Session ky hay ?

Session maliyati market yani forex ke hawale se woh awqat hain jin maim muktalif mumalik apna Currency's main tijarat karte hain aur session ke mutabik qadre market main tazi hote hay jis movement ke mutabik traders munasib profit hasil karne ke koshish karte hain

How many sessions are there in forex?

forex mein total teen session hain jin ka tazkira darj hay jahan se aap ko pata chal sakta hay ke session kon kon se hain jaisa ke

Asiayi session : yeh session Tokyo , Japan mein subah 9 bujey se shaam 5 bujey tak chalta hai. is session mein, asiayi krnsyon, jaisay japani yan, cheeni yoaan, aur janoobi Korean won, sab se ziyada fa-aal hoti hain .

Europi session : yeh session London , England mein subah 8 bujey se shaam 4 bujey tak chalta hai. is session mein, Europi krnsyon, jaisay euro, Bartanwi pound, aur soys frank, sab se ziyada fa-aal hoti hain .

North Amrici session : yeh session New York, ryast_haye mutahidda mein subah 8 bujey se shaam 4 bujey tak chalta hai. is session mein, shumali Amrici krnsyon, jaisay Amrici dollar, Canadian dollar, aur miksikn peso, sab se ziyada fa-aal hoti hain .

Deference between sessions

un sessions mein farq yeh hai ke mukhtalif mein ziyada se ziyada trading ka waqt mukhtalif hota hai. misaal ke tor par, asiayi krnsyon mein trading ka ziyada se ziyada waqt asiayi session ke douran hota hai, jabkay Europi krnsyon mein trading ka ziyada se ziyada waqt Europi session ke douran hota hai asiayi mumalik ke liye, asiayi session sab se ziyada munasib hai. is ki wajah yeh hai ke is session ke douran, asiayi krnsyon mein ziyada se ziyada trading ka waqt hota hai, aur is liye, is session ke douran, asiayi mumalik ke traders ke liye behtar qeematein aur ziyada maya markitin dastyab hoti hain taham, asiayi mumalik ke traders dosray sessions mein bhi trade kar satke hain. misaal ke tor par, agar koi asiai trader Europi Currency's mein trade karna chahta hai, to woh Europi session ke douran trade kar sakta hai .

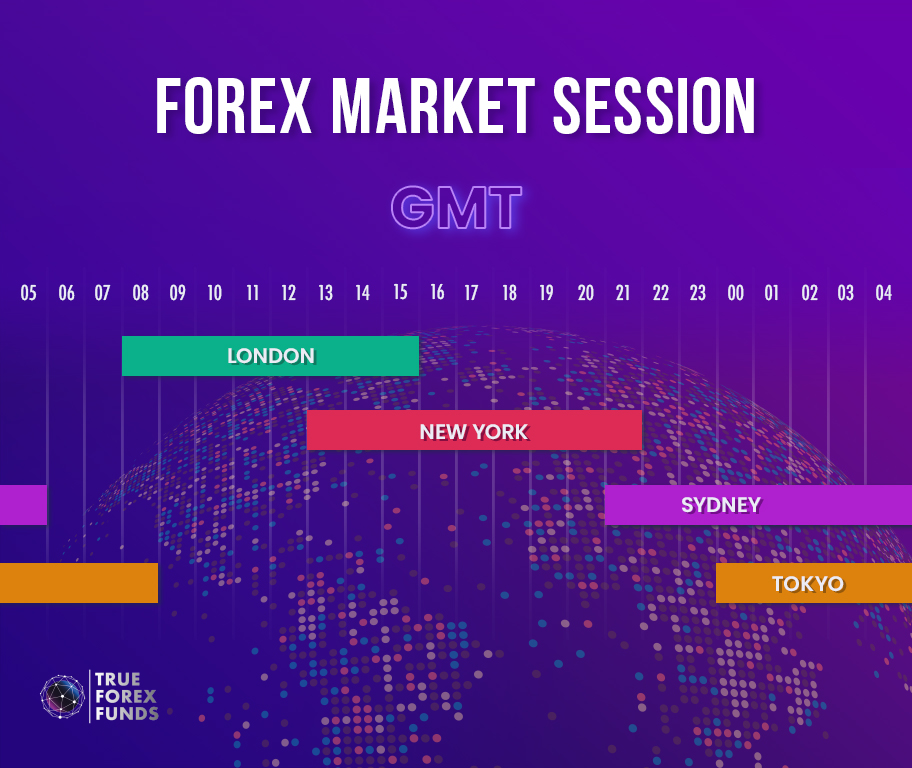

yahan aik jadole hai jo forex session ko khulasa kart hay

Session maliyati market yani forex ke hawale se woh awqat hain jin maim muktalif mumalik apna Currency's main tijarat karte hain aur session ke mutabik qadre market main tazi hote hay jis movement ke mutabik traders munasib profit hasil karne ke koshish karte hain

How many sessions are there in forex?

forex mein total teen session hain jin ka tazkira darj hay jahan se aap ko pata chal sakta hay ke session kon kon se hain jaisa ke

Asiayi session : yeh session Tokyo , Japan mein subah 9 bujey se shaam 5 bujey tak chalta hai. is session mein, asiayi krnsyon, jaisay japani yan, cheeni yoaan, aur janoobi Korean won, sab se ziyada fa-aal hoti hain .

Europi session : yeh session London , England mein subah 8 bujey se shaam 4 bujey tak chalta hai. is session mein, Europi krnsyon, jaisay euro, Bartanwi pound, aur soys frank, sab se ziyada fa-aal hoti hain .

North Amrici session : yeh session New York, ryast_haye mutahidda mein subah 8 bujey se shaam 4 bujey tak chalta hai. is session mein, shumali Amrici krnsyon, jaisay Amrici dollar, Canadian dollar, aur miksikn peso, sab se ziyada fa-aal hoti hain .

Deference between sessions

un sessions mein farq yeh hai ke mukhtalif mein ziyada se ziyada trading ka waqt mukhtalif hota hai. misaal ke tor par, asiayi krnsyon mein trading ka ziyada se ziyada waqt asiayi session ke douran hota hai, jabkay Europi krnsyon mein trading ka ziyada se ziyada waqt Europi session ke douran hota hai asiayi mumalik ke liye, asiayi session sab se ziyada munasib hai. is ki wajah yeh hai ke is session ke douran, asiayi krnsyon mein ziyada se ziyada trading ka waqt hota hai, aur is liye, is session ke douran, asiayi mumalik ke traders ke liye behtar qeematein aur ziyada maya markitin dastyab hoti hain taham, asiayi mumalik ke traders dosray sessions mein bhi trade kar satke hain. misaal ke tor par, agar koi asiai trader Europi Currency's mein trade karna chahta hai, to woh Europi session ke douran trade kar sakta hai .

yahan aik jadole hai jo forex session ko khulasa kart hay

تبصرہ

Расширенный режим Обычный режим