Golden Cross aur Death Cross trading mein do ahem technical analysis patterns hain jo traders istemal karte hain taakey market trends mein mumkinah tabdeeliyon ko pehchanein. Yeh patterns do moving averages ke crossover par mabni hoti hain, aam tor par 50-day moving average (MA) aur 200-day moving average. In patterns ko samajhna traders ko madad karta hai taa'ke woh assets ko kharidne ya bechne ke faislay mein behtar raay rakhein.

Golden Cross

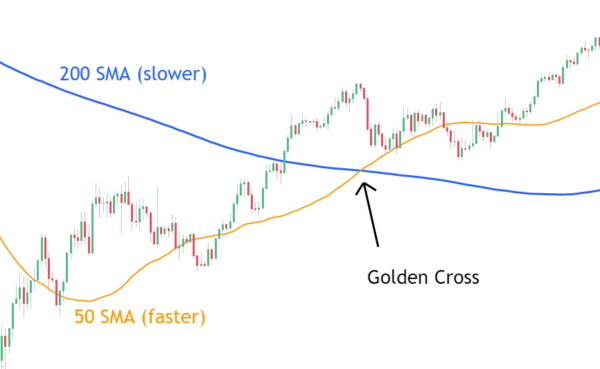

Golden Cross ek bullish technical signal hai jo tab paida hota hai jab short-term moving average long-term moving average se ooper jaata hai. Ziyadatar cases mein, traders 50-day moving average ko 200-day moving average ke ooper jaate hue Golden Cross signal ke tor par dekhte hain. Yeh crossover ek momentum shift ko darust karta hai bearish se bullish ki taraf, jo ek mumkinah uptrend ko dikhata hai market mein.

Traders Golden Cross ko ek mazboot bullish trend ki tasdeeq samajhte hain. Isse market sentiment mein ek significant tabdeeli ka izhaar hota hai, jahan buying pressure selling pressure ko peechay chhod deti hai. Issi wajah se, traders long positions kholne ya apni assets ke exposure ko barhane ka tajurba karte hain, mazeed price ki izafa ki umeed ke saath.

Lekin yeh zaroori hai ke yeh yaad rakha jaye ke Golden Cross hamesha kaamyaab nahi hota aur kabhi kabhi false positives bhi deta hai. Traders ko is pattern ki tasdeeq ke liye aur technical analysis tools aur confirmatory indicators ka istemal karna chahiye taake bullish trend ki mazbooti ko darust kar sakein, Golden Cross pattern par trading faislay sirf is pattern par na hone dein.

Death Cross

Dosri taraf, Death Cross ek bearish technical signal hai jo tab paida hota hai jab short-term moving average long-term moving average ke neeche jaata hai. Golden Cross ki tarah, traders aksar 50-day moving average ko 200-day moving average ke neeche jaate hue Death Cross signal ke tor par dekhte hain. Yeh crossover ek momentum shift ko darust karta hai bullish se bearish ki taraf, jo ek mumkinah downtrend ko dikhata hai market mein.

Traders Death Cross ko ek mazboot bearish trend ki tasdeeq samajhte hain. Isse market sentiment mein ek significant tabdeeli ka izhaar hota hai, jahan selling pressure buying pressure ko peechay chhod deti hai. Isi wajah se, traders short positions kholne ya apni assets ke exposure ko kam karne ka tajurba karte hain, mazeed price ki kami ki umeed ke saath.

Golden Cross ki tarah, Death Cross bhi hamesha sahi nahi hota aur false signals bhi deta hai. Traders ko is pattern ko aur technical indicators aur market analysis ke saath mila kar istemal karna chahiye taake bearish trend ki mazbooti ko darust kar sakein, Death Cross pattern par trading faislay sirf is pattern par na hone dein.

Importance of Confirmation

Golden Cross aur Death Cross dono hi ahem signals hote hain, lekin inko behtar se behtar ahem technical analysis tools aur market information ke saath istemal kiya jaana chahiye taake zyada behtar tasdeeq hasil ho. Traders aksar volume indicators, price patterns, support aur resistance levels, aur doosre momentum indicators se tasdeeq hasil karte hain takay in crossover patterns par trading strategies ko mazboot kiya ja sake.

Volume tasdeeq khaas tor par zaroori hai, kyun ke crossover ke doran trading volume ka significant increase tasdeeq ki mazbooti ko darust karta hai, jaise ke Golden Cross ya Death Cross ke signals mein. High volume market participation ko tasdeeq karta hai aur signal ko credibility deta hai.

Potential Trading Strategies

Traders Golden Cross aur Death Cross patterns par mukhtalif trading strategies develop kar sakte hain:

Golden Cross aur Death Cross patterns ko samajhne ke baad bhi, inke kuch limitations aur khatray hote hain jo traders ko yaad rakhne chahiye:

Lekin, traders ko in patterns ko doosre technical indicators, confirmatory signals aur risk management strategies ke saath istemal karna chahiye taake unki trading decisions ko mazboot kiya ja sake aur potential risks ko kam kiya ja sake. Golden Cross aur Death Cross patterns ke strengths, limitations aur risks ko samajhna traders ko behtar trading strategies banane mein madadgar sabit ho sakta hai, financial markets ke dynamic duniya mein.

Golden Cross

Golden Cross ek bullish technical signal hai jo tab paida hota hai jab short-term moving average long-term moving average se ooper jaata hai. Ziyadatar cases mein, traders 50-day moving average ko 200-day moving average ke ooper jaate hue Golden Cross signal ke tor par dekhte hain. Yeh crossover ek momentum shift ko darust karta hai bearish se bullish ki taraf, jo ek mumkinah uptrend ko dikhata hai market mein.

Traders Golden Cross ko ek mazboot bullish trend ki tasdeeq samajhte hain. Isse market sentiment mein ek significant tabdeeli ka izhaar hota hai, jahan buying pressure selling pressure ko peechay chhod deti hai. Issi wajah se, traders long positions kholne ya apni assets ke exposure ko barhane ka tajurba karte hain, mazeed price ki izafa ki umeed ke saath.

Lekin yeh zaroori hai ke yeh yaad rakha jaye ke Golden Cross hamesha kaamyaab nahi hota aur kabhi kabhi false positives bhi deta hai. Traders ko is pattern ki tasdeeq ke liye aur technical analysis tools aur confirmatory indicators ka istemal karna chahiye taake bullish trend ki mazbooti ko darust kar sakein, Golden Cross pattern par trading faislay sirf is pattern par na hone dein.

Death Cross

Dosri taraf, Death Cross ek bearish technical signal hai jo tab paida hota hai jab short-term moving average long-term moving average ke neeche jaata hai. Golden Cross ki tarah, traders aksar 50-day moving average ko 200-day moving average ke neeche jaate hue Death Cross signal ke tor par dekhte hain. Yeh crossover ek momentum shift ko darust karta hai bullish se bearish ki taraf, jo ek mumkinah downtrend ko dikhata hai market mein.

Traders Death Cross ko ek mazboot bearish trend ki tasdeeq samajhte hain. Isse market sentiment mein ek significant tabdeeli ka izhaar hota hai, jahan selling pressure buying pressure ko peechay chhod deti hai. Isi wajah se, traders short positions kholne ya apni assets ke exposure ko kam karne ka tajurba karte hain, mazeed price ki kami ki umeed ke saath.

Golden Cross ki tarah, Death Cross bhi hamesha sahi nahi hota aur false signals bhi deta hai. Traders ko is pattern ko aur technical indicators aur market analysis ke saath mila kar istemal karna chahiye taake bearish trend ki mazbooti ko darust kar sakein, Death Cross pattern par trading faislay sirf is pattern par na hone dein.

Importance of Confirmation

Golden Cross aur Death Cross dono hi ahem signals hote hain, lekin inko behtar se behtar ahem technical analysis tools aur market information ke saath istemal kiya jaana chahiye taake zyada behtar tasdeeq hasil ho. Traders aksar volume indicators, price patterns, support aur resistance levels, aur doosre momentum indicators se tasdeeq hasil karte hain takay in crossover patterns par trading strategies ko mazboot kiya ja sake.

Volume tasdeeq khaas tor par zaroori hai, kyun ke crossover ke doran trading volume ka significant increase tasdeeq ki mazbooti ko darust karta hai, jaise ke Golden Cross ya Death Cross ke signals mein. High volume market participation ko tasdeeq karta hai aur signal ko credibility deta hai.

Potential Trading Strategies

Traders Golden Cross aur Death Cross patterns par mukhtalif trading strategies develop kar sakte hain:

- Trend Tasdeeq: Traders Golden Cross ko ek uptrend ki tasdeeq aur Death Cross ko ek downtrend ki tasdeeq samajh kar long positions khol sakte hain Golden Cross ke signals mein aur short positions khol sakte hain Death Cross ke signals mein.

- Cross-Over Strategy: Kuch traders moving averages ke crossover ko apni mukhya trading strategy ke tor par istemal karte hain. Maslan, woh buy karte hain jab short-term moving average long-term moving average ke ooper jaata hai (Golden Cross) aur sell karte hain jab short-term moving average long-term moving average ke neeche jaata hai (Death Cross).

- Risk Management: Traders in patterns ko apne risk management strategy ka hissa banate hain. Maslan, woh bullish trends par jo Golden Cross se tasdeeq mil rahi hai uss ke niche recent lows par stop-loss orders rakh sakte hain aur bearish trends par jo Death Cross se tasdeeq mil rahi hai uss ke upar recent highs par stop-loss orders rakh sakte hain taake potential losses ko manage kiya ja sake.

- Timeframe Ka Ghoor Karna: Traders ko yeh bhi dhyan mein rakhna chahiye ke Golden Cross ya Death Cross kis timeframe par hota hai. Shorter timeframe, jaise daily chart par, crossover ka matlab alag ho sakta hai compared to longer timeframe, jaise weekly chart par. Isliye trading strategies ko chuni gayi timeframe ke saath mila kar istemal karna chahiye taake zyada sahi analysis ho sake.

Golden Cross aur Death Cross patterns ko samajhne ke baad bhi, inke kuch limitations aur khatray hote hain jo traders ko yaad rakhne chahiye:

- Whipsaws: Crossover signals kabhi kabhi whipsaws ko paida karte hain, jahan price crossover ke baad jaldi se direction change kar deta hai, false signals aur potential losses ka khatra barh jata hai traders ke liye jo jaldi action lete hain.

- Delayed Signals: Moving averages lagging indicators hote hain, matlab woh past price data ko reflect karte hain. Isi wajah se, crossover signals kabhi kabhi initial price move ke baad aate hain, jiski wajah se delayed entry ya exit points traders ke liye hosakta hai.

- Market Conditions: Golden Cross aur Death Cross patterns kaamyaabi market conditions par depend karta hai. Yeh trending markets mein acche kaam karte hain lekin choppy ya sideways markets mein kam reliable signals dete hain.

- False Signals: Traders ko crossover signals par trading decisions lene se pehle caution istemal karna chahiye aur additional confirmation tools ka istemal karna chahiye taake false positives se bacha ja sake, khaas karke low trading volume ya market uncertainty ke doran.

Lekin, traders ko in patterns ko doosre technical indicators, confirmatory signals aur risk management strategies ke saath istemal karna chahiye taake unki trading decisions ko mazboot kiya ja sake aur potential risks ko kam kiya ja sake. Golden Cross aur Death Cross patterns ke strengths, limitations aur risks ko samajhna traders ko behtar trading strategies banane mein madadgar sabit ho sakta hai, financial markets ke dynamic duniya mein.

تبصرہ

Расширенный режим Обычный режим