Forex trading, ek dynamic aur challenging duniya hai jahan har trader ko market ki harkat ko samajhne aur uss mein tawajjo deni hoti hai. Is challenging safar mein traders ke liye ahem hai ke woh sahi tools aur techniques ka istemal karein taake unki trading ko behtar bana sakein. Candlestick patterns bhi is safar mein ek ahem hissa hain jo traders ko market ki harkat ko samajhne mein madad karte hain. Harami candlestick pattern, in patterns mein se aik ahem pattern hai jo traders ke liye khaas ahmiyat rakhta hai. Is article mein, hum Harami candlestick pattern ke bare mein mazeed tafseelat aur iske istemal ke tareeqay par ghoor karenge.

1. Harami Candlestick Pattern Ki Tareef

Harami candlestick pattern ek technical analysis tool hai jo traders ko market ki trend reversal ki nishandahi karne mein madad deta hai. Is pattern mein do alag alag candles shamil hote hain, jinmein se pehli candle ka range zyada hota hai aur doosri candle ka range pehli candle ke andar hota hai. Harami candlestick pattern ki tareef ke mutabiq, yeh pattern market ki direction mein tabdeeli ki sambhavna ko zahir karta hai.

2. Harami Candlestick Pattern Ki Qisam

Harami candlestick pattern do qisam ke hote hain: bearish Harami aur bullish Harami. Bearish Harami pattern mein pehli candle ki range zyada hoti hai aur doosri candle ki range pehli candle ke andar hoti hai. Is pattern ki tasdeeq ke baad bearish trend ka aghaz hone ka imkan hota hai. Bullish Harami pattern mein pehli candle ki range chhoti hoti hai aur doosri candle ki range pehli candle ke andar hoti hai. Yeh pattern bullish trend ke ikhtitami hone ka ishara hai.

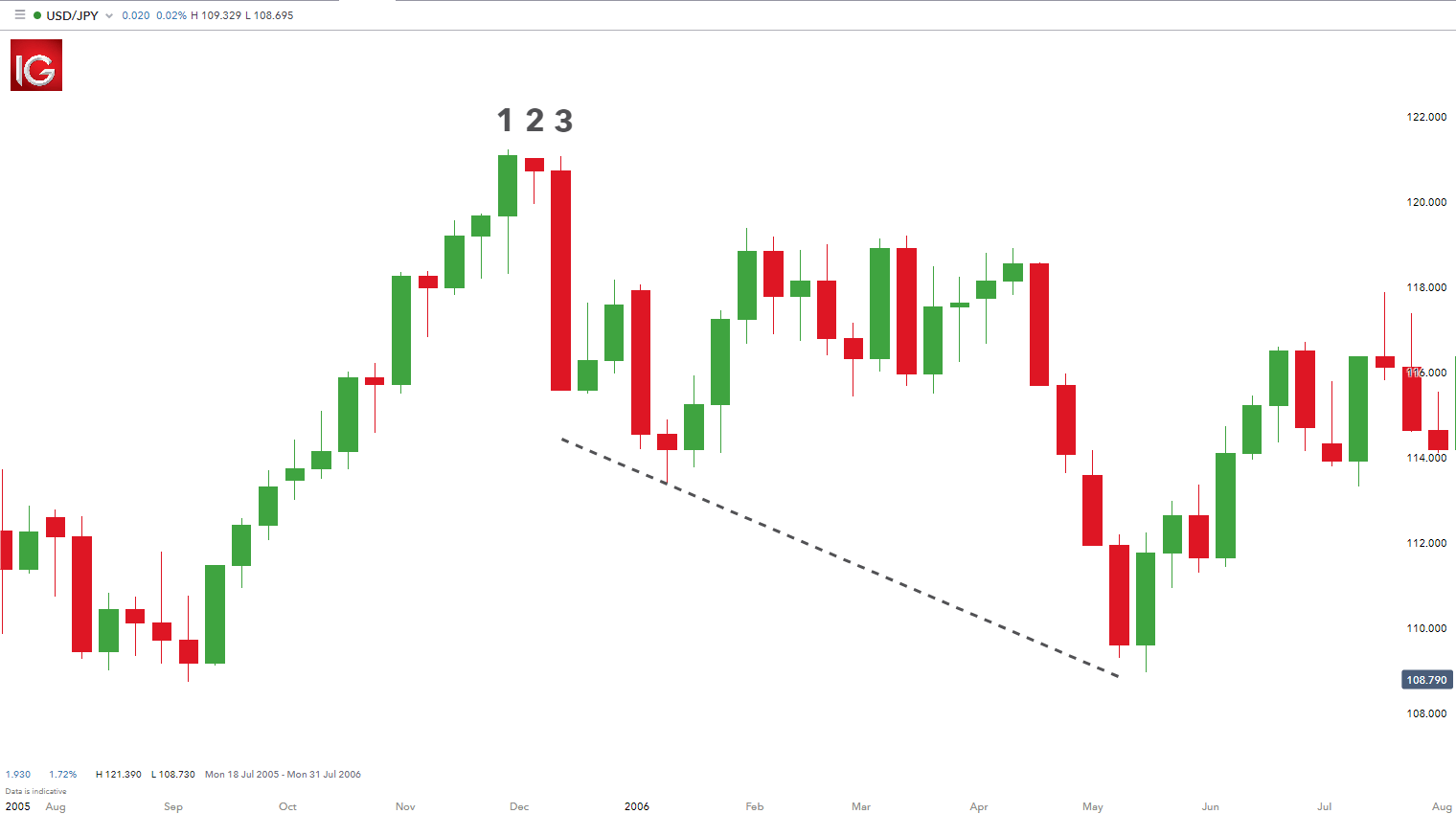

3. Bearish Harami Pattern

Bearish Harami pattern mein pehli candle bullish trend mein hoti hai jabke doosri candle bearish trend mein hoti hai. Is pattern ki tasdeeq ke baad bearish reversal ka imkan hota hai aur traders ko sell ki taraf ki raah par daal sakta hai.

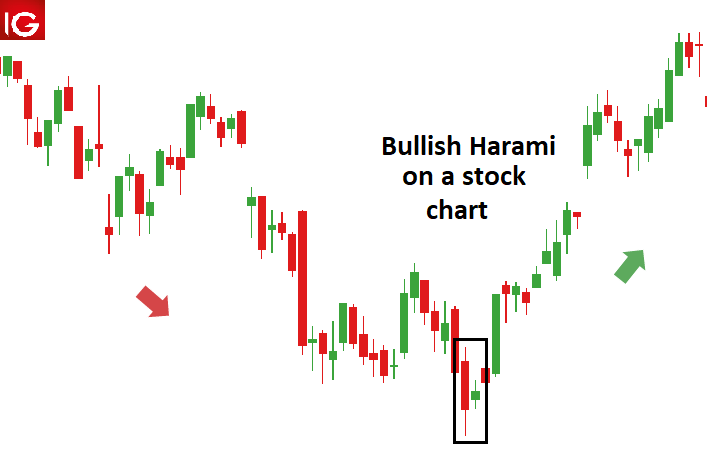

4. Bullish Harami Pattern

Bullish Harami pattern mein pehli candle bearish trend mein hoti hai jabke doosri candle bullish trend mein hoti hai. Yeh pattern bullish reversal ka imkan deta hai aur traders ko buy ki taraf ki raah par daal sakta hai.

5. Harami Candlestick Pattern Ka Istemal

Harami candlestick pattern ka istemal karne ke liye traders ko mukhtalif factors ka tawazun karna hota hai jaise ke trend, volume aur support/resistance levels. Agar yeh factors sahi hain, to Harami candlestick pattern ki tasdeeq ki ja sakti hai aur traders ko reversal ka andaza lagane mein madad milti hai.

6. Harami Candlestick Pattern Aur Digar Indicators

Harami candlestick pattern ko confirm karne ke liye traders doosre technical indicators jaise ke RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence) aur Fibonacci retracement ka istemal karte hain. In indicators ki madad se traders ko Harami pattern ki tasdeeq aur market ki direction ka theek andaza hota hai.

7. Harami Candlestick Pattern Ka Istemal Karein

Harami candlestick pattern ka istemal karne se pehle, traders ko market ki mukhtalif factors ko mukammal tor par tajziya karna chahiye. Iske baad, agar Harami candlestick pattern ki tasdeeq hoti hai, to traders ko trade entry aur exit ke faislay karne chahiye.

8. Harami Candlestick Pattern Ki Ahmiyat

Harami candlestick pattern ki ahmiyat forex trading mein kisi bhi trader ke liye bohot zyada hoti hai. Yeh pattern market ki direction mein hone wali tabdeeli ko pehchanne mein madad karta hai. Agar ek trader Harami candlestick pattern ko sahi tareeqe se samajh leta hai, toh usay market ki trend ka andaza lagane mein asani hoti hai. Is pattern ki madad se traders apni trading strategies ko improve kar sakte hain aur behtar trades kar sakte hain. Iske saath hi, Harami candlestick pattern ke istemal se traders ko market mein hone wali reversal ki peshangoi karne mein bhi madad milti hai, jo unko nuqsan se bachane mein madadgar sabit ho sakti hai.

9. Harami Candlestick Pattern Ka Risk Management

Harami candlestick pattern ka istemal karte waqt, risk management ko madhosi se barqarar rakhna bohot zaroori hai. Har trading decision lene se pehle, traders ko apne risk tolerance ke mutabiq stop loss orders aur position sizing ka tawazun banana chahiye. Agar Harami candlestick pattern ke istemal mein koi ghalti ho gayi aur trade ulta chala gaya, toh achi risk management se traders apne nuqsanat ko kam kar sakte hain. Isi tarah, agar trade sahi direction mein chala gaya, toh risk management ke zariye traders apne faiday ko maximize kar sakte hain.

10. Harami Candlestick Pattern Ki Mehnat aur Practice

Harami candlestick pattern ko samajhna aur istemal karna koi mamooli baat nahi hai. Iske liye traders ko mehnat aur practice ki zaroorat hoti hai. Traders ko is pattern ko samajhne aur sahi tareeqe se istemal karne ke liye market analysis mein waqt dena hoga. Iske alawa, traders ko historical data par backtesting bhi karna chahiye taake wo is pattern ke success rate ko samajh sakein. Mehnat aur practice ke baad hi traders Harami candlestick pattern ko confidently istemal kar sakte hain aur apni trading performance ko improve kar sakte hain.

11. Harami Candlestick Pattern Aur Trading Strategies

Harami candlestick pattern ko trading strategies mein shamil karne se pehle, traders ko apne trading plan ko mukammal tor par tajziya karna chahiye. Iske baad, wo apni trading plan ko Harami pattern ke mutabiq adjust kar sakte hain. Har ek trader ka trading style alag hota hai, isliye har trader ko apne liye suitable trading strategy tay karna chahiye. Kuch traders Harami pattern ko sirf trend reversal ka signal samajhte hain jabke doosre traders ise confirmation ke liye istemal karte hain. Is tarah, traders apne trading strategies ko customize karke Harami candlestick pattern ko apne faide ke liye istemal kar sakte hain.

12. Mukhtasir Mukhtasir

Harami candlestick pattern forex trading mein ek ahem tool hai jo traders ko market ki direction ka andaza lagane mein madad deta hai. Is pattern ko samajhne aur istemal karne ke liye mehnat aur practice ki zaroorat hoti hai. Sahi risk management aur trading strategies ke saath, Harami candlestick pattern traders ke liye ahem harkat hai. Yeh pattern traders ko market ki trends aur reversals ke bare mein sahi tareeqe se samajhne mein madad deta hai aur unko behtar trading opportunities provide karta hai.

تبصرہ

Расширенный режим Обычный режим