Knowledge about doji candlestick pattern

Assalam o Alaikum Dear Friends and Fellows market me doji candle design se sign aor bearing me change ho raha ho to us time ye pata chal jata hy to us waja se market me ye candle design banta hy to us me inversion ki sign hoti hy. Aisy candle design ko dekh k murmur ais market me exchange laga sakty hein kun k ye designs reverasal ka signal dy rahy hoty hy aor aisy designs ko find karna bahot asan hota hy. Aisi candle ko asani k sath wick dekh k murmur find kar sakty hein ais ki different types hy jin ko murmur dekh k ais market me exchange kar sakty hein.

1. Star Doji Light

Dear Friends Star doji candles k upper aur lower sides standard same shadow hota hy, jiss ki genuine body nahi hoti hy. Light ki open aur close cost aik jaisi hoti hy. Flame primary costs na to bahot ziadda up jati hy aur na howdy bahot ziadda descending, bulkeh mamuli si up aur ussi tarrah se descending jane k bad wapis appne open point pe close hoti hy. Is light ka nishan in addition to ki tarah boycott jata hy.

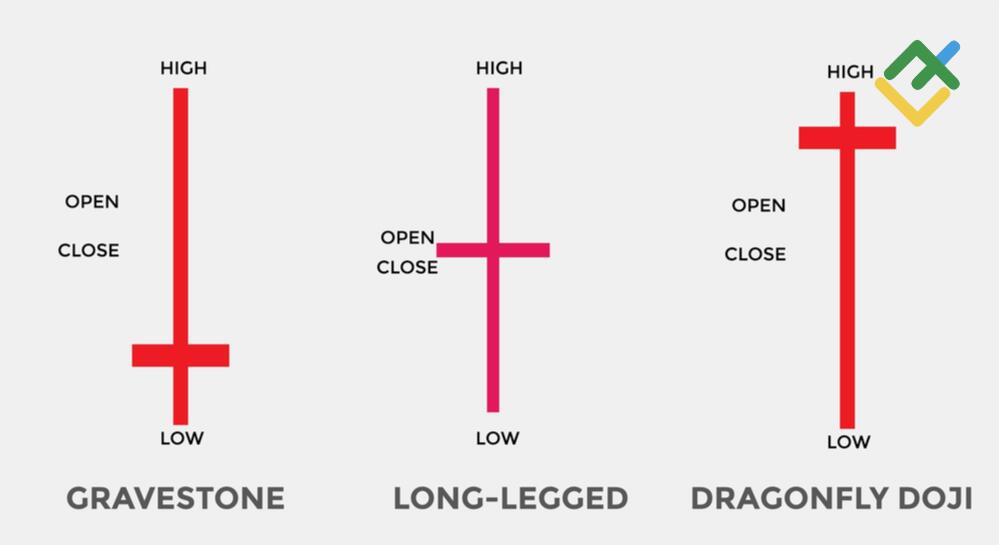

2. Long-legged Doji Light

Bhaiyo Long-legged light dekhny me fundamental star doji flame ki tarah hy, lekin iss candle k upper aur lower sides standard shadow bahot ziyada hota hy. Iss flame primary costs upper aur lower sides standard aik bara shadow (wicks) bannany k bad apnni opening cost pe close ho jati hy. Doji candle ki iss qisam ko "Cart man" doji candle bhi kaha jata hy.

3. Tombstone Doji Candle

Dear Fellows Tombstone doji candle "Qabar" k pathar jaise plan ka hota hy, jo k dragonfly doji light k inverse side standard banti hy. Headstone doji flame purchasers pressure ki wajja se costs up jane k bad wapis bear pressure se ussi point standard bannd ho jati hy. Headstone doji light ko dealers ziadda tar negative flame tasawar karte hen, aggar ye candle top cost ya bullish pattern primary banti hy, iss waja se ye candle bullish candle tasawar hoti hy.

4. Dragonfly Doji Candle

Dosto Dragonfly doji candle tombstone doji light k inverse bearing fundamental banti hy, jo k venders ki drawback development ko brief ta2ar standard oddball karti hy. Dragonfly doji market principal bullish pattern inversion ka kam karti hy, lekin uss k leye zarrori hy, k costs negative pattern fundamental hon. Dragonfly doji ki design k mutabbeq hit bhi bear cost ko nechay ki tarraf push karne k bad us standard control barqarrar nahi rakh pate aur bull costs ko wapis up dakhel deti hen. Negative pattern ya low costs principal banne ki waja se ye candle merchants ko purchase ka signals deta hy.

5. Four Value Doji Candle

Friends Four Value Doji Candle k nam k mutabiq candle principal open, close, high aur low costs ki position same hoti hy. Ye light dekhne principal maths k image "- " se melti julti hy. Four cost doji light me costs up aur descending janne ki bajjaye ek hello there position pe munjamed ya stuck rehti hy. Jiss se ye candle aik line si banti hy. Four cost doji market principal purchasers aur merchants donno ki adam tawajah ya moist market ki waja se banti hy. Ya baz agents ki taraf se market fundamental costs ka close sharpen ki waja se ye light banti hy.

Assalam o Alaikum Dear Friends and Fellows market me doji candle design se sign aor bearing me change ho raha ho to us time ye pata chal jata hy to us waja se market me ye candle design banta hy to us me inversion ki sign hoti hy. Aisy candle design ko dekh k murmur ais market me exchange laga sakty hein kun k ye designs reverasal ka signal dy rahy hoty hy aor aisy designs ko find karna bahot asan hota hy. Aisi candle ko asani k sath wick dekh k murmur find kar sakty hein ais ki different types hy jin ko murmur dekh k ais market me exchange kar sakty hein.

1. Star Doji Light

Dear Friends Star doji candles k upper aur lower sides standard same shadow hota hy, jiss ki genuine body nahi hoti hy. Light ki open aur close cost aik jaisi hoti hy. Flame primary costs na to bahot ziadda up jati hy aur na howdy bahot ziadda descending, bulkeh mamuli si up aur ussi tarrah se descending jane k bad wapis appne open point pe close hoti hy. Is light ka nishan in addition to ki tarah boycott jata hy.

2. Long-legged Doji Light

Bhaiyo Long-legged light dekhny me fundamental star doji flame ki tarah hy, lekin iss candle k upper aur lower sides standard shadow bahot ziyada hota hy. Iss flame primary costs upper aur lower sides standard aik bara shadow (wicks) bannany k bad apnni opening cost pe close ho jati hy. Doji candle ki iss qisam ko "Cart man" doji candle bhi kaha jata hy.

3. Tombstone Doji Candle

Dear Fellows Tombstone doji candle "Qabar" k pathar jaise plan ka hota hy, jo k dragonfly doji light k inverse side standard banti hy. Headstone doji flame purchasers pressure ki wajja se costs up jane k bad wapis bear pressure se ussi point standard bannd ho jati hy. Headstone doji light ko dealers ziadda tar negative flame tasawar karte hen, aggar ye candle top cost ya bullish pattern primary banti hy, iss waja se ye candle bullish candle tasawar hoti hy.

4. Dragonfly Doji Candle

Dosto Dragonfly doji candle tombstone doji light k inverse bearing fundamental banti hy, jo k venders ki drawback development ko brief ta2ar standard oddball karti hy. Dragonfly doji market principal bullish pattern inversion ka kam karti hy, lekin uss k leye zarrori hy, k costs negative pattern fundamental hon. Dragonfly doji ki design k mutabbeq hit bhi bear cost ko nechay ki tarraf push karne k bad us standard control barqarrar nahi rakh pate aur bull costs ko wapis up dakhel deti hen. Negative pattern ya low costs principal banne ki waja se ye candle merchants ko purchase ka signals deta hy.

5. Four Value Doji Candle

Friends Four Value Doji Candle k nam k mutabiq candle principal open, close, high aur low costs ki position same hoti hy. Ye light dekhne principal maths k image "- " se melti julti hy. Four cost doji light me costs up aur descending janne ki bajjaye ek hello there position pe munjamed ya stuck rehti hy. Jiss se ye candle aik line si banti hy. Four cost doji market principal purchasers aur merchants donno ki adam tawajah ya moist market ki waja se banti hy. Ya baz agents ki taraf se market fundamental costs ka close sharpen ki waja se ye light banti hy.

:max_bytes(150000):strip_icc():format(webp)/DojiDefinition-efc3ba7213db4200a0a69f354369960b.png)

تبصرہ

Расширенный режим Обычный режим