Tri star candlestick pattern

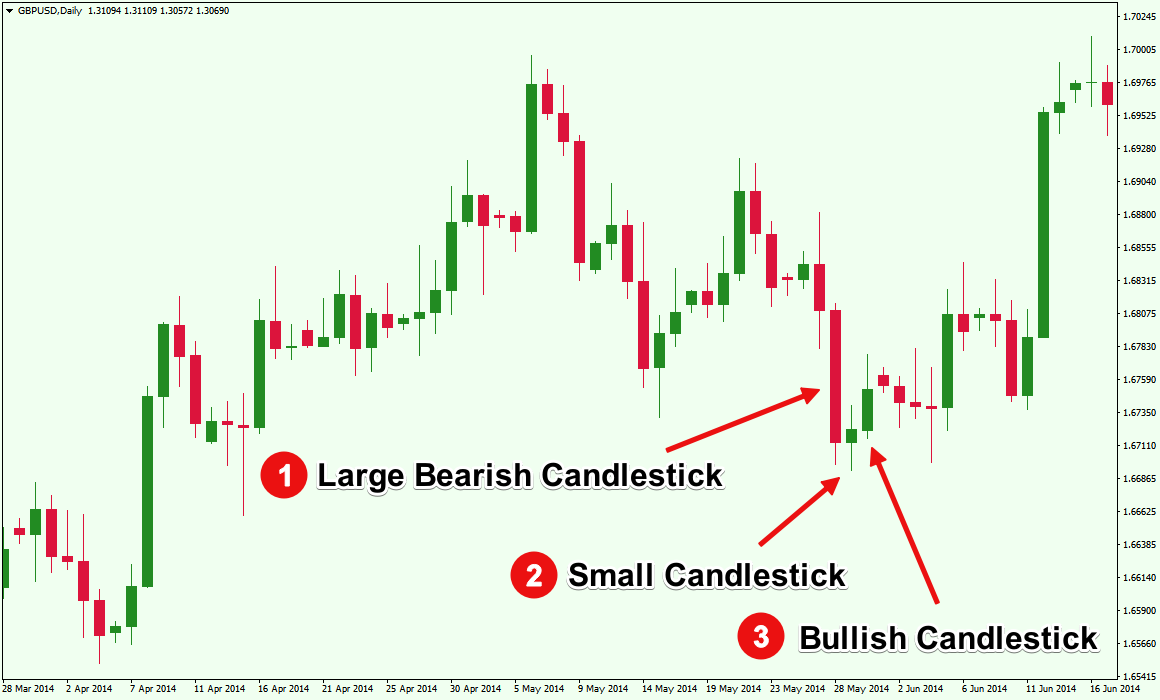

Tri-Star" candlestick pattern ek rare candlestick pattern hai jo ki Japanese candlestick chart analysis mein dekha jata hai. Ye pattern typically ek reversal pattern hai, lekin iski recognition aur interpretation difficult hoti hai compared to other more common candlestick patterns. Tri-Star pattern ko identify karna ek market mein experienced traders ke liye challenging ho sakta hai.Tri-Star pattern ka formation typically is tarah se hota hai:

- Three Consecutive Doji Candles: Tri-Star pattern mein typically three consecutive doji candles dekhe jate hain. Doji candles small-bodied candles hote hain jinke opening aur closing price barabar ya lagbhag barabar hoti hai, aur inke upper aur lower shadows short hoti hain.

- Gap between Candles: Har doji candle ke beech mein typically gap hota hai, indicating a pause or indecision in the market.

- High Probability Reversal Signal: Tri-Star pattern ek high probability reversal signal provide karta hai, indicating a potential trend reversal. Agar tri-star pattern ek uptrend ke baad form hota hai, toh ye bearish reversal ko suggest karta hai. Agar tri-star pattern ek downtrend ke baad form hota hai, toh ye bullish reversal ko suggest karta hai.

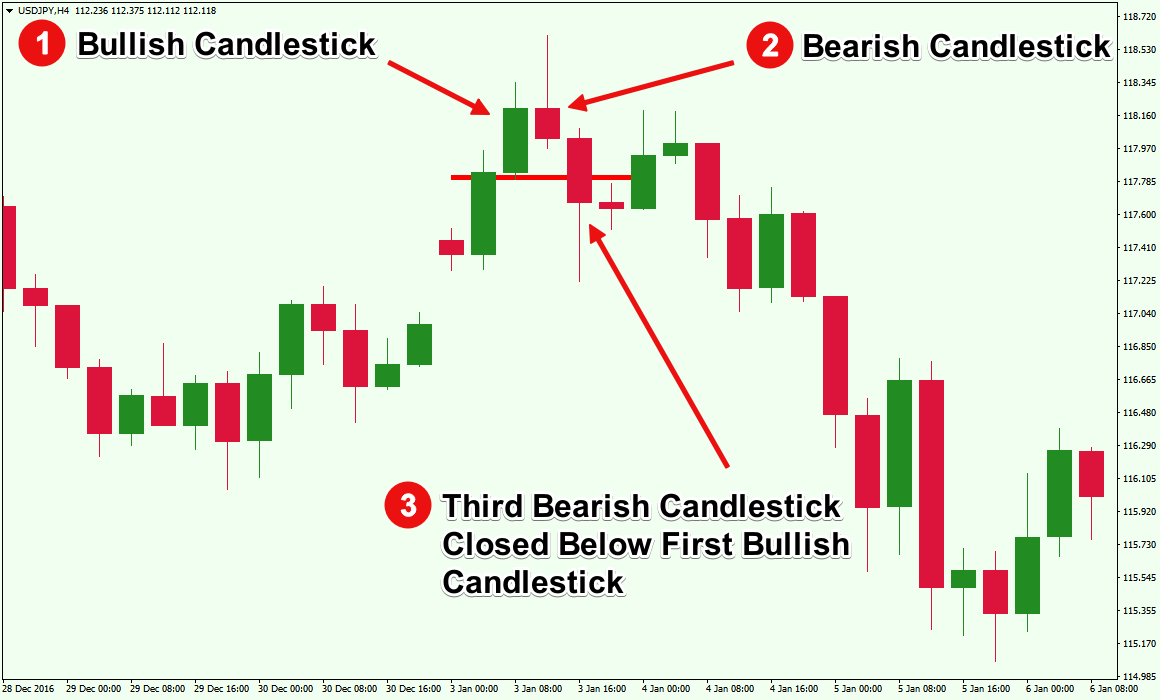

Treading Strategy and Identification

Tri-Star pattern ka formation bearish or bullish reversal ko indicate karta hai, lekin is pattern ko confirm karne ke liye traders ko additional technical analysis aur confirmatory indicators ka use karna hota hai. Market context, volume analysis, aur other technical indicators ke saath is pattern ko confirm karke hi traders ko trading decisions lena chahiye.Due to its rarity and difficulty in interpretation, traders often prefer to use more common and reliable candlestick patterns for their trading strategies. However, experienced traders who are adept at candlestick analysis may find value in recognizing and interpreting the Tri-Star pattern as part of their broader trading approach.

تبصرہ

Расширенный режим Обычный режим