Bullish aur Bearish Separating Line patterns technical analysis mein ahem concepts hain jo traders istemal karte hain taake market trends mein possible tabdeeliyan pehchaan sakein. Yeh patterns khaas tor par mukhtalif price movements aur candlestick formations ko shamil karte hain jo market sentiment mein tabdiliyan darust karte hain.

Bullish Separating Line Pattern

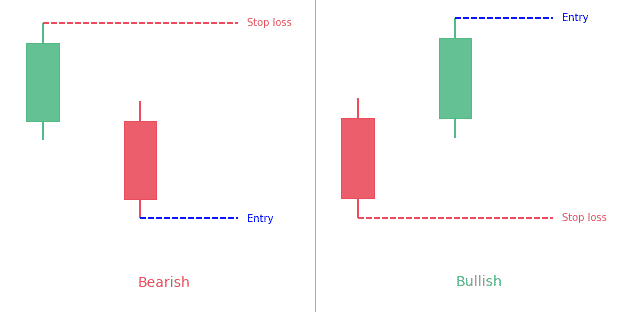

Bullish Separating Line pattern ek bullish reversal pattern hai jo aksar downtrend mein paaya jata hai. Is mein do candlesticks hote hain: pehli candlestick lambi bearish candle hoti hai jo selling pressure ko darust karti hai, aur doosri candlestick pehli candle ki low se neeche open hoti hai lekin apne midpoint ke upar close hoti hai. Doosri candlestick aam tor par choti bullish candle hoti hai.

Yahan Bullish Separating Line pattern ka tafseeli breakdown hai:

Bearish Separating Line Pattern

Dusri taraf, Bearish Separating Line pattern ek bearish reversal pattern hai jo aksar uptrend mein paaya jata hai. Is mein bhi do candlesticks hote hain: pehli candlestick lambi bullish candle hoti hai jo buying pressure ko darust karti hai, aur doosri candlestick pehli candle ki high se oopar open hoti hai lekin apne midpoint ke neeche close hoti hai. Doosri candlestick aam tor par choti bearish candle hoti hai.

Yahan Bearish Separating Line pattern ka breakdown hai:

Bullish aur Bearish Separating Line patterns dono market sentiment mein tabdili darust karte hain. Bullish Separating Line ek bullish reversal signal hai jo downtrend se uptrend ki taraf reversal ko darust karta hai, jabke Bearish Separating Line ek bearish reversal signal hai jo uptrend se downtrend ki taraf reversal ko darust karta hai.

Traders in patterns ko is tarah tashreeh karte hain:

Traders Bullish aur Bearish Separating Line patterns ko apni trading strategies mein mukhtalif tareeqon se istemal kar sakte hain:

Bullish Separating Line Pattern

Bullish Separating Line pattern ek bullish reversal pattern hai jo aksar downtrend mein paaya jata hai. Is mein do candlesticks hote hain: pehli candlestick lambi bearish candle hoti hai jo selling pressure ko darust karti hai, aur doosri candlestick pehli candle ki low se neeche open hoti hai lekin apne midpoint ke upar close hoti hai. Doosri candlestick aam tor par choti bullish candle hoti hai.

Yahan Bullish Separating Line pattern ka tafseeli breakdown hai:

- Downtrend Shuru: Pehle pattern ke shuru hone se pehle, market aam tor par downtrend mein hoti hai, jismein lagatar lower lows aur lower highs hote hain.

- Pehli Bearish Candle: Pattern lambi bearish candle ke saath shuru hota hai, jo mazboot selling pressure aur downtrend ki continuation ko darust karti hai.

- Doosri Bullish Candle: Doosri candlestick pehli candle ki low se neeche open hoti hai, jo gap down ko darust karti hai. Magar trading session ke doran, buyers market mein dakhil ho jate hain aur price ko oopar le jate hain, candle ko pehli candle ke midpoint ke upar close karte hain.

- Confirmation: Doosri candlestick dwara dikhayi gayi bullish sentiment downtrend ka possible reversal darust karti hai.

- Volume Confirmation: Traders Bullish Separating Line pattern ke sath zyada trading volume ki tafteesh karte hain taake reversal signal ko confirm karein.

Bearish Separating Line Pattern

Dusri taraf, Bearish Separating Line pattern ek bearish reversal pattern hai jo aksar uptrend mein paaya jata hai. Is mein bhi do candlesticks hote hain: pehli candlestick lambi bullish candle hoti hai jo buying pressure ko darust karti hai, aur doosri candlestick pehli candle ki high se oopar open hoti hai lekin apne midpoint ke neeche close hoti hai. Doosri candlestick aam tor par choti bearish candle hoti hai.

Yahan Bearish Separating Line pattern ka breakdown hai:

- Uptrend Shuru: Pehle pattern ke shuru hone se pehle, market aam tor par uptrend mein hoti hai, jismein lagatar higher highs aur higher lows hote hain.

- Pehli Bullish Candle: Pattern lambi bullish candle ke saath shuru hota hai, jo mazboot buying pressure aur uptrend ki continuation ko darust karti hai.

- Doosri Bearish Candle: Doosri candlestick pehli candle ki high se oopar open hoti hai, jo gap up ko darust karti hai. Magar trading session ke doran, sellers market mein dakhil ho jate hain aur price ko neeche le jate hain, candle ko pehli candle ke midpoint ke neeche close karte hain.

- Confirmation: Doosri candlestick dwara dikhayi gayi bearish sentiment uptrend ka possible reversal darust karti hai.

- Volume Confirmation: Bullish Separating Line pattern ke tarah, traders Bearish Separating Line pattern ke sath zyada trading volume ki tafteesh karte hain taake reversal signal ko confirm karein.

Bullish aur Bearish Separating Line patterns dono market sentiment mein tabdili darust karte hain. Bullish Separating Line ek bullish reversal signal hai jo downtrend se uptrend ki taraf reversal ko darust karta hai, jabke Bearish Separating Line ek bearish reversal signal hai jo uptrend se downtrend ki taraf reversal ko darust karta hai.

Traders in patterns ko is tarah tashreeh karte hain:

- Bullish Separating Line Tashreeh: Traders Bullish Separating Line ko long ya buy karne ka signal samajhte hain, umeed karte hain ke price downtrend ko reverse karega aur oopar ki taraf move karega.

- Bearish Separating Line Tashreeh: Umgeen, traders Bearish Separating Line ko short ya sell karne ka signal samajhte hain, umeed karte hain ke price uptrend ko reverse karega aur neeche ki taraf move karega.

Traders Bullish aur Bearish Separating Line patterns ko apni trading strategies mein mukhtalif tareeqon se istemal kar sakte hain:

- Confirmation with Other Indicators: Traders aksar doosre technical indicators jaise moving averages, RSI Relative Strength Index, ya MACD Moving Average Convergence Divergence se confirmation ka intezar karte hain pehle in patterns par trade karte hue.

- Risk Management: Stop-loss orders lagana aur risk-reward ratios ko define karna zaroori hai jab in patterns par trade karte hain taake potential nuqsanat ko manage kiya ja sake aur munafa optimize kiya ja sake.

- Timeframe Ka Tawajjo: Traders pattern ka timeframe bhi madde nazar rakhte hain. Lambi timeframes jaise daily ya weekly charts par patterns zyada ahmiyat rakhte hain mazeed chhote timeframes jaise hourly charts par.

- Backtesting aur Analysis: Live trading mein in patterns ko implement karne se pehle, traders apni strategies ko backtest karte hain aur historical data ka analysis karte hain taake pattern ki effectiveness ko alag-alag market conditions mein assess kiya ja sake.

- Market Context: Market context ko madde nazar rakhte hue patterns par trade karna zaroori hai, jismein fundamental factors aur market sentiment shaamil hote hain.

تبصرہ

Расширенный режим Обычный режим