BASIC KNOWLEDGE.

Dear traders market mein ess pattern ko minor reversal pattern ky tour par assume kiya jata hai, aor yeh pattern ki nature par depend kerta hai, aor ye bullish aur bearish both trends reversal ko show kerta hy. Yeh last down trend movement kay baad suddenly up trend movement kay baad suddenly aik hee candle main fall hota hay. Sometime yeh ess kay baad up and down mix candles create kerta hay, but trend reversal main profit day sakta hay. Yeh short pattern hota hay jis main bahut few pips gain karnay ka chance milta hay. Jaisy hee short profit mil jaye market say exit ker kay next trend ka wait kerna chehye. Long term ki entry ess pattern mein dangerous ho sakti hay.

SIGNIFICANCE.

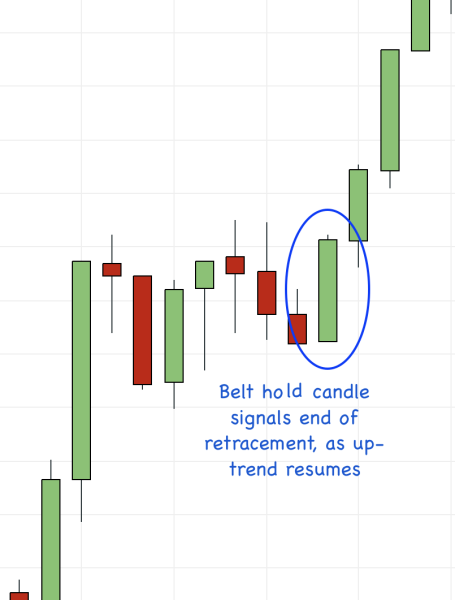

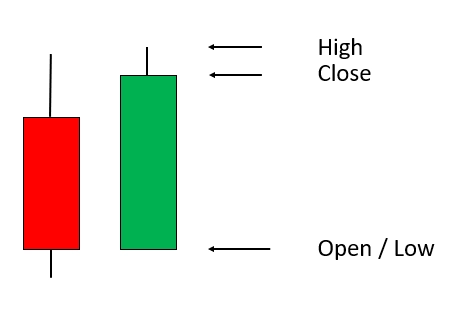

Friends ess pattern ky leye market mein initially down trend hota hay, aor phir aik candle aesi form hoti hay, jo completely bullish hoti hay, aur jis sy yeh market ky trend ko bearish sy bullish mein ley jati hay. Yeh pattern aksar market mein daikha ja sakta hay, but yeh ess kay results sometime positive nahi hoty. Secondly future prediction ratio bi reliable nahi hay. Ye pattern tab form hota hay jab last candle bearish candle ho. New candle iskay low say nichy ya same point say open ho aur suddenly rise hoti rahy, yahan tak keh yeh previous period ki candle kay high ko bhi cross kar jata hay. Aur ess kay baad kuch down aye aur up ja ker bilkal samall wick banaye. Ess candlestick ki base per ham trend ki reversal per trading mein enter ho sakty hein. Market mein kisi bi pattern ko identify ker ky, aur oss ky past analysis ko mind mein rakh ker analysis kiye jaty hein, aur ess ky baad market mei entry sy sucees ky chances rise ho sakty hain.

ANALYSIS.

Jo trader patterns ki jitni study kerta hy aur oss ki understanding hasil kerta hy market mein woh utna hee sucessfull ho jata hy.traders ko aesi trading techniques use kerny ki try kerni chehye. Jis sy easily market ki direction prediction mein help ho saky. Ess pattern k istemal sy traders apni trading strategy ko improve kar sakty hain. Agar traders ess pattern ky baad long positions enter karty hain or market ki movement unn ki expectations k opposite movement kerti hay tu unn ky leye loss ho sakta hay. Jis ky leye traders ko market ko closely monitoring karny or stop loss orders ki setting karny ki capability honi chahiye, ta ky trading mein big loss na ho.trading mein stop loss ki importance ko ignore nahi kiya ja sakta. Kyu ky yeh aik aesa method hy jis sy traders ka account safe rehta hy aur wrong prediction ki waja sy account wash hony sy bi bach jata hy. Ess kay sath sath take profit range ko bi set ker lena chehye, ta kay range hit hoty hoty hi trade closing ho jaye. Aur further koi bi market movement ka effect na rahy.

Dear traders market mein ess pattern ko minor reversal pattern ky tour par assume kiya jata hai, aor yeh pattern ki nature par depend kerta hai, aor ye bullish aur bearish both trends reversal ko show kerta hy. Yeh last down trend movement kay baad suddenly up trend movement kay baad suddenly aik hee candle main fall hota hay. Sometime yeh ess kay baad up and down mix candles create kerta hay, but trend reversal main profit day sakta hay. Yeh short pattern hota hay jis main bahut few pips gain karnay ka chance milta hay. Jaisy hee short profit mil jaye market say exit ker kay next trend ka wait kerna chehye. Long term ki entry ess pattern mein dangerous ho sakti hay.

SIGNIFICANCE.

Friends ess pattern ky leye market mein initially down trend hota hay, aor phir aik candle aesi form hoti hay, jo completely bullish hoti hay, aur jis sy yeh market ky trend ko bearish sy bullish mein ley jati hay. Yeh pattern aksar market mein daikha ja sakta hay, but yeh ess kay results sometime positive nahi hoty. Secondly future prediction ratio bi reliable nahi hay. Ye pattern tab form hota hay jab last candle bearish candle ho. New candle iskay low say nichy ya same point say open ho aur suddenly rise hoti rahy, yahan tak keh yeh previous period ki candle kay high ko bhi cross kar jata hay. Aur ess kay baad kuch down aye aur up ja ker bilkal samall wick banaye. Ess candlestick ki base per ham trend ki reversal per trading mein enter ho sakty hein. Market mein kisi bi pattern ko identify ker ky, aur oss ky past analysis ko mind mein rakh ker analysis kiye jaty hein, aur ess ky baad market mei entry sy sucees ky chances rise ho sakty hain.

ANALYSIS.

Jo trader patterns ki jitni study kerta hy aur oss ki understanding hasil kerta hy market mein woh utna hee sucessfull ho jata hy.traders ko aesi trading techniques use kerny ki try kerni chehye. Jis sy easily market ki direction prediction mein help ho saky. Ess pattern k istemal sy traders apni trading strategy ko improve kar sakty hain. Agar traders ess pattern ky baad long positions enter karty hain or market ki movement unn ki expectations k opposite movement kerti hay tu unn ky leye loss ho sakta hay. Jis ky leye traders ko market ko closely monitoring karny or stop loss orders ki setting karny ki capability honi chahiye, ta ky trading mein big loss na ho.trading mein stop loss ki importance ko ignore nahi kiya ja sakta. Kyu ky yeh aik aesa method hy jis sy traders ka account safe rehta hy aur wrong prediction ki waja sy account wash hony sy bi bach jata hy. Ess kay sath sath take profit range ko bi set ker lena chehye, ta kay range hit hoty hoty hi trade closing ho jaye. Aur further koi bi market movement ka effect na rahy.

تبصرہ

Расширенный режим Обычный режим