Forex trading ek mukhtalif duniya hai jahan investors currencies ko khareedte hain aur bechte hain, ummed hai ke daulat banayen. Is duniya mein, ek successful trader banne ke liye, zaroori hai ke aap naye tareeqon ko seekhen aur ek sahi strategy ko apnayen. Ek aham tareeqa jo traders istemal karte hain, wo hai candlestick patterns ka analysis. Aaj hum baat karenge ek aise candlestick pattern ki, jo ke "Wolf Wave" ke naam se jaana jaata hai aur jo forex trading mein istemal kiya jata hai.

1. Wolf Wave Candlestick Pattern Ki Tareef

Wolf Wave candlestick pattern ek technical analysis ka hissa hai jise traders use karte hain market trend ka pata lagane ke liye. Is pattern mein price action ko dekha jata hai, jo ke kisi bhi currency pair ya anya financial instrument par apply kiya ja sakta hai. Ye pattern ek specific sequence of candles ko follow karta hai, jo ek potential reversal ya trend continuation indicate karta hai.Wolf Wave pattern kaafi powerful hota hai, khaaskar jab wo sahi tarah se identify kiya jaata hai. Ye pattern market ke movement ko analyze karne ke liye ek systematic approach provide karta hai. Traders is pattern ki madad se market ke potential turning points ko identify kar sakte hain, jo unhe trading opportunities pradan karta hai.

2. Wolf Wave Ka Origin

Wolf Wave pattern ka naam ek famous trader Bill Wolfe se liya gaya hai. Unhone is pattern ko pehli baar 1990s mein introduce kiya tha. Wolfe ne is pattern ko market mein upasthit complexities ko samajhne ke liye develop kiya tha aur isay traders ke liye ek mufeed tool banaya tha.

Wolfe ke hisaab se, market ke movements mein ek specific pattern hota hai jo waves ke roop mein appear hota hai. Ye waves ek specific sequence mein hote hain aur unka pattern ek wolf ke pattern jaisa hota hai, jis se iska naam "Wolf Wave" rakh diya gaya.

3. Wolf Wave Ki Characteristics

Wolf Wave pattern ki pehchan karne ke liye kuch characteristics hain:

Yeh characteristics traders ko pattern ko identify karne mein madad karte hain aur unhe market ke potential movements ko anticipate karne mein sahayak hote hain.

4. Wolf Wave Ki Components

Wolf Wave pattern mein kuch mukhya components hote hain:

In components ko samajhna aur effectively istemal karna, traders ko pattern ko identify karne aur sahi trading decisions lene mein madad karta hai.

5. Wolf Wave Pattern Ki Trading Strategy

Wolf Wave pattern ko trade karne ke liye traders kuch steps follow karte hain:

Ye trading strategy traders ko systematic approach provide karta hai aur unhe market ke movements ke saath sath hi risk management karne mein madad karta hai.

6. Wolf Wave Pattern Ki Limitations

Wolf Wave pattern ke bawajood uski effectiveness, kuch limitations bhi hain:

In limitations ko samajh kar, traders ko pattern ko sahi tareeqe se interpret karna aur uski sahiyat ko samajhna zaroori hai.

7. Wolf Wave Pattern Ka Istemal

Wolf Wave pattern ko kisi bhi time frame par aur kisi bhi currency pair par istemal kiya ja sakta hai. Traders is pattern ko apne trading strategy ka ek hissa bana sakte hain aur isay other technical indicators ke saath combine karke better trading decisions le sakte hain.

Is pattern ko effectively istemal karne se pehle, traders ko pattern ki performance aur reliability ko samajhna zaroori hai. Iske saath hi, wo apne trading goals aur risk tolerance ke hisaab se pattern ko customize kar sakte hain.

8. Wolf Wave Pattern Aur Risk Management

Har trading strategy ki tarah, Wolf Wave pattern ko bhi sahi risk management ke saath istemal karna zaroori hai. Traders ko apne trades ke liye stop loss aur target levels tay karte waqt apne risk tolerance ko dhyan mein rakhna chahiye.

Risk management ke principles ko follow karke, traders apne trading positions ko protect kar sakte hain aur apne trading capital ko effectively manage kar sakte hain.

9. Wolf Wave Pattern Ki Backtesting

Wolf Wave pattern ko effectively istemal karne se pehle, traders ko ise backtesting karna chahiye. Isse traders ko pattern ki performance aur reliability ka pata chalta hai various market conditions mein.

Backtesting ke through, traders apne trading strategy ko refine kar sakte hain aur potential weaknesses ko identify karke unpar kaam kar sakte hain. Isse unka confidence bhi badhta hai aur wo apne trades ko with more conviction execute kar sakte hain.

10. Conclusion

Wolf Wave candlestick pattern ek mufeed tool hai forex trading mein jo traders ko market trends ko samajhne mein madad karta hai. Is pattern ko effectively istemal karne ke liye, traders ko price action ko analyze karna aur sahi risk management principles ko follow karna chahiye. Wolf Wave pattern ki understanding aur proficiency ke saath, traders apni trading performance ko improve kar sakte hain aur consistent profits generate kar sakte hain.

1. Wolf Wave Candlestick Pattern Ki Tareef

Wolf Wave candlestick pattern ek technical analysis ka hissa hai jise traders use karte hain market trend ka pata lagane ke liye. Is pattern mein price action ko dekha jata hai, jo ke kisi bhi currency pair ya anya financial instrument par apply kiya ja sakta hai. Ye pattern ek specific sequence of candles ko follow karta hai, jo ek potential reversal ya trend continuation indicate karta hai.Wolf Wave pattern kaafi powerful hota hai, khaaskar jab wo sahi tarah se identify kiya jaata hai. Ye pattern market ke movement ko analyze karne ke liye ek systematic approach provide karta hai. Traders is pattern ki madad se market ke potential turning points ko identify kar sakte hain, jo unhe trading opportunities pradan karta hai.

2. Wolf Wave Ka Origin

Wolf Wave pattern ka naam ek famous trader Bill Wolfe se liya gaya hai. Unhone is pattern ko pehli baar 1990s mein introduce kiya tha. Wolfe ne is pattern ko market mein upasthit complexities ko samajhne ke liye develop kiya tha aur isay traders ke liye ek mufeed tool banaya tha.

Wolfe ke hisaab se, market ke movements mein ek specific pattern hota hai jo waves ke roop mein appear hota hai. Ye waves ek specific sequence mein hote hain aur unka pattern ek wolf ke pattern jaisa hota hai, jis se iska naam "Wolf Wave" rakh diya gaya.

3. Wolf Wave Ki Characteristics

Wolf Wave pattern ki pehchan karne ke liye kuch characteristics hain:

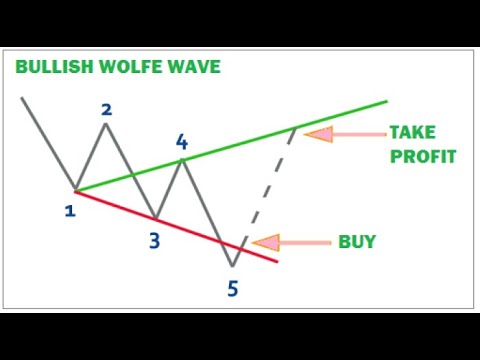

- Ek upward ya downward trend mein price action.

- Five waves jo ke specific high aur low points par hote hain.

- Waves ke beech mein ek channel banta hai jo price action ko define karta hai.

- Ek potential reversal ya continuation signal jab price action channel ke bahar nikalta hai.

Yeh characteristics traders ko pattern ko identify karne mein madad karte hain aur unhe market ke potential movements ko anticipate karne mein sahayak hote hain.

4. Wolf Wave Ki Components

Wolf Wave pattern mein kuch mukhya components hote hain:

- 1-2-3-4-5 Waves: Ye waves price action ke movements ko represent karte hain. Pehle chaar waves trend ke direction mein hote hain, jabki fifth wave opposite direction mein hoti hai.

- Equidistant Channel: Ye channel lines hote hain jo pehle chaar waves ko define karte hain. Ye lines pehli aur doosri wave ke beech mein draw kiye jate hain aur phir third aur fourth wave ke levels ko extend kiya jata hai.

- Entry, Stop Loss, aur Target Levels: Traders ko entry point, stop loss aur target levels tay karna hota hai pattern ko trade karne ke liye.

In components ko samajhna aur effectively istemal karna, traders ko pattern ko identify karne aur sahi trading decisions lene mein madad karta hai.

5. Wolf Wave Pattern Ki Trading Strategy

Wolf Wave pattern ko trade karne ke liye traders kuch steps follow karte hain:

- Step 1: Pattern Ki Identification: Traders ko pehle hi pattern ko identify karna hota hai. Iske liye wo price chart ko analyze karte hain aur potential Wolf Wave patterns ko dhundhte hain.

- Step 2: Entry Point Ka Teyaar Karna: Jab pattern identify ho jata hai, traders ko entry point tay karna hota hai. Ye entry point typically fifth wave ke breakout par hota hai.

- Step 3: Stop Loss Aur Target Levels Set Karna: Traders ko apne trades ke liye stop loss aur target levels set karna hota hai. Stop loss typically pattern ke opposite side ke breakout ke neeche aur target levels opposite direction ke price moves ke liye hota hai.

- Step 4: Trade Management: Jab trade activate ho jata hai, traders ko apne positions ko manage karna hota hai. Ismein profit booking aur stop loss adjustment shamil hote hain.

Ye trading strategy traders ko systematic approach provide karta hai aur unhe market ke movements ke saath sath hi risk management karne mein madad karta hai.

6. Wolf Wave Pattern Ki Limitations

Wolf Wave pattern ke bawajood uski effectiveness, kuch limitations bhi hain:

- Subjectivity: Pattern ki interpretation subjective hoti hai aur traders ke experience par depend karti hai.

- False Signals: Kabhi-kabhi pattern false signals bhi generate kar sakta hai, jisse traders ko nuksan ho sakta hai.

- Market Conditions: Pattern ki performance market conditions par bhi depend karti hai aur volatile markets mein iski reliability kam ho sakti hai.

In limitations ko samajh kar, traders ko pattern ko sahi tareeqe se interpret karna aur uski sahiyat ko samajhna zaroori hai.

7. Wolf Wave Pattern Ka Istemal

Wolf Wave pattern ko kisi bhi time frame par aur kisi bhi currency pair par istemal kiya ja sakta hai. Traders is pattern ko apne trading strategy ka ek hissa bana sakte hain aur isay other technical indicators ke saath combine karke better trading decisions le sakte hain.

Is pattern ko effectively istemal karne se pehle, traders ko pattern ki performance aur reliability ko samajhna zaroori hai. Iske saath hi, wo apne trading goals aur risk tolerance ke hisaab se pattern ko customize kar sakte hain.

8. Wolf Wave Pattern Aur Risk Management

Har trading strategy ki tarah, Wolf Wave pattern ko bhi sahi risk management ke saath istemal karna zaroori hai. Traders ko apne trades ke liye stop loss aur target levels tay karte waqt apne risk tolerance ko dhyan mein rakhna chahiye.

Risk management ke principles ko follow karke, traders apne trading positions ko protect kar sakte hain aur apne trading capital ko effectively manage kar sakte hain.

9. Wolf Wave Pattern Ki Backtesting

Wolf Wave pattern ko effectively istemal karne se pehle, traders ko ise backtesting karna chahiye. Isse traders ko pattern ki performance aur reliability ka pata chalta hai various market conditions mein.

Backtesting ke through, traders apne trading strategy ko refine kar sakte hain aur potential weaknesses ko identify karke unpar kaam kar sakte hain. Isse unka confidence bhi badhta hai aur wo apne trades ko with more conviction execute kar sakte hain.

10. Conclusion

Wolf Wave candlestick pattern ek mufeed tool hai forex trading mein jo traders ko market trends ko samajhne mein madad karta hai. Is pattern ko effectively istemal karne ke liye, traders ko price action ko analyze karna aur sahi risk management principles ko follow karna chahiye. Wolf Wave pattern ki understanding aur proficiency ke saath, traders apni trading performance ko improve kar sakte hain aur consistent profits generate kar sakte hain.

تبصرہ

Расширенный режим Обычный режим