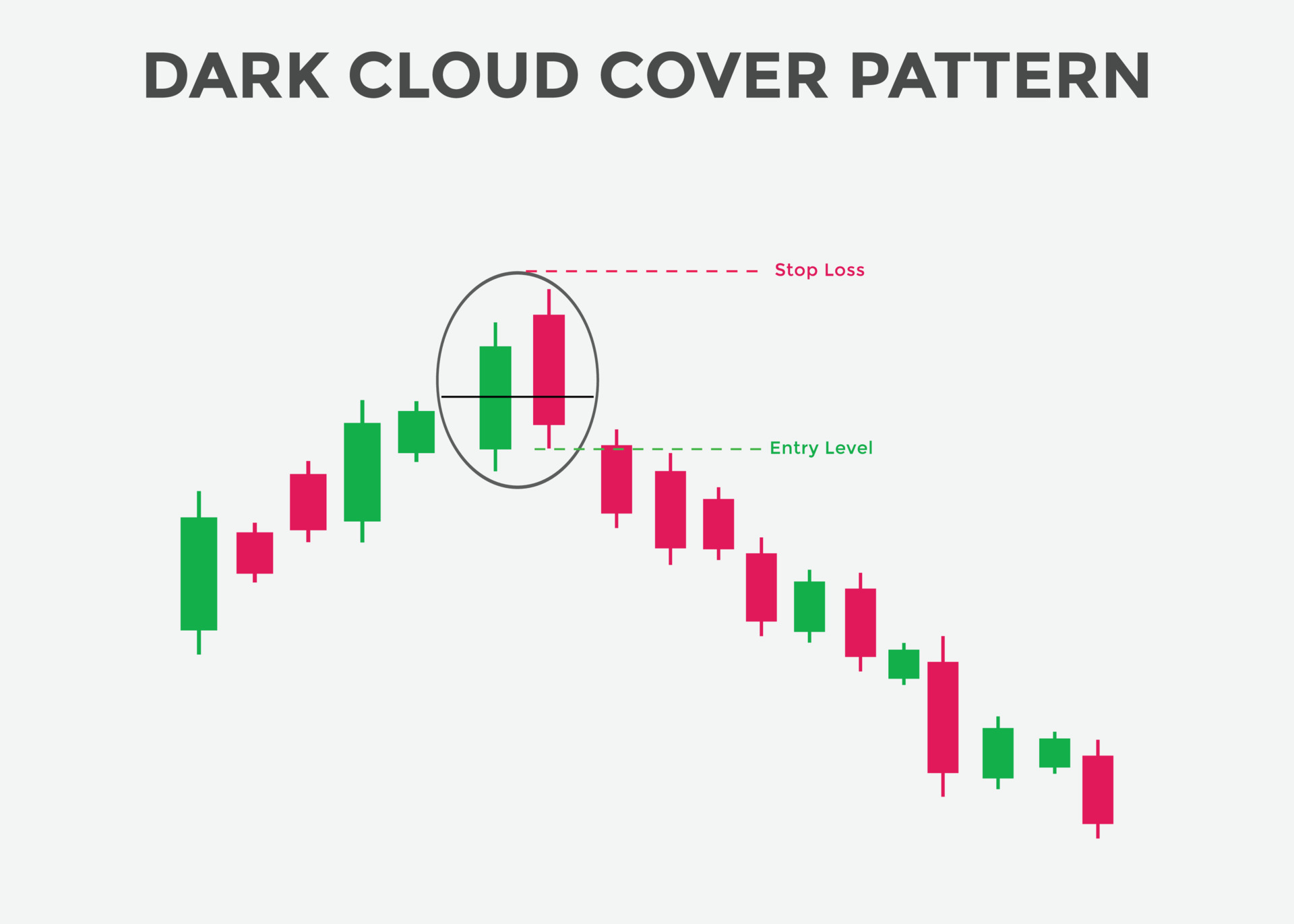

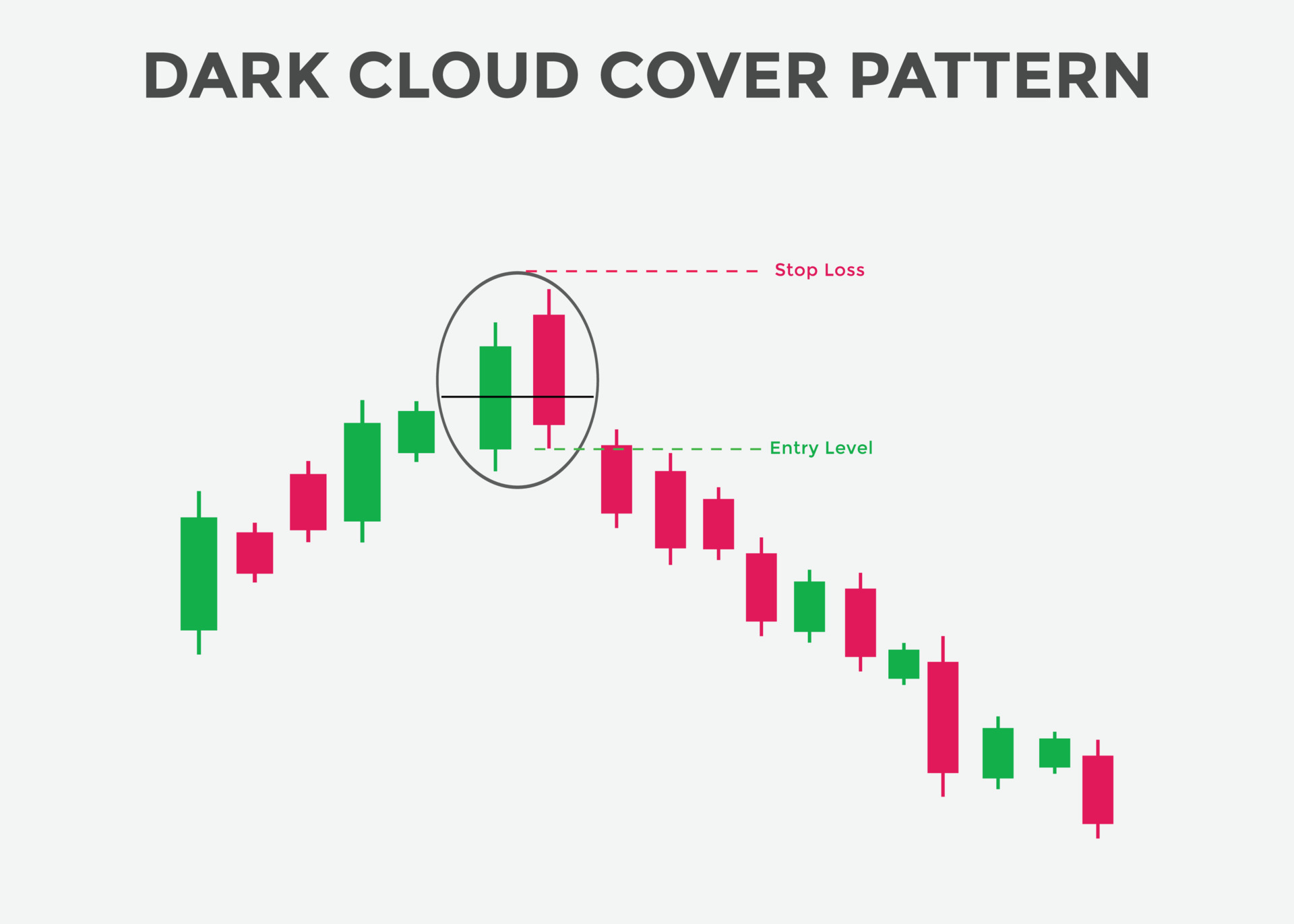

Dark Cloud Cover pattern trading mein aik ahem candlestick pattern hai jo uptrend mein mukhtalif palton ki pehchan ke liye istemal hota hai. Ye pattern do candles se bana hota hai: pehli candle bara bullish candle hoti hai, phir dusri candle jo bearish hoti hai aur pehli candle ke high se ziada open hoti hai lekin pehli candle ke body ke darmiyan close hoti hai. Dark Cloud Cover pattern bullish se bearish momentum ka tajziya karta hai aur ye traders ke liye ek warning sign hota hai jo kisi khaas asset par long hain.

Dark Cloud Cover pattern ko mazeed samajhne ke liye, iske components ko tod kar dekhte hain aur dekhte hain ke traders is pattern ko kaise samjhte hain aur apne analysis mein kaise istemal karte hain.

Dark Cloud Cover pattern traders ke liye ek ahem tool hai jo uptrends mein potential reversals ko identify karne mein madad karta hai. Magar jaise har technical analysis tool, isko bhi doosray indicators aur analysis methods ke saath istemal karna chahiye zyada sahi aur reliable trading decisions ke liye. Traders ko risk management strategies aur backtesting bhi consider karna chahiye Dark Cloud Cover pattern ke effectiveness ko validate karne ke liye apne trading approach mein.

Dark Cloud Cover pattern ko mazeed samajhne ke liye, iske components ko tod kar dekhte hain aur dekhte hain ke traders is pattern ko kaise samjhte hain aur apne analysis mein kaise istemal karte hain.

- Formation of the Dark Cloud Cover Pattern

- Dark Cloud Cover pattern ka pehla candle strong bullish candle hoti hai, jo strong buying pressure aur bullish sentiment ko darust karti hai market mein.

- Dusri candle pehli candle ke high se ziada open hoti hai, jo ek potential uptrend ka continuation darust karti hai.

- Magar dusri candle pehli candle ke body ke darmiyan close hoti hai, jo keh raha hai ke bearish momentum ka izhar ho raha hai jab sellers price ko neeche push kar rahe hain.

- Key Characteristics

- Dark Cloud Cover pattern ka dusra candle ahem hota hai kyunki ye strong bullish move ke baad selling pressure ka izhar karta hai.

- Dusri candle ka open up gap ko traders market mein dakhil hone aur control lenay ka mouqa samajhte hain.

- Dusri candle ka close pehli candle ke body ke darmiyan neeche suggest karta hai ke bears ne price ko neeche push karna shuru kar diya hai, jo ke potential reversal ya kam az kam uptrend mein thamna ka signal hota hai.

- Confirmation and Trading Strategies

- Traders typically Dark Cloud Cover pattern ko tasdeeq karne ke liye confirmation signals dhoondhte hain. Ye lower highs ya dusri bearish candlestick patterns shamil kar sakti hain jo Dark Cloud Cover pattern ke baad banti hain.

- Kuch traders next candle ka wait karte hain takay reversal ko tasdeeq kar sakein pehle action lene se pehle, jab ke doosray traders Dark Cloud Cover pattern ke baad hi short positions enter karte hain.

- Stop-loss orders Dark Cloud Cover pattern ke istemal mein zaroori hain risk ko manage karne ke liye agar market expected tarah se reverse na ho.

- Limitations and Considerations:

- Jaise ke har technical analysis pattern, Dark Cloud Cover pattern bhi foolproof nahi hai aur kabhi kabhi false signals produce kar sakta hai. Zaroori hai ke traders doosray technical indicators aur market conditions ko samjhein trading decisions lene se pehle Dark Cloud Cover pattern ke alawa.

- Dark Cloud Cover pattern ka asar alag alag time frames aur financial instruments par mukhtalif ho sakta hai. Traders ko apne trading strategies mein Dark Cloud Cover pattern ko shamil karne se pehle iska performance backtest aur validation karna chahiye.

- Examples and Interpretations:

- Chaliye ek misal samjhte hain: Ek strong uptrend mein, Dark Cloud Cover pattern ek series of bullish candles ke baad banta hai. Ye pattern darust karta hai ke bullish momentum kamzor ho sakta hai aur potential reversal ya correction ho sakta hai.

- Traders jo asset par long hain wo Dark Cloud Cover pattern ko signal samajh kar ya toh profits lena shuru karte hain, stop-loss orders ko tight karte hain, ya phir agar wo yakeen rakhte hain ke trend reverse hone wala hai toh short positions enter karte hain.

Dark Cloud Cover pattern traders ke liye ek ahem tool hai jo uptrends mein potential reversals ko identify karne mein madad karta hai. Magar jaise har technical analysis tool, isko bhi doosray indicators aur analysis methods ke saath istemal karna chahiye zyada sahi aur reliable trading decisions ke liye. Traders ko risk management strategies aur backtesting bhi consider karna chahiye Dark Cloud Cover pattern ke effectiveness ko validate karne ke liye apne trading approach mein.

تبصرہ

Расширенный режим Обычный режим