Strangle Options Trading Strategy:

Strangle options trading strategy ek advanced level ki trading strategy hai jo ke stock market mein istemal hoti hai. Is strategy mein traders ek stock ke call aur put options ke dono taraf positions lete hain, lekin strike price ko out-of-the-money (OTM) rakhte hain. Is article mein hum Roman Urdu mein strangle options trading strategy ke tareeqe, faiday aur nuqsanaat par ghaur karenge.

1. Strangle Options Trading Strategy Kya Hai?

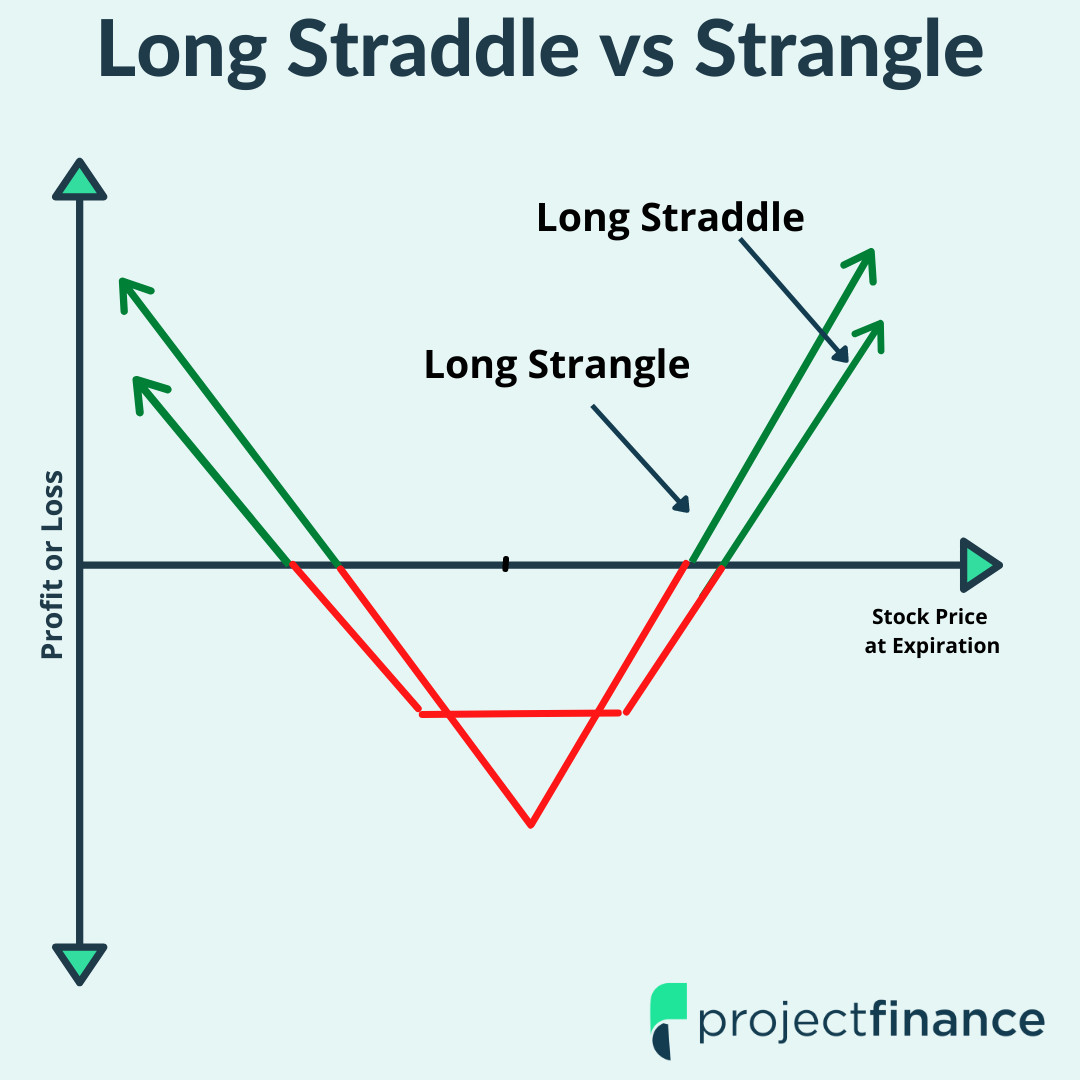

- Strangle options trading strategy mein traders ek stock ke call aur put options ke dono taraf positions lete hain. Call option ko buy kiya jata hai strike price ke upar aur put option ko buy kiya jata hai strike price ke neeche. Dono options ko out-of-the-money (OTM) rakha jata hai, yani strike price current market price se zyada door hota hai.

2. Strangle Options Trading Strategy Ka Tareeqa:

- Call Option Buy:

- Pehla kadam strangle strategy mein ek call option ko buy karna hai. Call option ko buy karte waqt strike price current market price se zyada door hona chahiye.

- Put Option Buy:

- Dusra kadam put option ko buy karna hai. Put option ko buy karte waqt strike price current market price se zyada door hona chahiye.

3. Strangle Options Trading Strategy Ki Ahmiyat:

- Volatility Ke Mauqe Par Kamai:

- Strangle options strategy traders ko volatility ke mauqe par kamai karne ka mauqa deta hai. Agar stock ke price mein kisi unexpected event ki wajah se zyada volatility aati hai, toh strangle strategy traders ko munafa dila sakti hai.

- Neutral Market Conditions Mein Kaam Aata Hai:

- Strangle options strategy neutral market conditions mein kaam aata hai. Agar traders ko lagta hai ke stock ka price stable rahega, lekin kisi unexpected event ki wajah se volatility badh sakti hai, toh strangle strategy unke liye faida mand ho sakti hai.

4. Strangle Options Trading Strategy Ke Nuqsanaat:

- High Cost:

- Strangle options strategy ka implementation high cost ke sath aata hai. Kyunki traders ko dono taraf ke options buy karne hote hain, toh ismein initial investment zyada hoti hai.

- Time Decay Ka Asar:

- Agar market mein volatility expected se kam hoti hai, toh time decay ka asar strangle strategy par pad sakta hai. Isse traders ko nuksan ho sakta hai agar options ka expiry time kareeb aa gaya hai aur volatility na aaye.

5. Strangle Options Trading Strategy Ko Istemal Karne Ke Tips:

- Volatility Ki Expectations:

- Strangle options strategy ko implement karne se pehle, traders ko market mein volatility ki expectations ko samajhna zaroori hai. Agar volatility ka expectation high hai, toh strangle strategy ka istemal faida mand ho sakta hai.

- Proper Strike Price Selection:

- Strike price selection ka dhyan rakhna zaroori hai strangle strategy mein. Traders ko strike price ko current market price ke base par select karna chahiye takay options OTM ho aur strategy ka kamyaabi se istemal ho sake.

- Risk Management:

- Har trading strategy mein risk management ka dhyan rakhna zaroori hai. Strangle options strategy ko implement karte waqt bhi traders ko apne risk management techniques ko follow karna chahiye takay nuksan se bacha ja sake.

تبصرہ

Расширенный режим Обычный режим