RSI Indicator: Ek Tafseeli Jaiza

Forex trading mein RSI (Relative Strength Index) ek ahem technical indicator hai jo market ki halat ka andaza lagane mein madad deta hai. Yeh indicator momentum ko measure karta hai aur oversold ya overbought conditions ko identify karta hai.

Tajziya ki Ahmiyat:

RSI indicator ka istemal karnay se traders ko market ki taizi aur mawad ki quwat ka andaza hota hai. Iske zariye, wo samajh sakte hain ke kisi currency pair ya stock ki keemat zyada ya kam hai.

RSI ka Tareeqa-e-Amal:

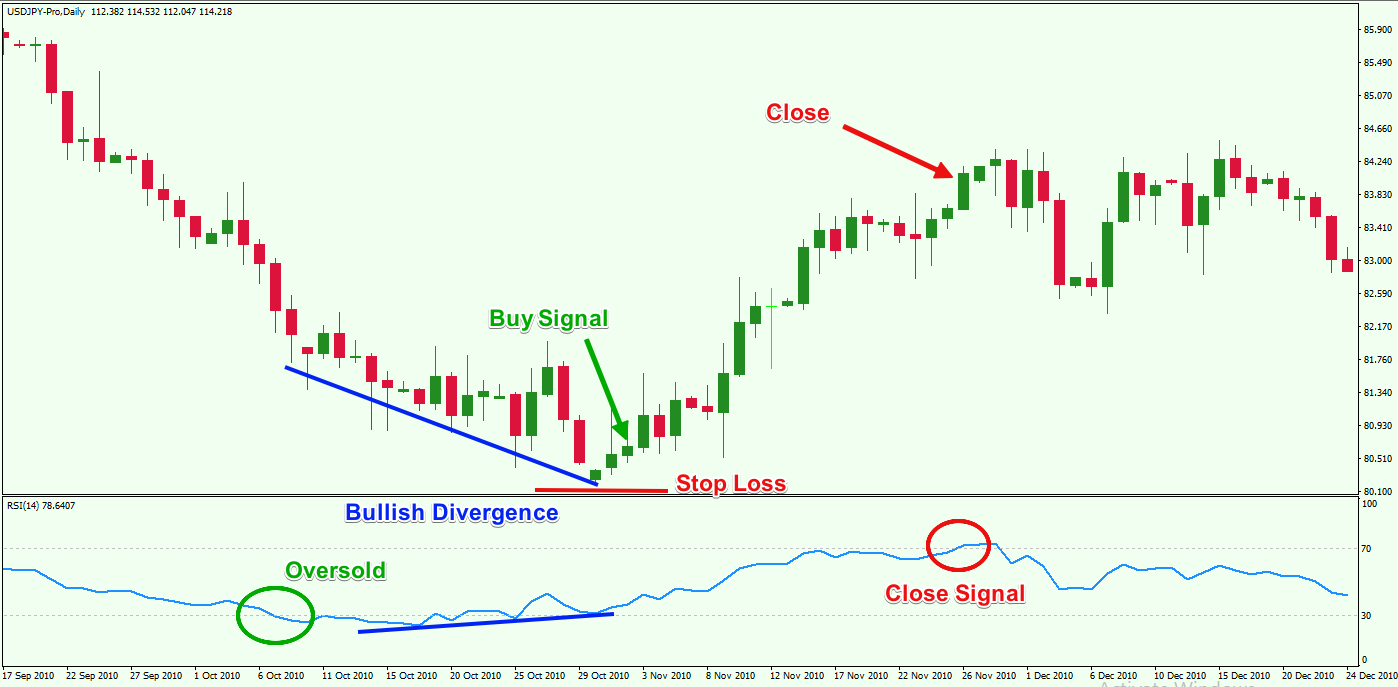

RSI ki value 0 se 100 tak hoti hai. 70 se zyada RSI overbought market condition ko darust karti hai, jabke 30 se kam RSI oversold market condition ko darust karti hai. Traders RSI ke levels ko dekhte hue trading decisions lete hain.

RSI ki Istemal ki Tadabeer:

- Overbought aur Oversold Zones: RSI ke overbought (70 se zyada) aur oversold (30 se kam) levels ko dekhte hue traders buy ya sell ki positions lete hain. Agar RSI overbought hai toh ye indicate karta hai ke market overbought hai aur ho sakta hai ke qeemat neechay aaye. Agar RSI oversold hai toh ye indicate karta hai ke market oversold hai aur qeemat buland hone ka imkan hai.

- Divergence: RSI ki value aur price action ke darmiyan kisi farq ko divergence kehte hain. Agar price naye highs bana raha hai lekin RSI naye highs nahi bana raha hai, toh ye bearish divergence hai, jo ke price ki girawat ka ishara hota hai. Umda wakt par ye trading signals provide karta hai.

- RSI ke Cross Overs: RSI ka moving average aur price ke cross overs bhi trading signals dete hain. Agar RSI ka moving average upar se niche guzar jata hai toh ye sell signal hota hai, jabke agar RSI ka moving average niche se upar guzar jata hai toh ye buy signal hota hai.

Nateeja:

RSI indicator forex trading mein ahem hai lekin iska istemal sahi samajh aur tajziya ke sath karna zaroori hai. Sirf RSI ki value par bharosa karke trading nahi karna chahiye, balki dusre indicators aur market ke overall context ko bhi ghor se samajhna chahiye.

تبصرہ

Расширенный режим Обычный режим